Economic Recovery Postponed Until 2022, Slight Rise in Inflation Forecast

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomists Still Confident

Economic experts expect the economic recovery to be postponed until 2022. However, not only is economic growth in Germany expected to pick up in 2022, the forecasts for the inflation rate in Germany and the euro area are also being revised up slightly. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

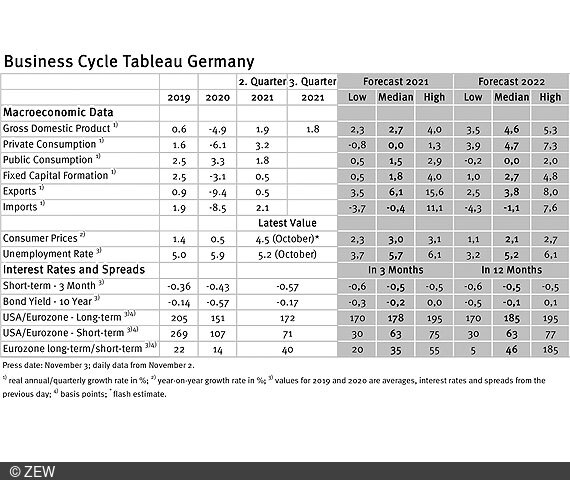

The current forecasts for economic growth in Germany have been revised significantly downwards. The median forecast for real gross domestic product (GDP) growth in 2021 is only 2.7 per cent. For comparison: In the previous month it was still 3.4 per cent and at the beginning of the year even 4.0 per cent. On a two-year horizon, however, not too much has changed, as the GDP forecasts for 2022 were raised at the same time. Currently, the forecast for 2022 is 4.6 per cent, compared to 4.4 per cent in October and 3.2 per cent in January.

Economic recovery postponed until 2022

The two-year forecasts for 2021 and 2022 currently predict GDP growth of 7.4 per cent. In the previous month, the forecast two-year growth was still at 7.9 per cent and in January at 7.3 per cent. Looking at the two-year horizon, the lowering of the growth rate for the current year therefore means for the most part merely a postponement of the expected strong economic recovery to 2022. However, this postponement increases uncertainty, as GDP forecasts for longer time horizons considerably lose accuracy. It is therefore to be hoped that the current production problems, which are mainly caused by international supply bottlenecks and raw material shortages, will ease in the course of the next few months. Otherwise, the GDP forecast for 2022 could quickly turn out to be mere wishful thinking that has little to do with reality.

Rise in inflation forecasts: Will the ECB soon have to justify its monetary policy?

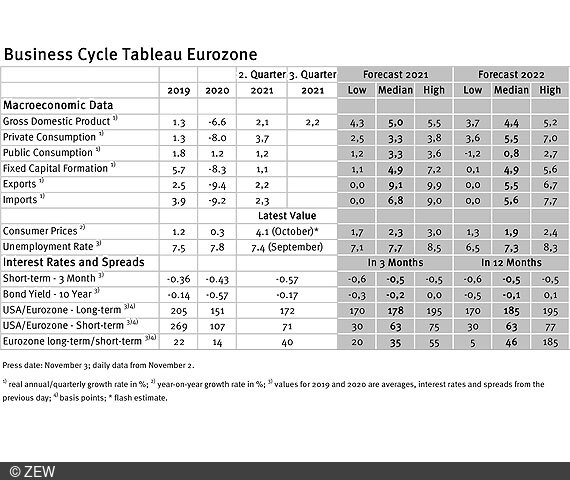

The relatively high inflation rates of recent months – the estimate for October is 4.5 per cent – have led to a slight increase in the forecasts. For the current year, an average inflation rate of 3.0 per cent is expected, which corresponds to an increase of 0.3 percentage points compared to the previous month. The forecasts for 2022 were also raised, from 1.9 per cent in October to now 2.1 per cent. Of course, more important than the German inflation rate for assessing the ECB’s monetary policy is that for the euro area. The inflation forecast for the euro area was also raised slightly. For 2021, it is 2.3 per cent (previous month: 2.0 per cent) and for 2022, 1.9 per cent (previous month: 1.6 per cent). The experts thus assume that the increase in consumer prices in both years will roughly correspond to the ECB’s target value of 2.0 per cent. With these forecasts, the ECB could still justify its ultra-loose monetary policy by saying that there is no excessive inflation trend yet. However, given the dynamic upward trend of recent months, it could quickly become difficult for the ECB to justify itself if it does not tighten the monetary policy rules again soon.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.