Slight Set-Back at the Beginning of the Year

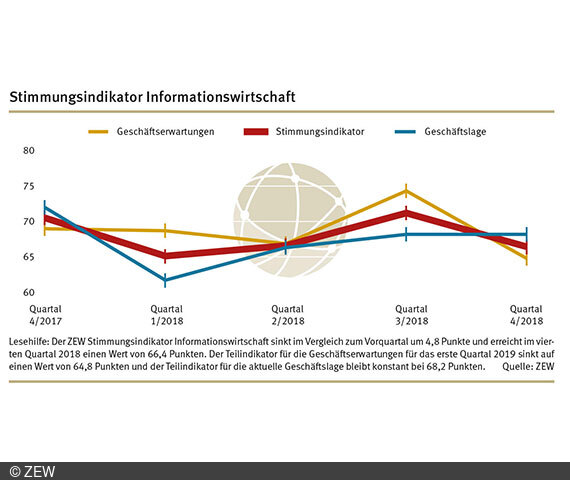

Information EconomyFirms in Germany’s information economy kicked off 2019 in a slightly negative mood. The ZEW sentiment indicator illustrates this for the sector. Compared to the previous quarter, the indicator decreased by 4.8 points, setting the mark to a reading of 66.4 points in the fourth quarter of 2018. However, a cause for greater concern is missing as the indicator shows that the majority of companies in the information economy continue to assess the economic situation positively. The ZEW Economic Sentiment Indicator is the result of a survey among companies in the German information economy, conducted by the ZEW – Leibniz Centre for European Economic Research (ZEW) in Mannheim, in December 2018.

The decrease of the sentiment indicator in the December survey results mainly from negative business expectations for the first quarter of 2019. The corresponding sub-indicator declines from optimistic 74.3 points for the first quarter of 2018 to 64.8 points for the first three months of 2019.

About 43 per cent of companies expect to see an increase in turnover in the first quarter of 2019. In contrast, 12.2 per cent of businesses expect declining turnovers in the same period. Meanwhile, the companies’ assessment of the business situation has not changed. With a constant level of 68.2 points, the corresponding sub-indicator signals that the majority of companies continue to assess the economic situation positively.

Mood in the ICT sector slightly worse

The information economy consists of the sub-sectors information and communication technologies (ICT), media service providers and knowledge-intensive service providers.

The very good economic sentiment among companies in the ICT sector has deteriorated slightly. Starting from a very high level of the sentiment indicator in the previous quarter, companies have now become somewhat less optimistic. The indicator has dropped by 11.5 points, although still maintaining a high value of 72.9 points. In contrast to the previous quarter, the assessment of the business situation in the ICT sector has improved slightly. The sub-indicator for the business situation has climbed 0.8 points, reaching a total of 75.2 points.

However, business expectations for ICT companies have developed very negatively. Compared to the previous quarter, the corresponding sub-indicator has dropped by 12.7 points, falling to a reading of 70.6 points.

Media and knowledge-intensive service providers less optimistic

The economic climate among media service providers experienced a slight setback in the fourth quarter of 2018. Compared to the previous quarter, the sentiment indicator dropped 3.8 points, and is just clearing the critical 50-point mark with a reading of 50.5 points. This indicates that only a small majority of media service providers gives a positive assessment of the economic mood. Even with both corresponding sub-indicators deteriorating, the assessment of business expectations, with 58.1 points, is significantly more positive than the assessment of the business situation. Almost unchanged at a level of 43.8 points, the assessment of the business situation still stands below the critical 50-point mark.

Also, the economic mood among knowledge-intensive service providers dampened slightly in the fourth quarter of 2018. Compared to the previous quarter, the sentiment indicator has decreased by 3.9 points, thereby reaching a total of 64.2 points. Whereas the sub-indicator for the business situation remained at 67.0 points, the sub-indicator for business expectations has developed negatively. The drop of the sub-indicator from 69.3 points in the previous quarter to currently 61.6 points signals the declining optimism. Nonetheless, the fact that the 50-point mark has been clearly exceeded indicates that the majority of firms are still looking ahead with optimism.

The Economic Sentiment Indicator for the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components turnover situation, demand situation, turnover expectations and demand expectations (each in comparison with the previous and following quarter). They are equally factored into the calculations. Sales situation and demand situation form a sub-indicator reflecting the business situation. Sales expectations and demand expectations form a sub-indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations is the value of the ZEW Economic Sentiment Indicator of the Information Economy. The sentiment indicator can take on values from 0 to 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The ZEW Business Survey in the Information Economy

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. Sub-sectors 4 to 9 make up the knowledge-intensive service providers. Overview of the ZEW Business Survey in the Information Economy (in German) http://www.zew.de/konjunktur.

Remark on the projection

To ensure that the analyses are representative, ZEW projects the answers of the survey participants with the sales value of the businesses with regard to the entire sector of the information economy. The phrasing “share of the businesses” thus reflects the share of sales of the businesses.