ZEW-PwC Indicator of Economic Sentiment for China Again Decreases

ResearchThe hopes of German company managers for a more dynamic growth of the Chinese economy in 2014 recede. As shown by the ZEW-PwC Indicator of Economic Sentiment for China for the second quarter, only 27 per cent of the surveyed company executives expect the overall macroeconomic trend to improve over the next twelve months. In comparison to the first quarter, the share of optimists has fallen by eleven points. In contrast, 23 per cent expect China's growth rate within the same time horizon to decline (a three-point plus).

"The increasing probability of a weaker macroeconomic development reflects the growing scepticism of German companies operating in China whether the high growth rates of the past can also be achieved in the future", explains Jens-Peter Otto, partner and China expert of PricewaterhouseCoopers.

The development of the construction sector and industries closely linked to construction, such as steel, are the main risk factors for the Chinese business cycle: "Investment in newly built residential real estate currently accounts for about 15 per cent of total value added in China", notes Dr. Oliver Lerbs, economist at ZEW. "In the absence of additional price jumps, some investors might reduce their engagement in China."

Still positive assessment of trade activities

Despite less optimistic general economic expectations, German managers continue to assess German trade relations with China positively. On balance (margin between positive and negative assessments), almost 50 per cent of the surveyed decision-makers expect trade activities to further expand. On balance, 30 per cent believe that Chinese imports of goods and services from Germany will continue to increase. These assessments are supported by rising wages, a robust growth of consumer credit, as well as moderate interest rates due to falling inflation expectations.

Executives also continue to assess the foreign direct investment (FDI) activities of Chinese firms to be highly expansionary. The respective balance ranks at an almost unchanged 70 points. Compared to the previous quarter, the managers assess the role of Germany as a destination of Chinese FDI slightly less optimistic: "We nonetheless assume that the current vitalization of mergers and acquisitions involving Chinese firms in Germany is going to persist", Otto comments.

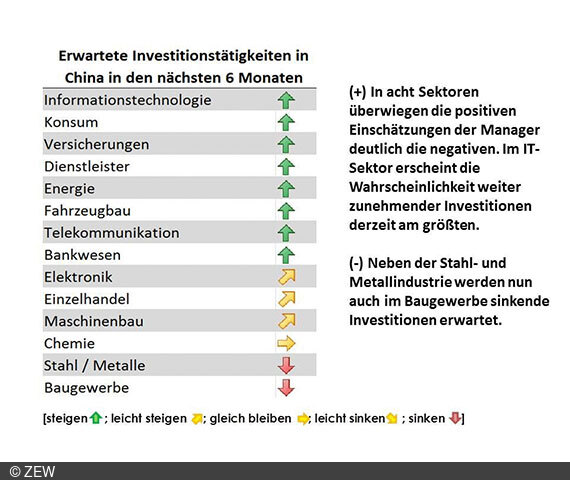

The development of M&A transactions within China is assessed similarly optimistic by German executives, while there are considerable changes compared to the first quarter concerning expectations about domestic investment activities in key sectors. While the consumer goods and energy sector join the top flight, the number of experts who expect declining investment in the construction, steel and metal industry now clearly exceeds the share of optimists. The top spot in this quarter is held by the IT industry (see the graph below).

The survey for the second quarter of 2014 of the ZEW-PwC Indicator of Economic Sentiment for China was conducted between 14 May 2014 and 30 May 2014. The survey covers executives of German firms operating in China. The indicator reflects the managers’ assessments of the Chinese business cycle development in the coming twelve months as well as expectations about macroeconomic trends, trade and investment activities, and the development of selected industries over the next six months.

For further information please contact

Dr. Oliver Lerbs, Phone +49 (0)621/1235-147, Email lerbs@zew.de

Prof. Dr. Michael Schröder, Phone +49 (0)621/1235-140, Email schroeder@zew.de