German “Debt Brake” Is Losing Public Approval

ResearchThe COVID-19 pandemic is a veritable stress test for German fiscal policy. In the midst of the crisis, the debt brake has increasingly lost public support. Voter support for the debt brake was initially strong, but began to wane as it neared entry into force. In 2021, only 59 per cent of Germans still supported the debt ceiling, while 20 per cent said they had doubts about it. More than 60 per cent were in favour of returning to a balanced budget at a later date. These are the results of a representative survey co-authored by ZEW Mannheim.

The debt brake, which has been enshrined in Articles 109 and 115 of the German Basic Law since 2009, has limited the federal government’s structural – i.e. cyclically adjusted – deficit to 0.35 per cent of GDP since the fiscal year 2016. For the state governments, this legislation became binding in 2020. Now researchers are analysing the development of citizens’ approval of the debt brake before and after its introduction, taking the COVID-19 crisis into account. Up to 4,822 persons from all 16 federal states participated in several representative surveys conducted between November 2014 and March 2021 based on the German Internet Panel (GIP).

Prior to the debt brake coming into force at state level, public approval declined steadily. Approval rates fell from 69 per cent in 2014 to 59 per cent in 2021. While about 20 per cent of respondents were sceptical about the debt cap in 2021, in 2014 it was only 15 per cent. “Both the prospect of the debt brake coming into force in the 16 federal states in 2020 and the pandemic-related crisis made the debt cap lose popularity,” explains Dr. Sebastian Blesse, researcher in the ZEW “Corporate Taxation and Public Finance” Department and co-author.

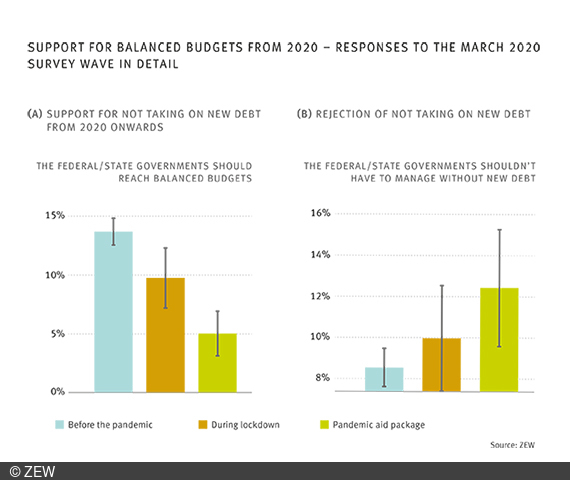

The survey identified a similar downward trend in the question of when the federal government and state governments should manage without new debt. In 2014, 33 per cent of respondents were in favour of balanced budgets from 2020. However, in 2020, only 12 per cent were in favour of this. At the same time, a growing share of respondents said that the federal government and state governments don’t have to manage without new debt at all (31 per cent in the 2020 survey). “The respondents’ approval of a timely realisation of balanced budgets has decreased over the years and the end of new public debt is being postponed further and further into the future,” says Justus Nover, ZEW researcher and co-author, explaining the results. The respondents were increasingly sceptical about the federal states’ compliance with the debt ceiling in 2020. By 2019, about 39 per cent of respondents expected their own state to reach a balanced budget from 2020, while 54 per cent did not think this goal was achievable. The COVID-19 crisis and the entry into force of the debt ceiling added to the pessimism. As a result, the perceived probability that the federal states would comply (or not comply) with the debt ceiling by March 2021 fell to 14 (or increased to 82) per cent.

The authors conclude that citizens’ preferences regarding the debt cap are not consistent over time, i.e. from a later point in time, forthcoming measures no longer seem ideal, despite citizens not receiving any relevant information to the contrary in the meantime. In fact, the closer the day of the debt cap entering into force came, the more likely citizens were to give up their request for stricter fiscal policy. The pandemic reinforced this tendency. “Anchoring the debt ceiling in the Basic Law helped to ensure that temporarily changing opinions of politicians and citizens do not influence the rules of the debt ceiling,” says Dr. Sebastian Blesse.