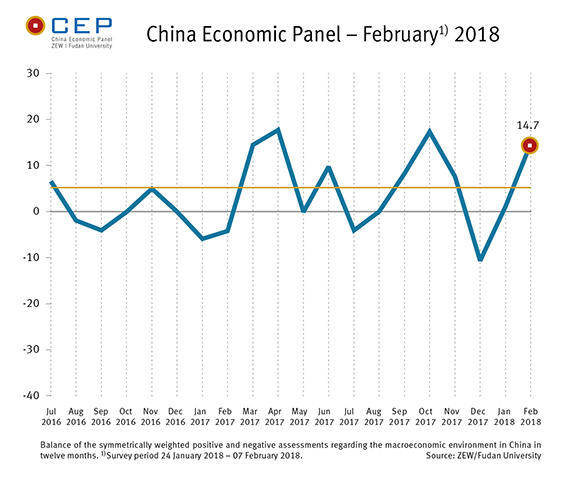

Indicator of Economic Sentiment for China Continues to Improve Significantly

China Economic PanelIn the most recent survey conducted in February (24 January–7 February 2018) expectations for the Chinese economy have improved again, with the CEP indicator climbing to 14.7 points. This corresponds to an increase of 13.6 points compared to January, and an impressive hike of 25.4 points compared to December 2017. According to the CEP Indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, a significant improvement in the economic outlook for China has thus taken place since the end of last year.

This impression is reinforced by the fact that the assessment of the economic situation for China has also recorded an increase of 8.3 points to a current level of 32.3 points. Since the beginning of 2017 the assessment of the economic situation has shown a noticeable upward trend, with the corresponding indicator being well above the long-term average of 1.3 points.

The improved outlook for the Chinese economy is also reflected in the increase of the point forecasts for GDP growth in 2018 and 2019. Both figures climbed 0.1 percentage points compared to the previous month and currently stand at 6.7 per cent for 2018 and 6.6 per cent for 2019.

“Domestic consumption continues to be the main driver of growth in China,” says Dr. Michael Schröder, senior researcher in ZEW’s Research Department “International Finance and Financial Management” and project leader of the CEP survey. The expectations regarding domestic consumption climbed 11.1 points, with the corresponding indicator standing at 52.5 points. With 18.8 points, the indicator for private investments is well below that for domestic consumption; it is, however, still in the positive range. The indicator for public consumption currently stands at 38.8 points. “This underlines the fact that government programmes aimed at providing economic stimulus are still very important for the Chinese economy,” says Schröder.

The indicators for domestic and external debt, which can be used to measure the impact of credit growth on the economy, both increased compared to the previous month. Of the two, however, only the indicator for domestic debt, which currently stands at 35.0 points, is in line with the expectation that economic growth will continue to pick up pace.

For more information please contact

Dr. Michael Schröder, Phone: +49 (0)621/1235-368, E-mail michael.schroeder@zew.de