What Europe Can Prepare for in the New Decade

EventsNew Year’s Lecture: ZEW President Taking a Look at the World Economy

It’s not just a new year, but a new decade. What’s in store for Germany, Europe, and the world? In his first New Year’s Lecture at ZEW Mannheim on Thursday, 23 January, ZEW President Professor Achim Wambach talked about which developments will determine the global economy in the near future – and how the EU can position itself to compete with the other two major economic powers, China and the USA.

Wambach began his lecture entitled “America First, Made in China 2025 – and Europe?” with a look at the current economic situation. Expectations for Germany look good. The indicator of economic sentiment, for which ZEW surveys up to 300 financial market experts monthly, rose in January 2020 to its highest value since July 2015; expectations for the eurozone also improved considerably again. “Things looked much worse this past summer, but we’ve recovered from that,” Wambach said.

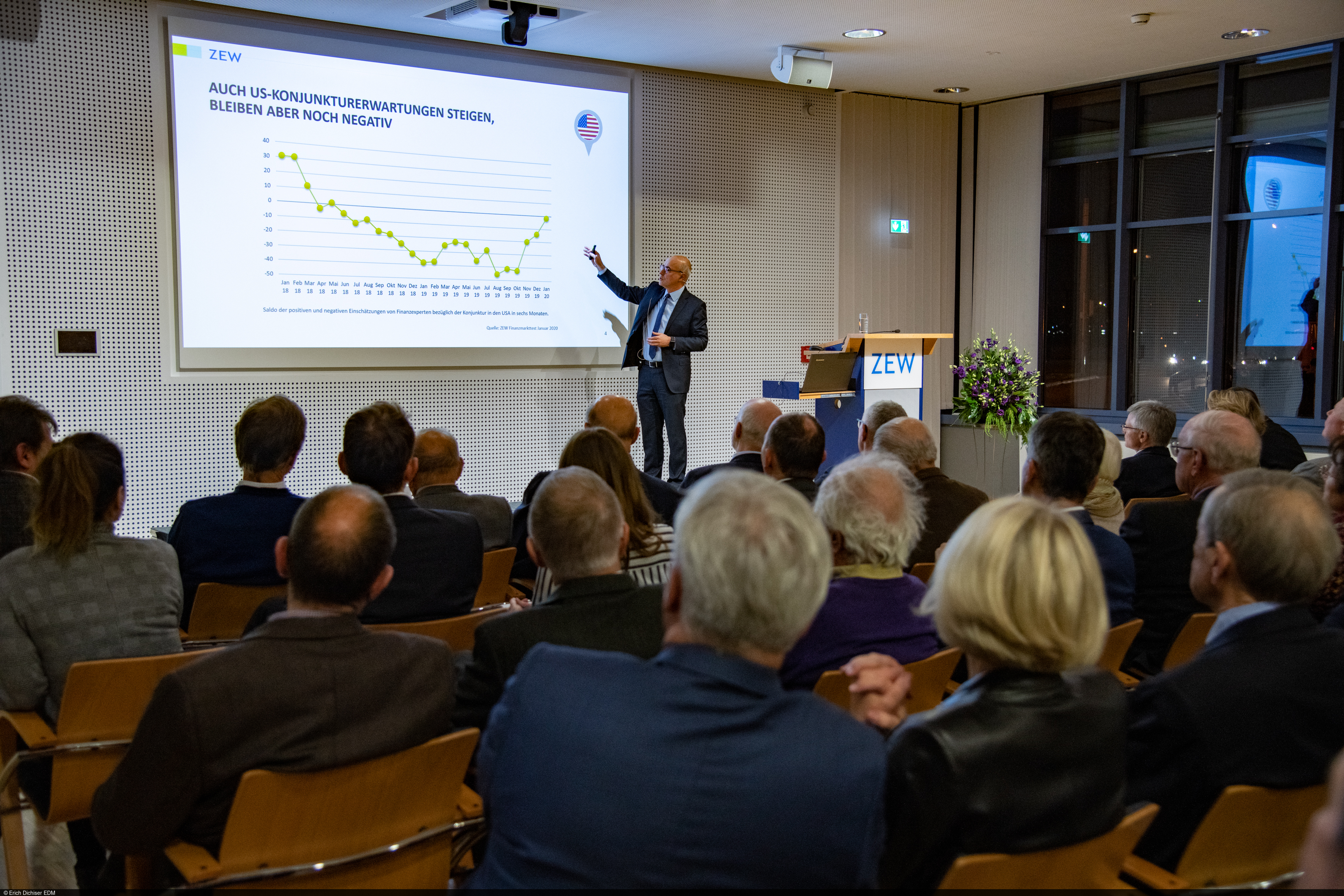

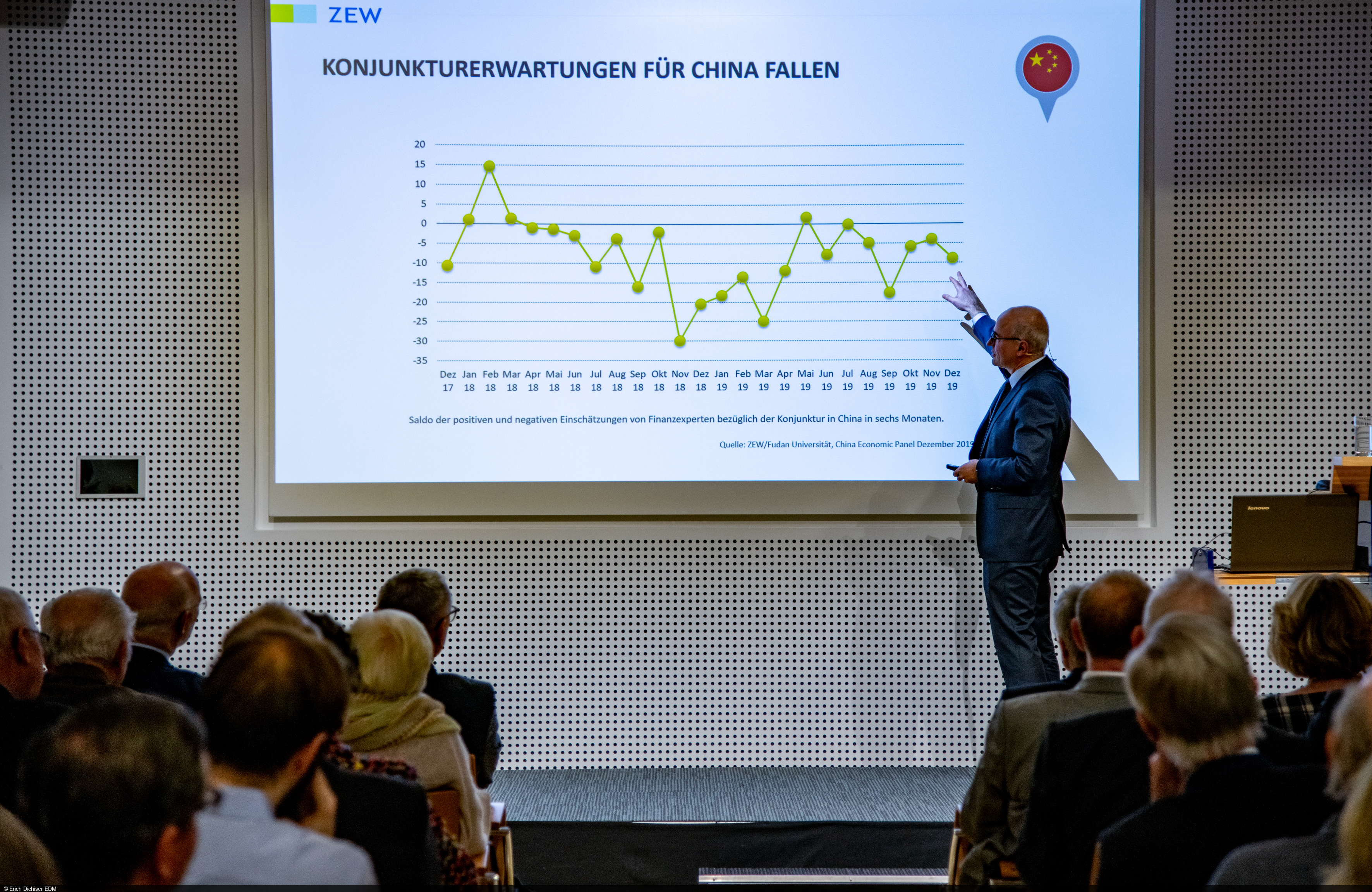

Economic expectations also rose in the USA but remained in the negative. The latest survey for the China Economic Panel, which ZEW regularly conducts with Fudan University in Shanghai, shows a somewhat bleaker picture for China. As far as GDP growth is concerned, weak growth of 1.4 per cent is expected for the EU in 2020. “Although the economy’s growing, it’s no cause for euphoria,” Wambach summed up.

