Financial Market Experts Do Not Expect Deposit Platforms to Take Action

ResearchAfter Greensill Collapse: ZEW Study on Deposit Insurance

Following the collapse of Greensill Bank, financial market experts believe there is a considerable need to regulate deposit platforms and reform banks’ deposit insurance. The majority of respondents, however, do not expect that deposit platforms will take action and keep banks with excessively risky business models off their platforms unless they are obliged to do so. Therefore, they should be required to provide more information on the associated risks to their customers, according to the experts. This is the result of a special question included in the ZEW Financial Market Survey in May 2021 among 188 financial market experts.

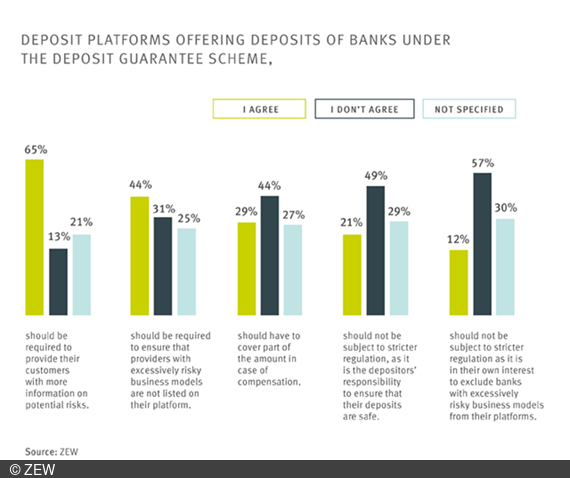

The Greensill collapse in March 2021 cost German private banks under the statutory and voluntary deposit guarantee schemes more than three billion euros. Around 65 per cent of the financial experts surveyed are in favour of requiring deposit platforms, which play a key role in offering riskier deposits, to provide more information on potential risks to their customers. About 57 per cent of the respondents doubt that it is in the platforms’ own interest to ensure that providers with excessively risky business models are not listed on their platform. A majority of 44 per cent, however, rejects the idea that these platforms should have to cover part of the compensation amount.

Stronger risk sharing in private banks’ deposit insurance recommended

“The example of Greensill confirms what we already know from numerous studies: deposit insurance can lead investors to underestimate the risks of their deposits. This is understandable, but it is time that the banking sector take corrective action to mitigate the risk of a compensation event and to limit the compensation amount covered by the deposit insurance,” says Dr. Karolin Kirschenmann, deputy head of the ZEW Research Department “International Finance and Financial Management”.

Risk sharing between guarantee schemes and depositors as well as increased supervision by the Federal Financial Supervisory Authority (BaFin) are seen as particularly suitable measures for reforming deposit insurance. About 33 per cent of the respondents are strongly positive and another 36 per cent are positive about customers having to bear a small share of five to 15 per cent of losses themselves in the event of compensation. A stricter examination and supervision of banks by BaFin is seen as strongly positive by 32 per cent of the respondents and as positive by another 38 per cent. The proposals that there should be stricter auditing and monitoring by the Auditing Association of German Banks (26 per cent strongly positive, 41 per cent positive) and that banks’ premiums to the Deposit Protection Fund should better reflect their actual level of risk-taking (27 per cent strongly positive, 36 per cent positive) receive somewhat less approval. “Interestingly, trust in BaFin has not diminished among the financial market experts surveyed, even though there have been many negative reports about the supervisory authority in connection with Wirecard,” says ZEW banking expert Kirschenmann.

More transparency needed for public investments

Approximately 49 per cent of respondents agree that investments of public budgets should be made more transparent by law, and 21 per cent of respondents believe that the investment options of public budgets should be legally restricted. Only ten per cent think it is sufficient that public budgets can be sanctioned by the voters. A majority of 54 per cent of the financial market experts also believe that, in the future, deposit insurance should only compensate private investors, while 32 per cent disagree with this statement and 14 per cent did not specify.