Almost One Year After Flood Disaster: Majority in Favour of Mandatory Insurance Against Flood Damage

ResearchNatural Disasters

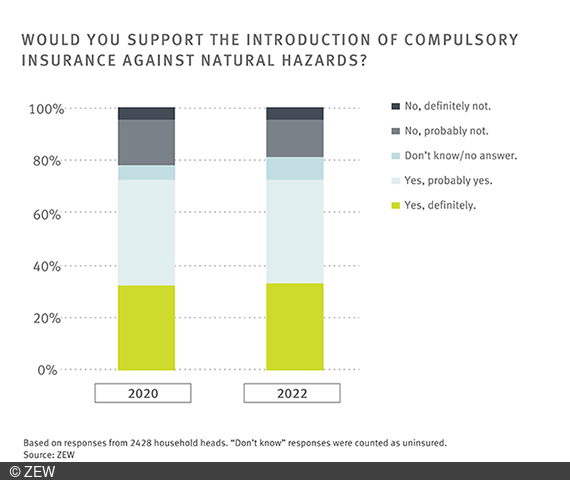

More than two thirds of German households support the introduction of mandatory insurance against flood damages and other natural hazards. Support has risen slightly following the flood disaster in 2021. This is the result of a representative survey conducted by ZEW Mannheim among around 5,000 households in 2020 and 2022.

“A cleverly designed mandatory insurance scheme could significantly contribute to a better protection of the population without abandoning market principles,” says Dr. Daniel Osberghaus, expert on climate adaptation and flood prevention at ZEW Mannheim and author of the ZEW policy brief. “Moreover, there are many reasons to replace the current practice of the state stepping in with ad hoc aid.”

State-funded flood relief prompts even more households to count on state aid

In July 2021, devastating flash floods hit western Germany, causing numerous deaths and billions of euros in economic damage. A large proportion of the affected households were not insured. In Rhineland-Palatinate, for example, only 37 per cent of households had taken out building insurance that also covered natural hazard damage. With a 30 billion euro flood relief fund, the federal and state governments helped uninsured people rebuild their homes and livelihoods.

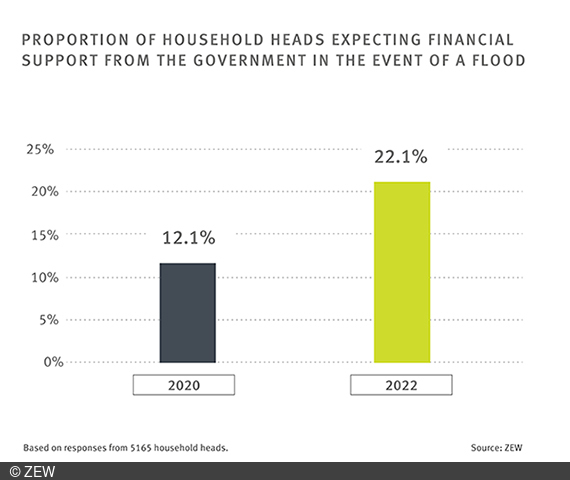

“In the event of an acute disaster, the provision of state aid for uninsured victims is essential. In the long run, however, they set the wrong incentives and discourage people from taking more preventive measures. We also find indications of this in our survey following the Eifel floods,” says environmental economist Osberghaus. For example, the share of households that would expect to receive financial help from the state in the event of damage increased significantly after the flood disaster – from 12 per cent of households in 2020 to 22 per cent in 2022.

“Relying solely on the state for flood protection can be expensive, because emergency aid cannot be taken for granted by consumers,” explains Osberghaus. Experience shows that the government helps out when many households are affected and the natural disaster receives nationwide media coverage. Between 2002 and 2019, however, around half of the flood victims were left without state support, for example because they were affected by minor weather events.

ZEW flood expert recommends a capped insurance obligation

Osberghaus therefore suggests imposing a twofold insurance obligation: He proposes that every privately used residential property should have to be insured against flood damage, and at the same time insurers would have to make an offer to every household. “From an economic point of view, it is important to determine premiums according to risk classes. Those who live in high-risk zones should also pay more.” This creates an incentive to build in safe areas. To provide financial relief to low-income households in high-risk regions, they could receive a subsidy on their insurance premium, according to Osberghaus – provided that new buildings remain excluded from this.

He also recommends limiting mandatory insurance to a living wage level. Homeowners could obtain further insurance on a voluntary basis for property values exceeding this amount. This would reduce insurance premiums within the scope of the coverage obligation. “Reforming flood protection in this way would make the costs calculable in advance for both consumers and the state. In addition, the incentives to reduce risk can lower the overall costs for society. In this way, we not only ensure the sustainability of public finances, but also prepare for the consequences of climate change in the future,” explains Osberghaus.