He also mentioned how international factors were the main causes of the domestic economy having weakened in summer 2019, from drastic events such as the impending Brexit, or the trade conflict between the USA and China. In light of the great importance of international trade, Wambach focused his remarks on central developments within the USA, China, and EU, since together, these economic giants are responsible for 62 per cent of the global gross domestic product.

The USA in-between protectionism and free trade

The 2017 tax reform in the USA is of particular importance, with the reduction of the corporate tax rate, among other measures, having made the US more attractive for cross-border investments. “Germany is a high-tax country in comparison,” noted Wambach. He therefore welcomed the proposal by Federal Minister for Economic Affairs and Energy Minister Peter Altmaier to consider a reform of corporate taxation.

However, it is impossible to discuss the current state of the US economy without considering the issue of tariffs. The much-discussed tariff policy of US President Donald Trump was not interpreted by the ZEW President as protectionist in principle, but rather as a negotiating instrument. The signing of a first free trade agreement between the United States and China, for example, has already brought about a partial settlement of their trade dispute.

Trump’s aggressive tariff policy even has its advantages for the EU, according to Wambach: “We actually benefit from trade diversions because the EU now partly supplies the US with products no longer coming from China.” He further sees it as positive that the EU has been reacting to protectionist signals from the USA in 2019 by negotiating its own bilateral free trade agreements. “As a result, resistance to free trade in Germany isn’t as strong as before.”

Mixed signals from China

China has only recently arrived on Germany’s main political agenda, according to Wambach; trade with them is growing. “Because we don’t just import a lot from China, but export just as much, we profit from the well-priced goods coming in, as well as the new jobs created,” he said. As the German patent strategy – in contrast to the US one – is complementary to the Chinese one (as opposed to being in direct competition with it), both sides benefit from the cooperation.

Nonetheless, there were mixed signals from China. With the strategy “Made in China 2025”, the Chinese government is aiming to make the state more independent of foreign technologies while spreading its own more starkly on international markets. Especially regarding new advances in artificial intelligence, China has already taken over the leading role worldwide, followed by the USA. “Germany and the EU are lagging behind in this area,” Wambach noted.

The particularly challenging question is how Germany and the EU are to deal with a very strong state that doesn’t follow the conventional rules of a market economy. Germany has already reacted to China’s position of power with some initial measures, having tightened the Foreign Trade and Payments Ordinance in December 2018, for example, which made foreign takeovers of German companies more difficult. “For the future, an investment agreement with China would certainly help,” said Wambach. All eyes are therefore on the EU-China Summit taking place in Leipzig in September 2020.

Alumni meeting at ZEW

r taking a look at the USA and China, Wambach eventually turned to the special challenges facing Europe in the near future – first and foremost the UK’s withdrawal from the EU on 31 January 2020, the final agreement having to be negotiated by summer this year. Wambach also paid particular attention to the issue of financial market integration, currently being handled by the EU Commission. Learning from the financial crisis, the Commission knows there is a need for an orderly restructuring of public debt in order to better absorb economic fluctuations. Climate protection will also be paramount. The USA, China, and the EU together are responsible for 52 per cent of global CO2 emissions. “This is why it’ll be very important to work on the EU Commission’s Green Deal and reform emissions trading in 2020.”

Following the lecture, Wambach opened the discussion to the 110 audience members, among them 18 ZEW alumni who had previously gathered for an alumni meeting. The evening, which was supported by the <link en das-zew foerderkreis _blank>ZEW Sponsors’ Association for Science and Practice, ended with a debate on the innovation dynamics of the three major economic powers, as well as the future balance of power between them and the rapidly catching up emerging markets.