Sentiment Indicator for Commercial Real Estate Financing Continues to Rise

DIFI Report by ZEW and JLLDIFI at Highest Level Since Early 2016

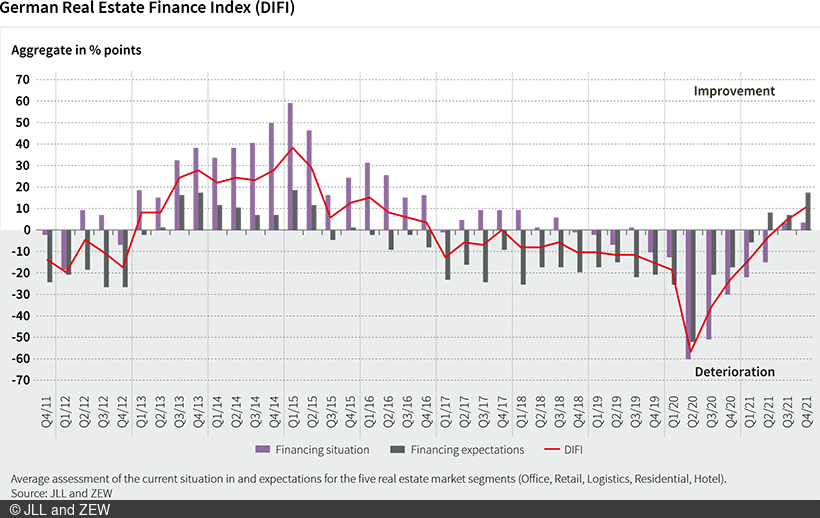

Even though the sentiment indicator’s growth is not as strong as in the previous quarter, the German Real Estate Finance Index (DIFI) by ZEW Mannheim and JLL is rising for the sixth time in a row and has reached its highest level since the beginning of 2016. In the fourth quarter of 2021, the DIFI stands at 10.7 points, 5.1 points higher than in the previous quarter.

While the assessments of the financing situation have tended to stabilise in the past six months compared to the previous quarter, the experts expect the financing situation to improve in the coming six months.

Financing conditions for office and hotel properties improve significantly again

A look at the individual real estate segments shows that the increase of the DIFI in the fourth quarter of 2021 is primarily due to the favourable development in the office and hotel segments. The corresponding DIFI sub-indicators, which reflect both the current situation and expectations, are only exceeded by the DIFI sub-indicator for logistics properties in the fourth quarter of 2021. The situation indicator for the office segment has risen by 10.2 points to 17.4 points. The expectations indicator for the office segment has also increased by 13.6 points and is thus back in positive territory for the first time since the third quarter of 2016.

The situation indicator for the hotel segment has improved by 9.2 points, but on balance remains clearly in negative territory at -22.8 points. However, the experts’ assessments for the coming six months show an increase of 55.0 points, which gives reason for hope. Of all the segments considered, this has been the clearest improvement.

