2013 Starts with Cautious Expectations for the Information Economy

Information EconomyIn the first quarter of 2013, optimism among the companies of the information economy concerning the economic trend in the sector has waned. Contrary to these expectations, the companies assess their current business situation significantly more positive than a few months ago. These are the findings of a survey conducted by the Centre for European Economic Research (ZEW) in the information economy sector in December 2012.

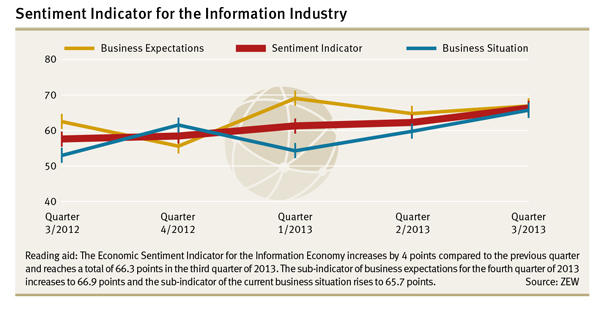

Currently, there is no reason to be concerned about the development of the information economy. The sub-indicator of the business expectations for the first quarter of 2013 dropped by 6.9 points to 55.6 points and the sub-indicator of the business situation at the end of 2012 increased by 8.5 points reaching a value of 61.5 points. Both sub-indicators thus remain above the 50 point mark signifying the favourable economic development of the branch. Correspondingly, the economic sentiment indicator for the information economy increased by 0.9 points to 58.5 points in the fourth quarter of 2012 and hence stays clearly above the 50 point mark as well.

The sector of the information economy consists of the sub-sectors information and communication technologies (ICT), media service providers and knowledge-intensive service providers. In the ICT sub-sector, the somewhat less optimistic business expectations for the first quarter of 2013 are overcompensated with a considerable improvement of the current business situation. All in all, the sentiment of the ICT companies has thus brightened up for the first time since the beginning of 2012 and the overall indicator for the ICT sub-sector grows by 7.4 points to a total of 66.9 points.

The media service providers, however, will not be able to keep up the positive economic sentiment observed in the third quarter of 2012. The current sentiment indicator for this sector decreased to 39.5 points at the end of 2012. Thus, the media branch still does not manage to exceed the critical 50 point mark. In terms of the media sector and the entire information economy sector, the current situation proves more positive that the expectations for the future economic development. The discrepancy between the two components is particularly high in the sector of media service providers.

The sentiment indicator for knowledge-intensive service providers slightly drops by 4.2 points to 55.1 points, the lowest level in the past two years. Nevertheless, the level of the indicator suggests a continuously positive economic trend for knowledge-intensive service providers. In the case of a basically constant business situation, the noticeably falling business expectations are responsible for the slight set-back. The corresponding sub-indicator decreases from 60.3 points to 52.8 points.

For further information please contact

Daniel Erdsiek, Phone +49 621/1235-356, E-mail erdsiek@zew.de

The Economic Sentiment Indicator for the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. Sales situation and demand situation form a partial indicator reflecting the business situation. Sales expectations and demand expectations form a partial indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations amounts to the value of the Economic Sentiment Indicator of the Information Economy. The sentiment indicator can adopt values between 0 and 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The economic survey conducted by ZEW

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. The last six sectors make up the knowledge-intensive service providers.

Overview of the ZEW economy survey (in German language)

Comment on the projection

To ensure that the analyses are representative, ZEW projects the answers of the survey participants with the sales value of the businesses with regard to the entire sector of the information economy. The phrasing "share of the businesses" thus reflects the share of sales of the businesses.