Economic Outlook for China Drops Slightly

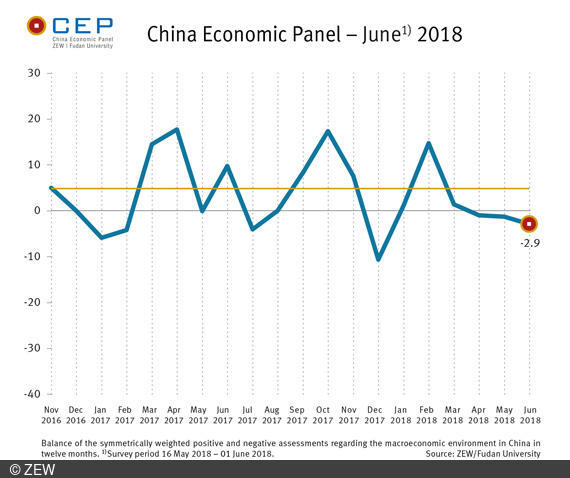

China Economic PanelAccording to the most recent survey for June (16/05/2018–01/06/2018), the economic outlook for China dropped slightly by 1.6 points to a new value of minus 2.9 points. This represents the fourth consecutive decrease in the CEP Indicator, which is currently well below the long-term average of 4.8 points. The CEP Indicator reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months.

Moreover, the assessment of the current economic situation in China experienced a three-point drop down to 22.0 points compared to the previous month. Despite this decrease, the assessment of the economic situation remains largely positive and well above the average reading of 3.1 points (since the survey began in May 2013).

The financial market experts polled in the current survey predict that real GDP in China will grow by 6.7 per cent in 2018 and 6.5 per cent in 2019. These are the same as the results from the previous survey. The slight dampening of both the economic expectations as well as the assessments of the economic situation has apparently not yet had an effect on the experts’ point forecasts.

One reason for this could be that many expect the Chinese government to introduce an increasing number of economic stimulus measures. The indicator for government consumption has climbed by six points to a level of 48.5 points. There was also a significant increase in the number of survey participants expecting an increase in domestic debt levels (for the government, banks, companies and private households), with the corresponding indicator climbing 23.1 points to a current reading of 45.2 points.

“In the face of already high levels of domestic debt, the sustainability of the Chinese government’s growth ambitions for 2018 and beyond is increasingly being called into question. The economic policy based on ever higher levels of debt could lead to a severe crisis in the financial sector, ultimately causing an economic downturn,” says Dr. Michael Schröder, senior researcher in the ZEW Research Department “International Finance and Financial Management” and project leader for the CEP survey.

The indicator readings for China’s exports, imports and share of global trade have once again seen considerable increases. This suggests that the experts currently expect the country’s ongoing trade dispute with the US to de-escalate.

Dr. Michael Schröder, Phone: +49 (0)621-1235-368, E-mail: michael.schroeder@zew.de