ZEW Survey: Risks of Cryptocurrencies

ResearchFinancial Market Experts Favour Regulation of Stablecoin Issuers

Investors’ confidence in cryptocurrencies is currently being severely tested. The sell-offs on the markets are huge. In the midst of this financial turmoil, the digital token, TerraUSD, collapsed in mid-May this year. The crash caused a sensation because, in theory, it should not have happened, as TerraUSD is a stablecoin. This means that each unit of this digital currency, which is independent of states, banks or companies, should always be worth exactly one US dollar. The stablecoin losing its peg from the dollar was not an isolated case. Even the market leader among stablecoins, Tether, was temporarily quoted below the target price of one US dollar.

Against this background, the financial market experts surveyed by ZEW Mannheim in June were by a large majority in favour of a general regulation of stablecoin issuers. At the same time, however, most respondents still see only a low risk to the traditional financial system from large asset-backed stablecoins – i.e. crypto-assets that are backed by other traditional asset classes. “Overall, the majority of respondents are in favour of greater regulation of stablecoin providers. However, the discrepancy between the assessment of a systemic risk of stablecoins and the need to regulate the issuers of these products indicates that financial market experts also perceive the latter as competitors who enjoy competitive advantages because they are not subject to regulation,” says Dr. Frank Brückbauer, advanced researcher in ZEW’s “Pensions and Sustainable Financial Markets” Department.

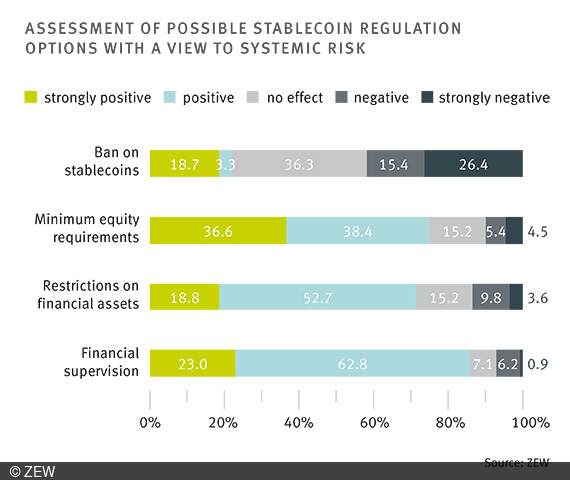

However, only a few respondents would ban stablecoins completely. Around 42 per cent view a ban negatively. Around 36 per cent think that stablecoins have no impact on systemic risk and around 22 per cent of the survey participants see a ban as generally positive. “The reluctance of financial market experts to support a complete ban on stablecoins is probably mainly due to the uncertainty as to whether a ban on stablecoins would be feasible at all. One argument against this is that stablecoins are purely digital financial assets that are traded in decentralised networks. The state may not have access to them,” says Frank Brückbauer.

Proposal for establishing financial supervision receives greatest support

Specifically, around 85 per cent of the participants are in favour of a general regulation of stablecoin issuers. Around 37 and 48 per cent, respectively, fully or partially agree with the statement “issuers of stablecoins should generally be regulated”. While a good nine per cent are unsure about this, the remaining seven per cent reject the statement.

Of the possible options for regulation, the introduction of financial supervision of stablecoin issuers met with the greatest approval. Proposals for restrictions on the financial assets that stablecoin issuers can hold to back the stablecoin and minimum equity requirements for stablecoin issuers were also seen as predominantly positive.

Overall, the majority of the financial market experts surveyed believe that large asset-backed stablecoins pose a threat to the traditional financial system. However, with a share of 68 per cent, most of the respondents estimate the direct, negative effect for the traditional financial system as very low or low if a large asset-backed stablecoin were to collapse. Around 27 per cent expect a medium to large negative effect. The remaining five per cent do not expect any consequences for the traditional financial system should a large asset-backed stablecoin crash.