Labor in the Boardroom

Research Seminars: Mannheim Applied SeminarWe estimate the effects of a mandate allocating a third of corporate board seats to workers (shared governance). We study a reform in Germany that swiftly abolished this mandate for certain firms incorporated after August 1994 but locked it in for the slightly older cohorts. In sharp contrast to the canonical hold-up hypothesis – by which increasing labor’s power reduces owners’ capital investment – we find that granting workers formal control rights raises capital formation. Shared-governance firms shifted their production process towards higher capital intensity, as the capital share increases. This effect is not driven by outsourcing labor-intensive production steps. We also document a moderate compositional shift towards skilled labor. Shared governance does not raise wage premia or rent sharing, consistent with the absence of hold-up patterns. Leverage is unaffected, but firms with shared governance face lower interest rates, perhaps due to an associated collateral channel or reflecting worker preferences for safer projects. Overall, the evidence is inconsistent with hold-up mechanisms at play. Instead, shared governance may crowd in investment by facilitating cooperation, perhaps by institutionalizing communication and repeated interactions between labor and capital.

People

Contact

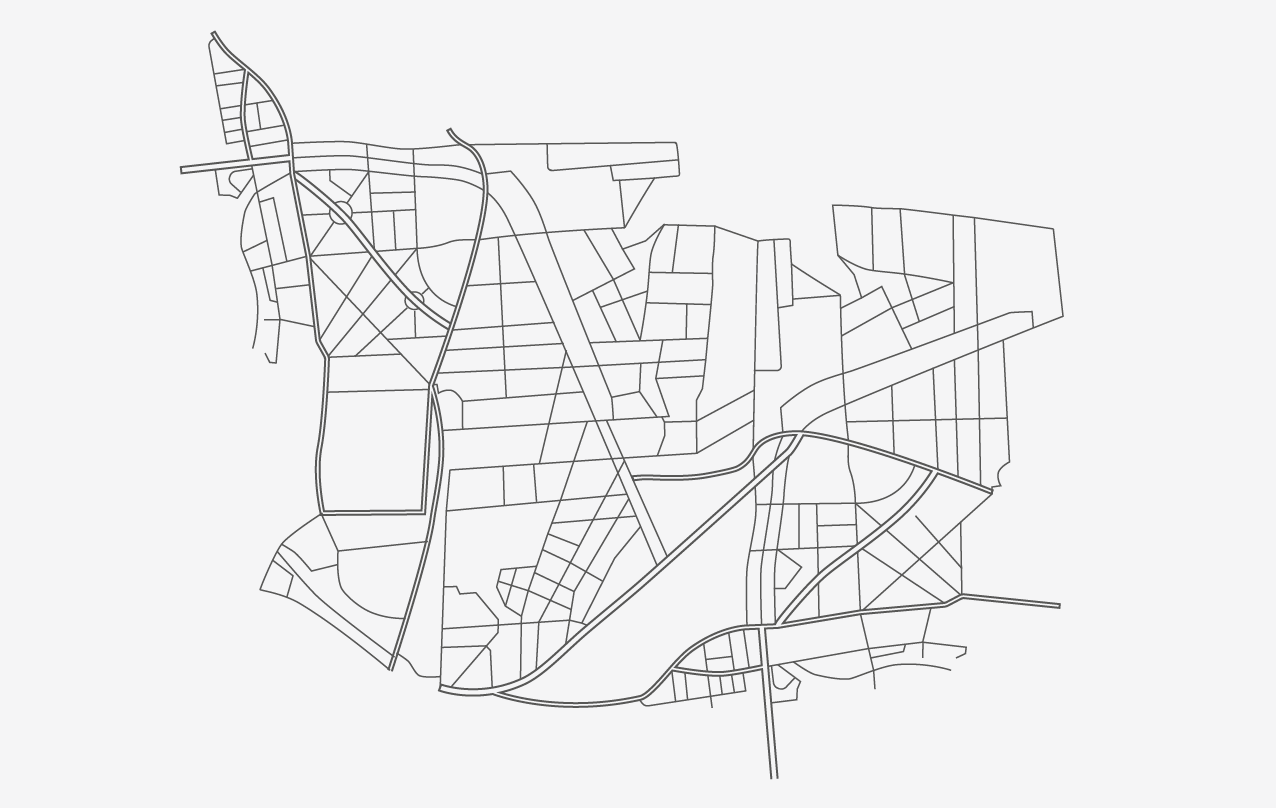

Directions

- Room Straßburg