Introducing Standardised Pension Products

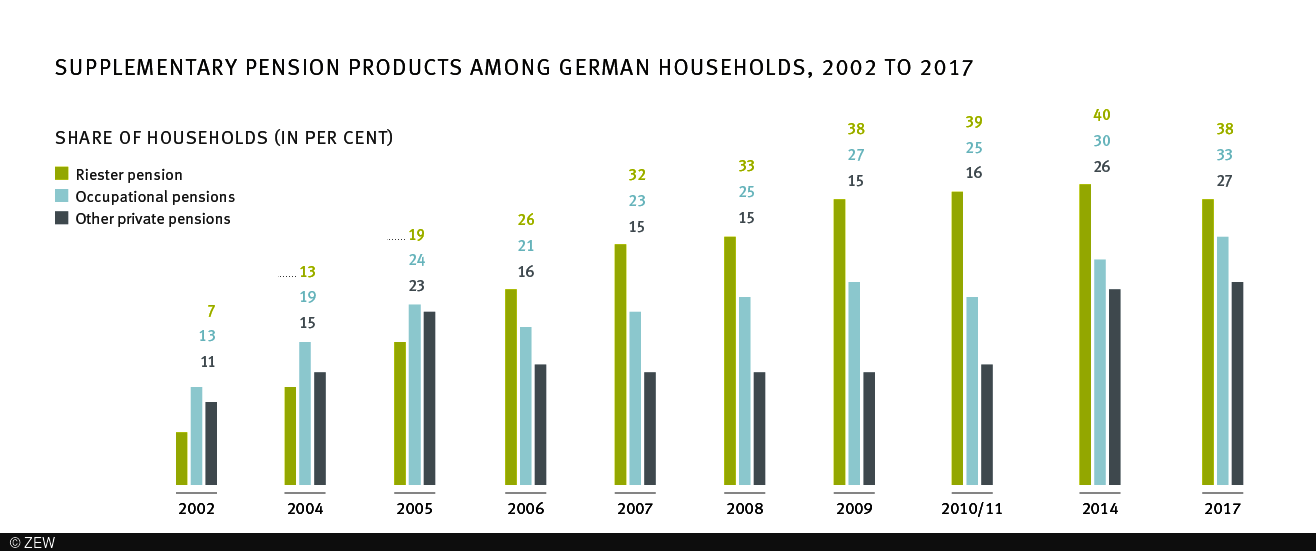

ResearchAlmost every third household does not own any supplementary pension products. Therefore, these households might face an income gap between their previous salary and their income at retirement. It is true that private old-age provision – especially through the Riester pension – has made great progress over the past twenty years. However, the Riester pension has been criticised heavily, because high administrative and sales costs as well as contribution guarantees substantially reduced returns. Additionally, lack of financial literacy and poor financial advice lead to investment mistakes. In recent years, the distribution of Riester contracts has stagnated.

This can be done better: Internationally, there are many examples of how the traditional pay-as-you-go pension systems can be supplemented by funded systems in which households can benefit from returns on the capital market and diversify their pension income at the same time. For this purpose, standardised pension products are offered both in occupational and statutory pension schemes as well as in private pension schemes. Examples include the National Employment Savings Trust (NEST) in the UK, a standard funded solution within the occupational pension system; the Swedish pension fund AP7, which is a mandatory funded component of the statutory pension; and standard products in the US, which have been introduced in many states as part of private pensions. Germany could follow suit and offer a standard life-cycle fund. Moreover, households should have the choice to opt for more or less risky options within the standard scheme.

What does ZEW recommend?

Standardised, funded pension products offer several advantages and thus increase the incentive for individuals to make private provision: by promoting market transparency and crowding out more expensive products, they can help to overcome the existing problem of high costs for the insured. They should be easy to understand in terms of design and potential subsidies. Standard products could also be suitable for people who are unable or unwilling to inform themselves about the possibilities and risks of additional pension products. Finally, independent, standardised pension information covering all different forms of pensions can create transparency and make pension planning easier.