Economic Expectations for China Rise, but Remain Very Negative

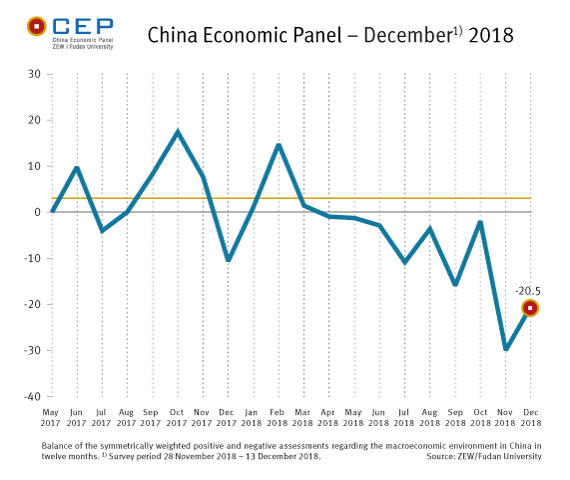

China Economic PanelExpectations regarding the Chinese economy improved in the most recent survey for December (28/11/2018 –13/12/2018). With a current reading of minus 20.5 points, the CEP indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, remains, however, clearly in negative territory. Despite its most recent increase of 9.5 points compared to the previous month (November 2018: minus 30.0 points), the indicator continues to signal an economic downturn. The indicator has thus remained well below the long-term average of 3.0 points, which has not been exceeded since March 2018.

The point forecasts for 2018 and 2019 have remained unchanged compared to the previous month, with experts expecting the economy to grow by only 6.4 per cent in 2018 and by 6.2 per cent in 2019.

The experts’ assessment of the economic situation has been seeing a clear decrease since January 2018. While at that time the corresponding indicator was still at 24.0 points, today it is down to 0.0 points. “On the one hand, this indicates that China’s economy grew slower this year than had previously been estimated. At the same time, this means that the economy could again see a rather weak performance in the fourth quarter of 2018,” says Dr. Michael Schröder, senior researcher in the “International Finance and Financial Management” Department at the Centre for European Economic Research (ZEW), Mannheim, and project leader of the CEP survey.

Experts’ views are very nuanced when it comes to the expectations for the major economic regions in China, with estimates being most unfavourable for Shenzhen (minus 15.6 points) and Chongqing (minus 6.3 points). The twelve-month outlook for the other regions is only slightly better, with expectations ranging from minus three to plus three points. “This relatively subdued outlook is reflected in a very sharp decline in real estate price estimates for all regions,” says Michael Schröder.