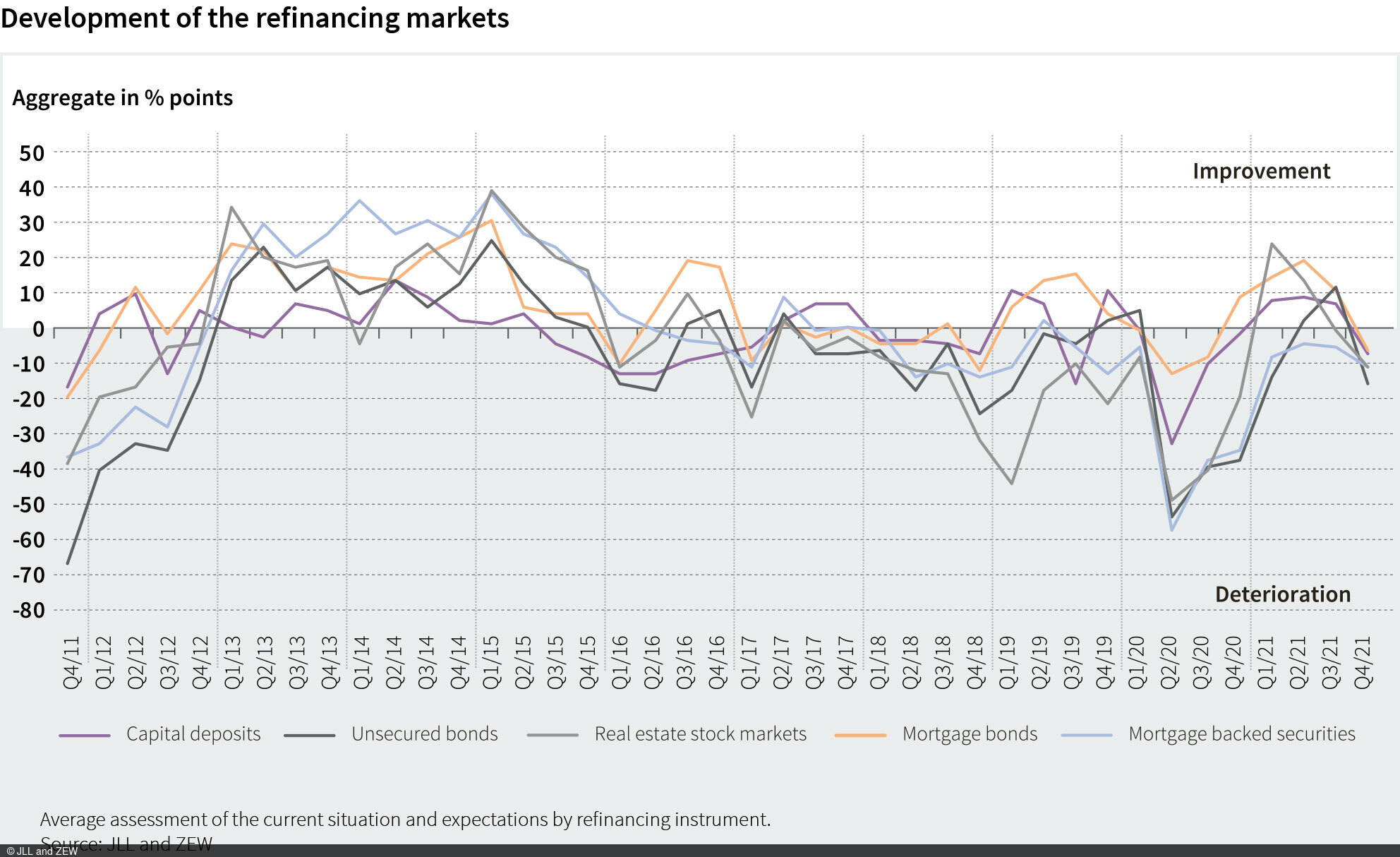

Situation assessment on real estate refinancing markets worsens significantly

The respondents assessed the real estate refinancing situation in the fourth quarter as significantly worse overall than in the previous quarter. The situation indicators of all the refinancing instruments considered recorded double-digit declines. The respective expectation indicators all either decreased or remained almost unchanged. The declines in the situation indicators range from -11.1 points for mortgage-backed securities to -42.3 points for unsecured debt securities. All situation indicators are in negative territory.

The picture is mixed when looking at the individual expectations indicators. While the outlook for the refinancing markets for deposits, covered bonds and mortgage-backed securities has remained almost the same compared to the previous quarter, expectations for unsecured debt securities and real estate equity markets are more pessimistic in the fourth quarter. The expectations indicators for the latter have fallen by 7.7 points each, both reaching a new level of -7.7 points. Despite a slight increase of 1.2 points, the expectations indicator for mortgage-backed securities in the fourth quarter of 2021 is the lowest compared to the other instruments and currently stands at -10.0 points. For deposits and covered bonds, respondents do not expect to see any change in the next six months compared to the current situation. The corresponding expectation indicators therefore remain at 0.0 points each.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by Jones Lang LaSalle (JLL) and ZEW Mannheim. 29 experts participated in the survey, which was conducted 25 October–5 November 2021.