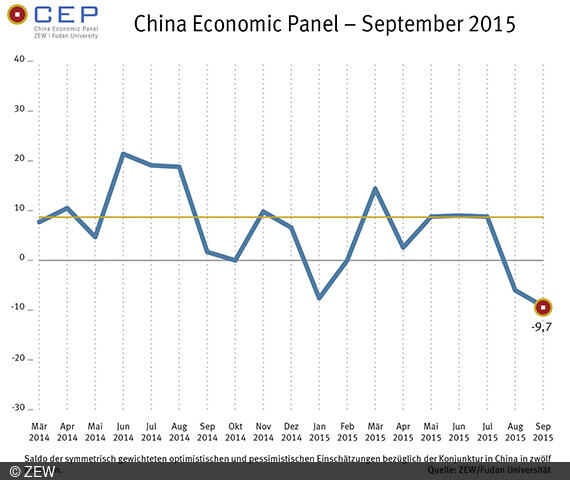

Indicator of Economic Sentiment for China Shows Further Decreases

China Economic PanelChina Economic Panel (CEP) of the Centre for European Economic Research (ZEW) and Fudan University (Shanghai)

The outlook for further economic development in China remains negative in September 2015. The CEP Indicator, which reflects the expectations of international financial market experts regarding China's macroeconomic development over the coming twelve months, has deteriorated significantly in the current survey period (14/09 - 28/09/2015), falling from minus 6.0 to minus 9.7 points. The GDP forecasts for 2015 total 6.8 per cent, whilst these fall to 6.6 per cent for 2016.

In regard to interest rates, the experts surveyed expect to see a slight decrease in both deposit rates and loan rates (both with a one-year term) in the coming three months, as well as over the next twelve months. This fall in interest rates, together with an expected increase in the rate of growth of the money supply, may stimulate domestic demand.

The lower interest rates are not yet expected, however, to calm down stock markets. With respect to at least two of the most prominent stock market indexes (SSE Composite Index and Hang Seng Index) the experts surveyed still expect a decline in share prices to occur within the next three months.

The relation of the Chinese Yuan to the US Dollar shall remain stable over the next three and the next twelve months. By predicting a further decline in foreign reserves, experts expect that the Chinese Central Bank will continue to make active interventions in the foreign exchange market and so will successfully stabilise the Chinese Yuan.

Forecasts show great variation across individual economic sectors. According to the experts surveyed, developments in the private banking sector, in the automotive industry and, above all, in the information technology and services sector shall be significantly worse than has as yet been the case. There is, however, a glimmer of hope; expectations for the consumer/trade sectors, for chemical/pharmaceutical industries, as well as providers/energy providers, are significantly more positive than they were in the previous month.

When it comes to the most important economic regions, Shanghai, Shenzhen, as well as Beijing and Chongqing, forecasts regarding economic performance over the coming twelve months remain positive. This is reflected in real estate prices; further price increases are to be expected particularly for properties in Shanghai and Shenzhen, as well as in Guangzhou and in Beijing.

For further information please contact

Prof Dr Michael Schröder, Phone +49(0)621/1235-140, E-mail schroeder@zew.de