Tax Rates in Europe Are Converging

ResearchMannheim Tax Index 2025: Germany Needs Investment Incentives

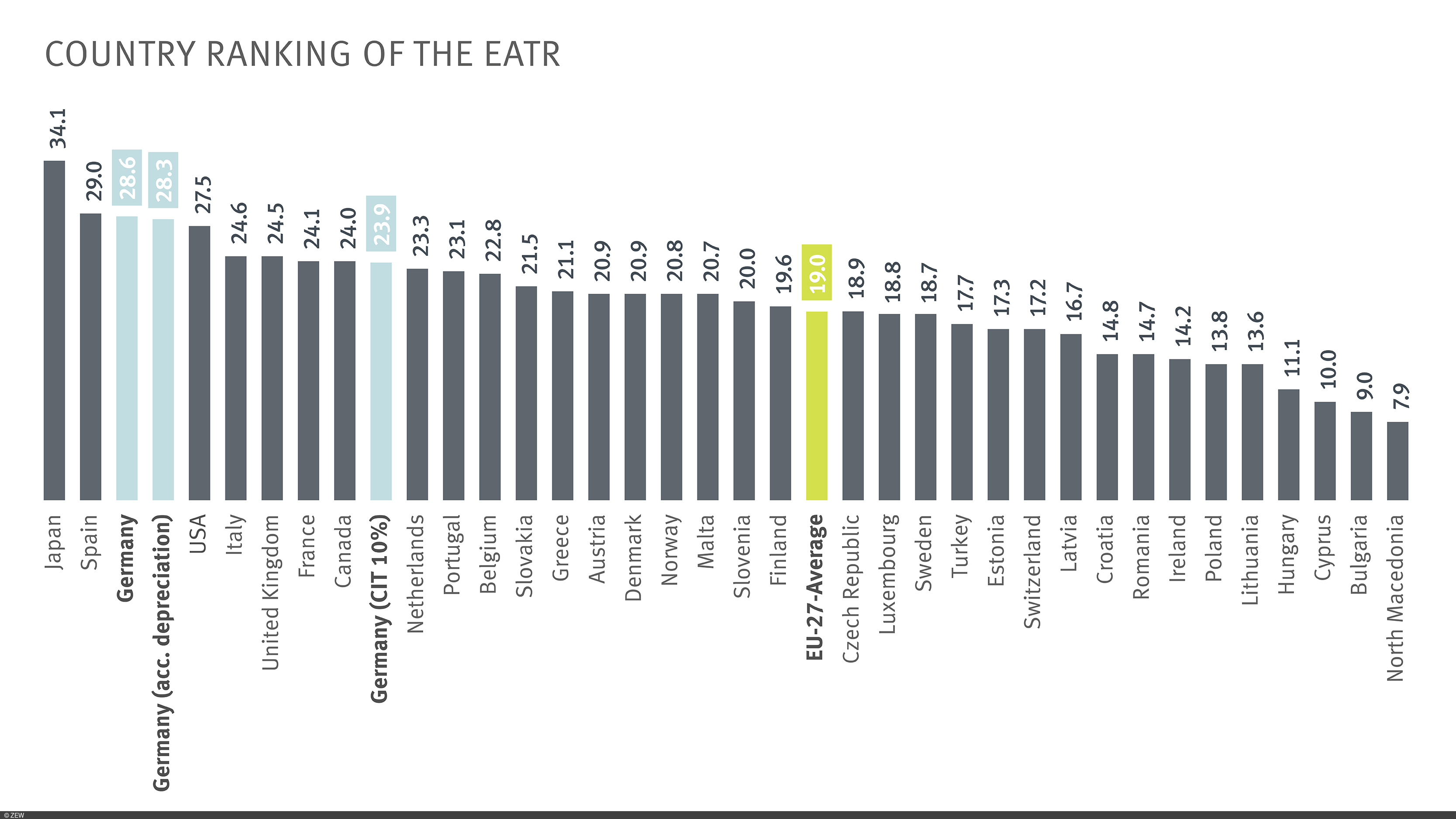

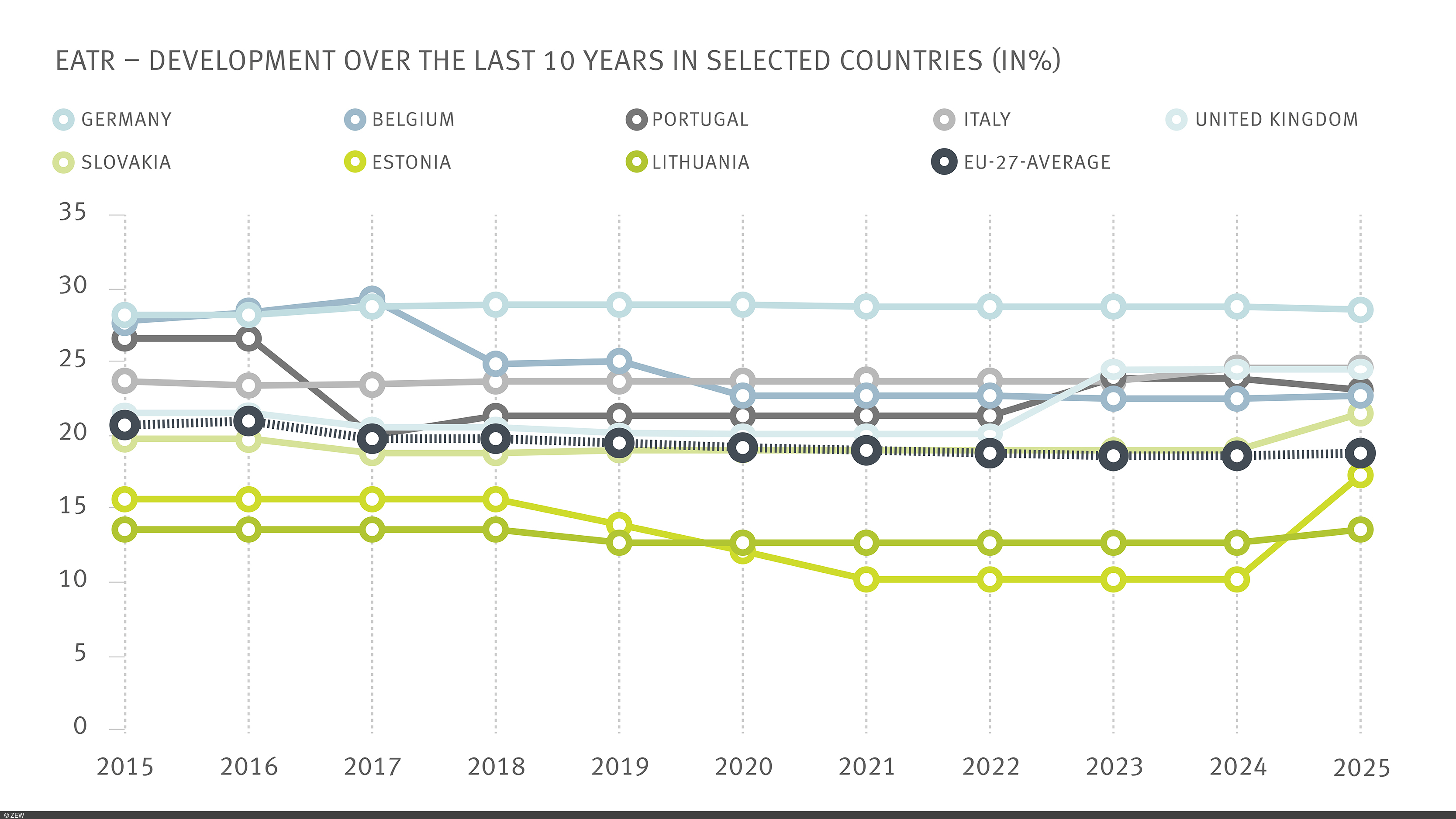

The update of the Mannheim Tax Index 2025 shows: The relative attractiveness in international tax competition of low and high tax locations has changed only to a minor degree. However, measured in terms of the effective average tax rate (EATR), corporate tax rates are rising in several Central and Eastern European countries and are approaching the EU average. At the same time, growing attention is being paid to how governments can stimulate investment not only through tax rates but also by means of targeted tax incentives.

Corporate tax rate: Less of a ‘race to the bottom’

Tax rates are rising noticeably in some countries: For instance, Estonia is raising its general corporate tax rate from 20 to 22 per cent and abolishing the reduced rate of 14 per cent; Lithuania is raising the tax rate from 15 to 16 per cent and in Slovakia the rate is even rising from 21 to 24 per cent. Slovenia and the Czech Republic had already increased their tax rates in the previous year, from 19 to 22 per cent and from 19 to 21 per cent, respectively. This trend is driven by the burdens resulting from the multiple crises of recent years and, consequently, by the increased need for stabilised government revenues.

“In the EU, we are currently seeing a move away from aggressive tax policies which had the aim to create locational advantages primarily through lower tax rates. Against this backdrop, reducing the combined corporate tax rate in Germany from around 30 to 25 per cent by 2032, as planned by the government, is a sensible step. It will bring Germany closer to a competitive tax level without a need for directly entering a European race to the bottom. But it will be crucial to promote investments more via the tax base, because this is where the greatest leverage lies for reducing the cost of capital effectively and creating additional investment incentives,” explains Julia Spix, researcher in ZEW’s Research Unit “Corporate Taxation and Public Finance”.

