Downward Trend in Global Mega Deals Continues

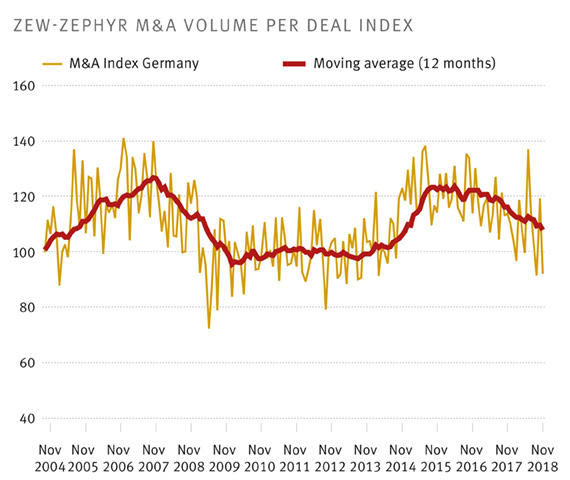

M&A IndexThe number of mergers and acquisitions (M&A) completed worldwide has continued to decline. This downward trend was only briefly interrupted in June 2018, which saw the number of global acquisitions rise to a moderate 660 transactions. The volume per deal, on the other hand, has remained stable. After a brief upturn, the twelve-month moving average has continued its downward trend and now stands at 112 points – its lowest level since February 2015. These are the findings of studies carried out by the Centre for European Economic Research (ZEW), Mannheim, on the basis of the Zephyr database of Bureau van Dijk.

This year, the ZEW-ZEPHYR M&A Volume per Deal Index showed no signs of recovery from the relatively low levels recorded in 2017. The twelve-month moving average has been experiencing a downward trend since February 2017, the only exception being June 2018, which saw the index climb a spectacular 137 points – only to fall down to 91 points again in September 2018. The high level in June had, however, only limited impact on the twelve-month moving average, as the most recently recorded low index value shows.

In terms of transaction volume, the two largest transactions, which both took place in June, involved the takeover of the media conglomerate Time Warner by the US telecommunications company AT&T for 93 billion euros, and Bayer’s acquisition of Monsanto for 53 billion euros. All other acquisitions carried out this year reached significantly lower transaction volumes.

Expectations for global M&A market remain highly uncertain

With a volume of 28 billion euros, another major deal completed in 2018 was the purchase of Spanish toll road operator Abertis by German builder Hochtief. Hochtief itself belongs to the Italian holding company Atlantia, which is controlled by the Benetton family. In November 2018, the chipmaker Broadcom Inc. acquired CA Technologies, a software company based in New York, for around 15 billion euros. After failing to acquire its competitor Qualcomm in early 2018, Broadcom decided to move its headquarters from China to San Jose in California, US. This way, the chip giant aims to improve its chances to buy up US firms, since the US government will no longer be able to block planned takeover bids on the grounds of national security concerns.

“The expectations for the global M&A market remain highly uncertain. On the one hand, the US is still involved in trade disputes, while the outcome of Brexit is yet to be seen. On the other hand, however, favourable depreciation rules have benefited many US-based companies, which now hold substantial cash reserves – money that top managers would like to see invested in M&A projects. In the next year, these two opposing effects will most likely balance each other out.” explains Dr. Niklas Dürr, a researcher in the ZEW “Economics of Innovation and Industrial Dynamics” Department and responsible for the ZEW-ZEPHYR M&A Index.