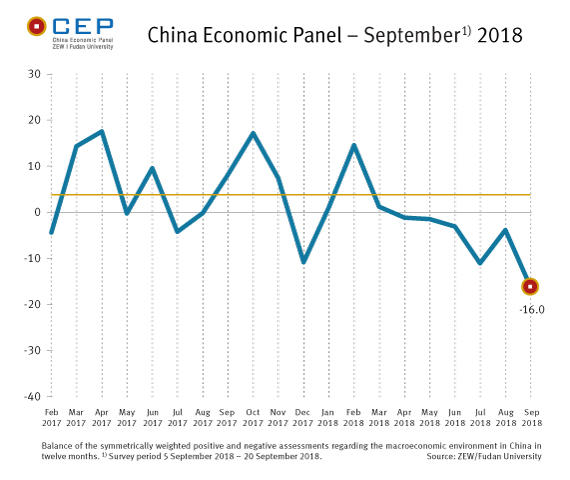

Economic Outlook for China Nosedives

China Economic PanelIn the most recent survey for September (05-20/09/2018), economic expectations for China experienced a considerable drop. The CEP Indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, currently stands at minus 16.0 points, 12.3 points lower than in the previous month (August 2018: minus 3.7 points). This means that the indicator has remained below the long-term average of 4.0 points since March 2018. The assessment of the current economic situation in China also worsened compared to the previous month, with the indicator dropping 7.5 points to a reading of 1.8 points. The assessment of the current situation has therefore experienced a decrease of 30.5 points since February 2018, when an interim high of 32.3 points was recorded.

According to the surveyed experts, both exports and private investment are set to develop more negatively over the next six months than previously predicted. Both indicators decreased by 22 points compared to the previous month and currently exhibit negative readings. There is also growing scepticism among the experts over the outlook for China’s share in global trade. The corresponding indicator currently stands at 12 points following a drop of 9.7 points compared to the previous month.

The experts’ assessment of the medium-term development for China’s exports sunk to an historic low of minus 10 points. That being said, this indicator is highly volatile since it is a direct reflection of the latest developments in China’s trade dispute with the US. “The renewed tensions in this conflict following the US government’s announcement of additional punitive tariffs and the resulting retaliatory measures from the Chinese government have caused this indicator to nosedive once again in the latest survey,” says Dr. Michael Schröder, senior researcher in the ZEW Research Department “International Finance and Financial Management” and project leader of the CEP survey.

The surveyed experts expect the yuan to remain fairly stable in relation to the US dollar and the euro both over the course of the next three months and in a year’s time. Their assessment of China’s foreign exchange reserves (decrease of 30.8 points to a new reading of minus 12.0 points), however, shows that the stability of the currency is partially dependent on supportive measures from the government. It therefore remains to be seen when the latent devaluation pressure on the yuan will actually be reflected in exchange rates.

For more information please contact

Dr. Michael Schröder, Phone: +49 (0)621-1235-368, E-mail: michael.schroeder@zew.de