Who Could Benefit from Which Electoral Victories

ResearchZEW Analysis of the Party Programmes for the German Federal Election

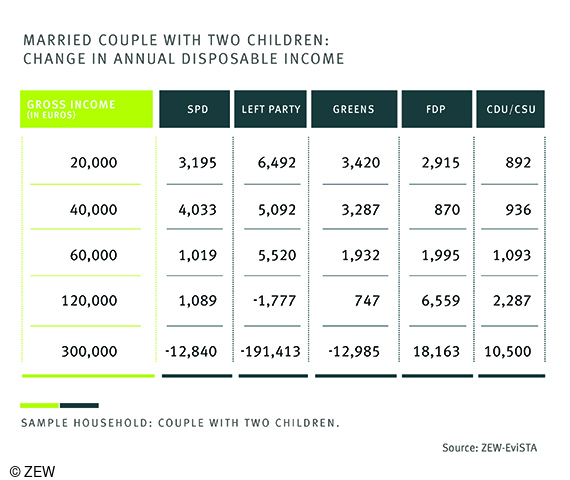

Financial policies proposed by parties running in the federal election differ greatly in their effect on low-income and high-income households. Tax relief proposed by FDP and CDU/CSU would greatly benefit high-income groups, while the political programmes of SPD, the Left Party and the Greens would increase the disposable income, combining net wages and social transfers, for low and medium-income groups. This is the result of an analysis conducted by a team of researchers at ZEW Mannheim, who evaluated the effects of central reform proposals on taxation, minimum wage, mini and midi-jobs, social security, and family policy on private households, on behalf of the daily newspaper “Süddeutsche Zeitung”.

The study analysed the election manifestos of the political parties most likely to be part of a coalition government.In case a proposal in the election manifesto was too vague, the researchers made plausible assumptions, based on e.g. political decisions and statements made by the party, to represent the proposal’s intention. The simulation model used data of the German Socio-Economic Panel (SOEP).

SPD, Greens and Left Party aim to benefit low-income households

A low-income household, consisting of a married couple with two children, would benefit considerably if the programmes of SPD, the Greens and the Left Party were implemented. The disposable income of a household with an annual gross family income of 40,000 euros would increase by roughly 3,300, 4,000 or even 5,100 euros, respectively; with the FDP and CDU/CSU programmes it would merely increase by roughly 900 euros. “The SPD, Greens and Left Party aim to provide tax relief to low and medium-income households by increasing taxes on high-income households,” ZEW researcher Dr. Florian Buhlmann explains.

Instead of suggesting redistribution measures, the CDU/CSU and FDP want to relieve the tax burden on all households, but especially on high-income households. The disposable income of a household consisting of a married couple with two children with an annual gross family income of 300,000 euros would increase by 11,000 to 18,000 euros, while it would decrease under the programmes of SPD, the Greens and the Left Party.

FDP intends to provide the highest tax relief to top earners

Similar results can be found when comparing the relative increase, based on the election programme, in households of different income groups in the SOEP. The largest relative increase – roughly 10.8 per cent – in average annual disposable income is provided by the Left Party to households with a gross family income between 10,001 and 20,000 euros. The FDP intends to offer the highest tax relief to households with a gross family income between 150,001 and 250,000 euros (an increase of 9.7 per cent in disposable income).

The study shows that the parties’ proposals on social, family and tax policy for the next term have a direct influence on indicators of inequality. The Left Party’s programme would cause the strongest reduction of the Gini coefficient, by -15 per cent compared to the status quo, followed by the Greens with - 6.5 per cent and SPD with -4.3 per cent. In case the FDP’s proposals are implemented, the inequality score would increase by 3.2 per cent, and by 1.6 per cent for CDU/CSU. “We have observed that there are opposing political camps in the election campaign in terms of redistribution policy,” says Professor Sebastian Siegloch, head of the Research Department “Social Policy and Redistribution”. “Political parties have taken a clear stance on where they stand regarding the redistribution of wealth”.

Political parties primarily benefit voters of other parties

An analysis of SOEP data on election behaviour in 2017 and the current election manifestos shows that the financial advantages parties provide to their primary group of voters differ greatly. The FDP offers the greatest tax relief – 6.2 per cent on average – to the group of voters who primarily support the Greens, while its own voters come second with 5.9 per cent. The Greens’ policy provides an increase of 1.1 per cent in average disposable income to its own voters, which is the fourth highest figure. The AfD’s core group of voters benefits most from the Greens’ programme, with an increase of 2.9 per cent. This is also the case with the SPD (2.75 per cent) and the Left Party (6.94 per cent).

The impact on the national budget

The election programmes of the FDP and CDU/CSU and the promised tax cuts would burden the federal budget the most with -88 billion euros and -33 billion euros, respectively. “CDU/CSU and FDP are relying on economic growth to balance the budget,” says ZEW economist Buhlmann. At the same time, the Left Party’s proposal evaluated in this study would create a surplus of 90 billion euros in the national budget, the Greens’ proposal a surplus of 18 billion euros. One of the reasons for this result is the wealth tax of five and one per cent planned by the Left Party and the Greens, respectively, as well as the Left Party’s proposal to increase the top tax rate to up to 75 per cent.

The research method

The calculations were carried out using the ZEW-EviSTA model (evaluation model for integrated tax and transfer policy analyses) for the legal status of 2021. ZEW-EviSTA completes calculations on fiscal effects, inequality scores and changes in annual disposable income considering gross income and election behaviour based on data taken from the German Socio-Economic Panel (SOEP) v.34 Behavioural responses – e.g. change in working hours or tax evasion – are not considered.

[Translate to English:] Aktualisierung am 19. Juli

[Translate to English:]

Diese aktualisierte Version der Pressemitteilung berücksichtigt die endgültigen Vermögensteuerpläne der Linken und nicht die Regelung, wie sie im Entwurf des Wahlprogramms skizziert wurde. Diese hatten die ZEW-Wissenschaftler für den Artikel der Süddeutschen Zeitung vom 8. Juli 2021 zugrunde gelegt.

Außerdem verlinkt sind nun eine neue Version der zugehörigen ZEW-Kurzexpertise. In dieser sind auch die Berechnungen zu Musterhaushalten dargestellt, auf denen der Artikel der Süddeutschen Zeitung vom 17. Juli 2021 basiert.