German Information Economy - An Optimistic Start into the New Year for Information Economy Companies

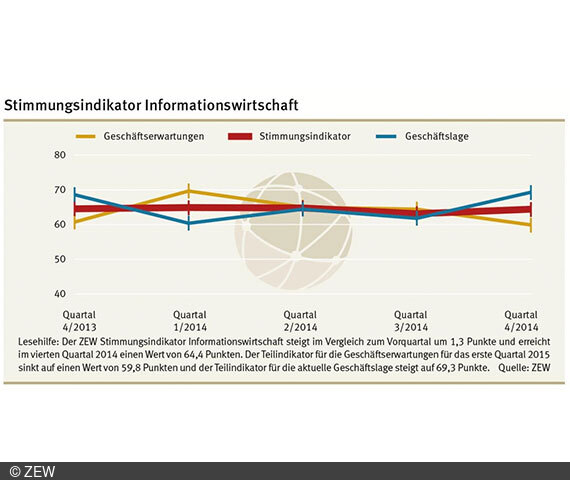

Information EconomyThe positive economic trend for the German information economy continues. The companies in the information economy sector are largely optimistic concerning the economic situation in the fourth quarter of 2014 as well as the economic development in the first three months of 2015. The ZEW Economic Sentiment Indicator for the Information Economy, which is based on assessments of the current situation and on expectations, had a reading of 64.4 points at year end. This is the result of a survey in the information economy conducted by the Centre for European Economic Research (ZEW) in December 2014.

The majority of companies expect a positive development of sales and demand in the first quarter of 2015. In the December survey, the sub-indicator for business expectations has reached a total of 59.8 points, clearly exceeding the critical 50-points mark, which signals a positive economic situation. Due to a positive assessment of the business situation in the fourth quarter of 2014 by most companies, also because of the year-end business, the corresponding sub-indicator has increased to 69.3 points.

The information economy consists of the sub-sectors information and communication technologies (ICT), media service providers and knowledge-intensive service providers.

ICT companies have a slightly more optimistic economic sentiment than in the previous quarter. The sentiment indicator has thus climbed to a total of 66.4 points. Optimism among ICT companies largely stems from the favourable development of the business situation. Reading 70.3 points, the corresponding sub-indicator has reached its highest level in 2014. By contrast, business expectations have worsened slightly. The corresponding sub-indicator has fallen back to 62.9 points. Yet this figure indicates that most companies expect sales and demand to increase even further in the first quarter of 2015, starting from an already outstanding business situation in the last three months of 2014.

The economic climate in the media industry has once again improved. The sentiment indicator has exceeded the critical 50-points mark for the third consecutive time, reflecting most media service providers' optimism. With a total of 60 points, the sentiment indicator has reached a three-year high. The prevailing optimism can be attributed to the remarkably positive development of the business situation. The corresponding sub-indicator has increased by 17.4 points to 66.7 points. In contrast, the sub-indicator for business expectations has lost 9.9 points and closes at 54.1 points. However, this level suggests that the majority of media service providers still expect a positive business development.

The knowledge-intensive service providers also have a positive assessment of their business situation, but business expectations in this sub-sector have worsened. The sentiment indicator has increased to 63.8 points due to the favourable development of the business situation, which outweighs the negative trend in business expectations. All in all, 41.4 per cent of the knowledge-intensive service providers generate increasing sales and 35 per cent record a stronger demand for their services. Consequently, the sub-indicator for the business situation has reached 69.1 points. The sub-indicator for business expectations, however, has dropped to 58.9 points, yet still signalling optimistic expectations.

For more information please contact

Daniel Erdsiek, Phone +49(0)621-1235-356, E-mail erdsiek@zew.de

The Economic Sentiment Indicator for the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally factored into the calculations. Sales situation and demand situation form a sub-indicator reflecting the business situation. Sales expectations and demand expectations form a sub-indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations is the value of the Economic Sentiment Indicator of the Information Economy. The sentiment indicator manoeuvres between values from 0 to 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

ZEW Business Survey in the Information Economy

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, auditing (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. Sub-sectors 4 to 9 make up the knowledge-intensive service providers. Overview of the ZEW Business Survey in the Information Economy (in German) http://www.zew.de/konjunktur

Remark on the Projection

To ensure that the analyses are representative, ZEW projects the answers of the survey participants with the sales value of the businesses with regard to the entire sector of the information economy. The phrasing "share of the businesses" thus reflects the share of sales of the businesses.