Outlook for Chinese Economy Improves Significantly

China Economic PanelCEP Indicator Rises to 44.4 Points

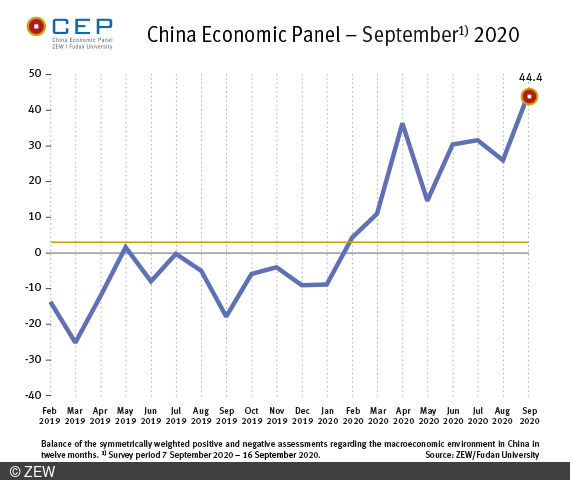

In the September survey (7–16 September 2020), the CEP indicator rose by 18.3 points to a new level of 44.4 points. This is by far the highest value of the indicator since the survey began in mid-2013. The CEP indicator, based on the China Economic Panel (CEP) in cooperation with Fudan University, Shanghai, reflects the economic expectations of international financial market experts for China on a 12-month basis.

The assessment of the current economic situation has also improved very strongly, with the corresponding indicator rocketing by 31.1 points to a new reading of 1.9 points, thus signalling a ‘normal’ economic situation. The point forecasts for real gross domestic product (GDP) have also gone up considerably. For the current year, the surveyed experts now expect GDP growth of 2.7 per cent (compared to 2.1 per cent in the previous month), and the forecast for 2021 has been revised upwards from 4.3 per cent to 5.7 per cent.

China could reach pre-COVID-19 growth levels

“According to the forecasts, the Chinese economy would return to pre-COVID-19 growth rates next year,” says Dr. Michael Schröder, senior researcher in the “International Finance and Financial Management” Research Department at ZEW Mannheim. Expectations have risen sharply for all components of GDP, including exports, consumption and private investment. The experts are also optimistic regarding the individual sectors as well as the most important economic regions, which means that they are expecting to see a lasting economic recovery. Nevertheless, the indicator values for domestic and foreign debt remain very high. “The Chinese government has indeed managed to revive China’s economy through active economic policy measures. However, the improved economy has come at the price of significantly higher debt,” says Michael Schröder.