Outlook for China Improves Again

China Economic PanelCEP Indicator Stands at 64.0 Points

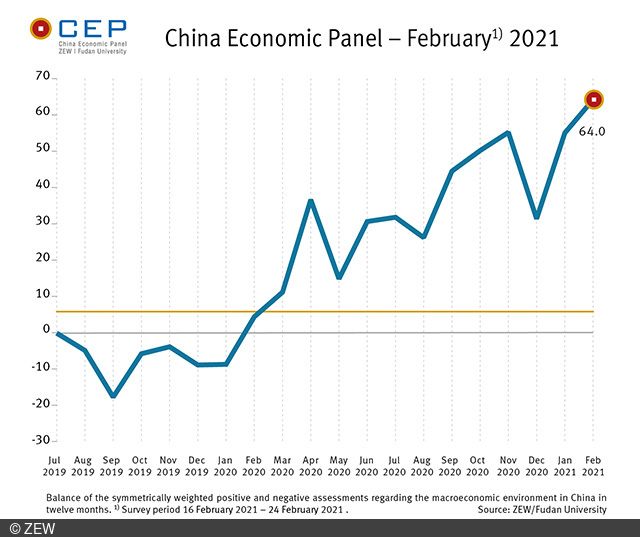

In the February 2021 survey (16–24 February 2021), the CEP indicator increased by 9.1 points to a new value of 64.0 points, its highest value to date since the survey began in mid-2013. The CEP indicator, based on the China Economic Panel (CEP) and conducted by ZEW Mannheim in cooperation with Fudan University, Shanghai, reflects the economic expectations of international financial market experts for China on a 12-month basis.

The assessment of the current economic situation rose by 13.6 points to 55.8 points, which means that the corresponding indicator has also reached its highest value since the beginning of the survey. “The significant increase in both the expectations and the assessment of the current situation shows that the experts’ economic outlook for China is considerably better than in January,” says Dr. Michael Schröder, who coordinates the survey in ZEW’s Research Department “International Finance and Financial Management”.

The respondents’ positive view of the economy is also reflected in their economic growth forecasts, which are now significantly more positive for both the current year and 2022 than they were at the beginning of the year. For 2021, the experts expect an increase in real gross domestic product (GDP) of 6.5 per cent compared to the previous year. In January, this forecast was still at 5.9 per cent. In 2022, real GDP is expected to grow by 5.5 per cent; previously, growth of only 4.9 per cent was expected.

The strong rise in expectations regarding government consumption by 23.4 points to an indicator level of 70.0 points shows that government economic stimulus programmes are likely to be further expanded. In the meantime, 88 per cent of the experts expect an either slight or strong increase in government consumption, and only four per cent anticipate a slight drop.

A similar picture is presented by the indicator for domestic debt, which climbed 11.3 points to a current value of 68.0 points. In fact, all respondents expect at least a slight rise in domestic debt within the next twelve months, and 64 per cent of the experts predict a further increase in foreign debt. “The dichotomy of expectations for the development of China’s major economic regions continues to persist in February. While the outlook for Shenzhen, Shanghai, Guangzhou, Beijing and Chongqing is very positive, expectations for Hong Kong and Tianjin remain far below average. In the case of Hong Kong, the relatively weak economic development is also reflected in a predicted decline in property prices,” says Schröder.