Pessimism Prevails over Financing Situation

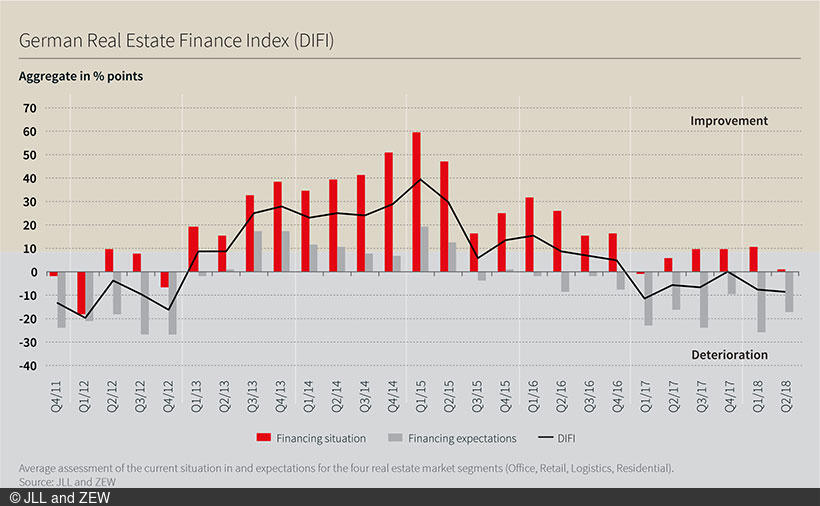

DIFI Report by ZEW and JLLIn the second quarter of 2018, the German Real Estate Finance Index (DIFI) continues its downward trend. Falling by 0.4 points, the DIFI indicator now stands at minus 8.2 points. This drop can be attributed to a less favourable assessment of the financing situation which caused the corresponding indicator to fall by 9.5 points. With a current reading of 0.6 points, the indicator remains only slightly above zero.

In contrast, expectations regarding commercial real estate financing have improved. Despite this increase, the indicator still finds itself in negative territory. In the categories “offices” and “residential properties”, the assessment of the commercial real estate financing market has shown hardly any changes compared to the first quarter of 2018, leaving the corresponding indicator at minus 2.7 points. The market for retail property financing once again scores the worst rating: The corresponding indicator, which had already closed at a low level in the previous quarter, has now fallen again, reaching a new low of minus 32.8 points. As in the previous year, the indicator for logistics financing remains slightly above zero. This most recent survey shows, however, that the development of the refinancing markets has, on average, received slightly less favourable assessments compared to the previous quarter. These are the key findings of the DIFI Report, a quarterly survey on the commercial real estate financing market in Germany carried out by ZEW in cooperation with JLL.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. DIFI is a survey conducted and published by JLL and the ZEW – Leibniz Centre for European Economic Research. 29 experts participated in the January/February 2019 survey.