M&A Activities in the European Energy Sector in Decline

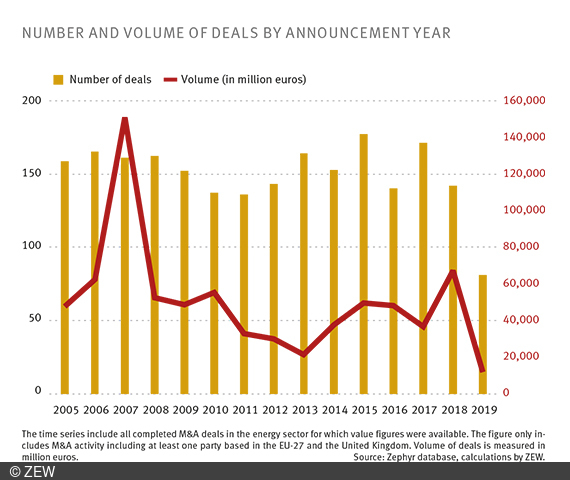

M&A IndexFollowing a peak phase between 2005 and 2017, the number of mergers and acquisitions (M&A) on the European energy market almost halved between 2017 and 2019. Moreover, the transaction volume in 2019 reached its lowest level in the past 15 years. This is the result of calculations carried out by ZEW Mannheim based on the Zephyr database of Bureau van Dijk.

“Few sectors have been subject to as much regulatory scrutiny and change as the European energy generation sector in recent years,” says Moritz Lubczyk, a researcher in ZEW’s “Economics of Innovation and Industrial Dynamics” Department. “As a result of the energy transition, the firms in the industry face a variety of key trade-offs. Maintaining affordable energy prices is a key priority, while regulators and consumers are setting incentives to transition to more sustainable business models and to phase out environmentally harmful capacities.”

The competitive pressures entailed in this changing regulatory environment have led to a flurry of M&A activity amongst the affected companies in recent years. Between 2005 and 2017, the EU energy generation sector maintained a steady average of slightly more than 150 completed deals per year, on average accounting for a total deal volume of almost 52 billion euros. However, the volume of M&A activity has noticeably declined since 2017. In the two years since, the number of deals completed dropped from over 160 in 2017 to just above 80 in 2019. While the combined volume of transactions rose between 2017 and 2018, the 12 billion euros recorded in 2019 marks a 15-year-low.

“While these trends deviate from long-run averages,” says Lubczyk, “it remains open whether they indicate that the sector has moved past its activity peak and will see continuously lower levels of M&A, or whether the industry is simply taking a break before returning to previous levels of activity.”