Investment incentives have indirect impact via cost of capital

While changes in tax rates have a noticeable impact on the EATR, indirect tax incentives (e.g. depreciation rules) influence the cost of capital in particular – meaning the minimum pre-tax return that an investment must achieve in order to remain attractive after tax compared to an alternative investment on the financial market. The cost of capital varies strongly across high-tax countries: Over the last ten years, the cost of capital in Italy and Portugal has averaged 4.6 per cent (patents) and 4.1 per cent (machinery) respectively. By contrast, the United Kingdom reduced the cost of capital for machinery to 4.7 per cent through an immediate write-off option, despite increasing the corporation tax rate to 25 per cent in 2023. The incentives currently offered by Germany are considerably less attractive: The cost of capital of 5.7 per cent (patents) and 6.4 per cent (machinery) is well above the assumed market interest rate of 5 per cent for such investments.

About the Mannheim Tax Index

The Mannheim Tax Index is an indicator for the effective tax rate applied to companies. It compares countries and regions from a tax perspective, considering all taxes on profits and invested capital as well as the most important regulations for determining the tax base. A comprehensive overview of the tax landscape is thus obtained by tracking two general strands, i.e. taxation of domestic companies including their shareholders, and cross-border corporate investment. The Mannheim Tax Index is based on the investment theory approach by Devereux and Griffith (1999, 2003).