Vacant Housing Puts Pressure on Home Prices

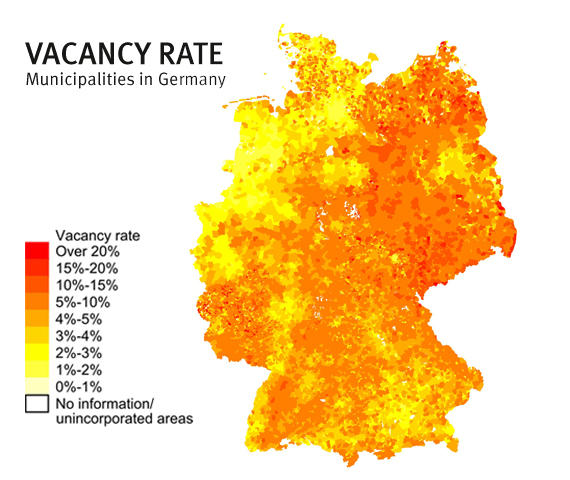

ResearchWhile rising housing prices in large cities are currently a popular topic for discussion in Germany, there are an increasing number of homes in rural and peripheral areas being left vacant. This is particularly, though not exclusively, the case in the East German states. A decisive factor for high numbers of empty properties is often a struggling local economy. Vacant housing in turn exerts pressure on property prices in the surrounding area. These are the findings of a current discussion paper of the Centre for European Economic Research (ZEW) in Mannheim. The study is part of the interdisciplinary research project "Single-Family Homes under Pressure (Homes-uP)", which is funded by the Leibniz Association.

The research is based on more than 10,000 individual sales of detached, semi-detached and row houses taken from the purchase price records of the Committees of Valuation Experts in Brandenburg, Lower Saxony, Rhineland-Palatinate and Saxony-Anhalt. These individual sales were combined with small-scale data on housing vacancy rates on a municipal level taken from the 2011 census. The results suggest that whenever the local vacancy rate doubles, the market value of homes in the area drops by on average 30 per cent. Even when taking into account variations in the quality of the property and the general attractiveness of the area, price discounts of five to eight per cent, depending on the state concerned, still remain.<o:p></o:p>

Market failure could be remedied through demolition incentives<o:p></o:p>

The study further shows that municipalities with currently a relatively high number of vacant homes tend to have already been dealing with this problem for many decades. To show this, vacancy figures from the 1987 and 1995 censuses were compared with those from the 2011 census. The fact that vacancy rates are likely to persist over time in spite of falling prices is economically inefficient and points to market failure. "We can tackle this market failure through economic policy by having housing which has long since become unsellable taken off the market with government support such as demolition incentives," says Dr. Oliver Lerbs, deputy head of the ZEW Research Department "International Finance and Financial Management" and co-ordinator of the Research Area "Household Finance and Real Estate". Similar programmes have previously focussed on eastern Germany and large apartment buildings. "In view of the demographic development of rural municipalities in particular, demolition should be considered an option in western Germany, too."

<o:p></o:p>

For further information please contact

Dr. Oliver Lerbs, Phone +49 (0)621/1235-147, +49 (0)179-1409582, E-mail lerbs@zew.de

Markus Teske, Phone +49 (0)621/1235-372, E-mail teske@zew.de