Financial Market Experts Expect Number of Zombie Firms to Grow Due to COVID-19 Measures

ResearchThanks to the measures adopted to mitigate the economic effects of the coronavirus, the German economy has largely stabilised. Nevertheless, financial market experts expect the number of company insolvencies and credit defaults to rise in the first half of 2021. Moreover, they assume that the number of so-called zombie companies – i.e. firms that are insolvent but artificially kept alive by loans – is likely to grow. These are the results of a special question featured in the most recent ZEW Financial Market Survey conducted by ZEW Mannheim in December 2020 among 174 financial market experts.

The federal government has taken far-reaching measures to cushion the economic effects of the coronavirus pandemic. As part of these measures, policymakers, for instance, suspended the obligation to file for insolvency in the period between March and September 2020, eased the conditions for short-time working grants and introduced several credit and aid programmes. While these steps have helped stabilise the German economy, they have, at least in part, only postponed the damaging effects of the lockdown and other restrictions. The results of the special question included in the ZEW Financial Market Survey shows that a large majority of the surveyed financial market experts expect the number of insolvencies to rise in the coming six months: 43 per cent of the respondents expect only a slight increase, whereas 55 per cent anticipate a strong increase.

Savings banks and cooperative banks seem to be particularly affected

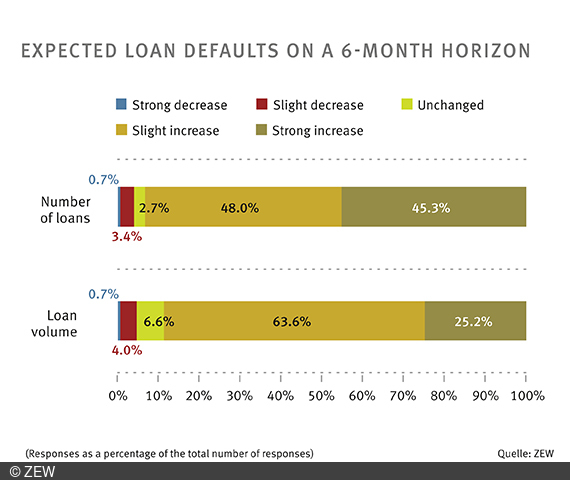

Unlike the global economic crisis of 2007/2008, which originated in the financial sector and spread to the real economy, the COVID-19 crisis is foremost a global health crisis. However, since combating the spread of the virus involves major economic cuts, this time there is a risk that the current crisis will spill over from the real economy into the banking sector. According to financial market experts, loan defaults in the German banking sector will increase in the first half of the year. 48 per cent of respondents expect a slight and 45 per cent a strong increase in the number of loan defaults, while 64 per cent (25 per cent) expect a slight (strong) increase in the volume of loans in default.

The savings banks and cooperative banks are particularly affected by these defaults, according to 58 per cent and 56 per cent of the experts, respectively. In contrast, only 32 per cent of the respondents expect to see above-average defaults at large banks and only nine per cent among private bankers. “In view of increasing warnings about a possible upcoming banking crisis, the banks themselves emphasise that they have significantly improved their capital base in the years since the financial crisis and have taken sufficient precautions. Banking regulators also consider the German financial system to be robust overall, even if some of the weakest banks would probably not survive the crisis,” says Dr. Karolin Kirschenmann, deputy head of the ZEW Research Department “International Finance and Financial Management”.

Suspended obligation to file for insolvency as main reason for rise in zombie firms

The coronavirus-related economic policy measures could also lead to unintended side effects, such as an increase in the number of so-called zombie companies. These companies are basically insolvent and unprofitable, but are kept artificially alive by constant loans. Thus, 58 per cent of the financial market experts surveyed fear a small and 39 per cent a large increase in zombie companies in Germany as a result of the economic policy measures to mitigate the economic effects of the COVID-19 crisis. From the experts’ point of view, the increase in zombie companies is mainly caused by the suspension of the obligation to file for insolvency: A total of 61 per cent of respondents believe this to have a very strong effect. Other causes cited are state loans via the German development bank KfW (23 per cent) and short-time working grants (17 per cent). In contrast, the reduction in VAT is attributed only little influence on the increase in zombie companies. “While it was right and necessary to introduce these measures quickly at the beginning of the crisis, it is now important to contain the repercussions on the banking sector and the emergence of zombie enterprises as much as possible. There are a number of ways to do this, such as providing companies with equity capital instead of debt capital or through banking supervision,” explains Karolin Kirschenmann.