Expectations for Chinese Economy Worsen

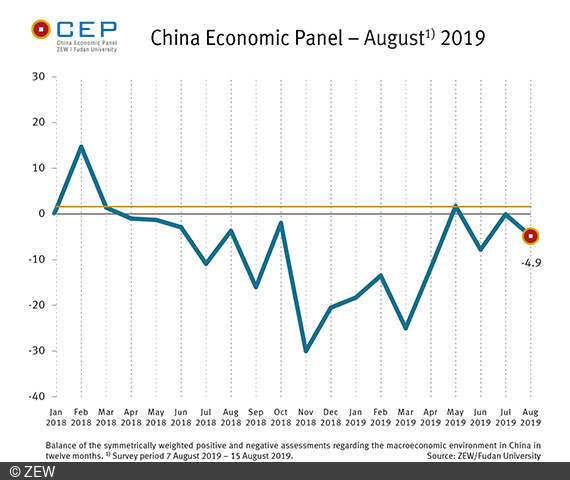

China Economic PanelCEP Indicator Falls to a New Reading of Minus 4.9 Points

In the most recent survey for August (7–15 August 2019), the expectations regarding the Chinese economy decreased by 4.8 points. This leaves the CEP Indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, at a current level of minus 4.9 points (July 2019: minus 0.1 points). The CEP indicator has been below its long-term average of 1.5 points since March 2018 and has been experiencing an almost uninterrupted series of negative readings since April 2018.

The assessment of the current economic situation has risen slightly by 2.1 points, and now stands at minus 12.9 points.

The point forecasts for real gross domestic product (GDP) growth remain unchanged from those of the previous month, with the experts forecasting a growth rate of 6.1 per cent for the whole of 2019. The average GDP forecast for 2020 is 5.9 per cent.

“Experts expect the depreciation of the yuan against the US dollar to continue. According to forecasts, the current exchange rate will shift from 7.03 yuan per US dollar to 7.07 yuan per US dollar in the next three months, and to 7.14 yuan per US dollar in the next 12 months. This depreciation of the yuan may support China’s exports on the one hand, but could also contribute to a further escalation in the trade dispute with the US,” says Dr. Michael Schröder, senior researcher in the Research Department “International Finance and Financial Management” at the ZEW – Leibniz Centre for European Economic Research and project leader of the CEP survey.