Upward Trend in Commercial Real Estate Financing Continues

DIFI Report by ZEW and JLLDIFI Increases Despite Ongoing COVID-19 Crisis

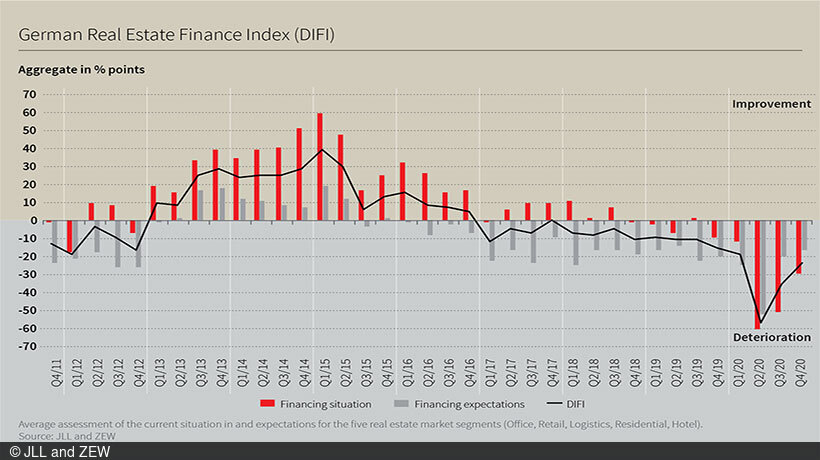

The German Real Estate Financing Index (DIFI) of ZEW Mannheim and JLL continues to improve in the fourth quarter of 2020. The sentiment indicator climbed 12.5 points to minus 23.5 points, thus almost returning to the level of the first quarter of 2020 (minus 18.5 points). In particular, the assessment of the financing situation of the past six months has resulted in the index almost reaching pre-pandemic levels.

The experts are also cautiously optimistic in their assessment of the financing expectations for the next six months. The sectors of housing and logistics, which were also seen as very relevant during the crisis, are rated particularly positively both for the present and future, while the assessment of the financing situation is even better than before the pandemic. The logistics asset class has reached its highest level since the beginning of 2016.

These are the key findings of the DIFI Report, a quarterly survey on the commercial real estate financing market in Germany carried out by ZEW in cooperation with JLL.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by Jones Lang LaSalle (JLL) and ZEW Mannheim. 35 experts participated in the survey, which was conducted between 26 October and 9 November 2020.