How Can Corporate Tax Burdens Be Compared Internationally?

Questions & AnswersInterview with ZEW Economist Daniela Steinbrenner

Public debt levels have skyrocketed as a result of the COVID-19 crisis. In order to bridge the massive financing gaps in public budgets, policymakers are shifting their focus of attention on corporate taxation. However, corporate tax rates differ greatly in international comparison.

In this interview, Daniela Steinbrenner explains how the Mannheim Tax Index can be used to determine and compare the effective tax burden for companies across countries.

What does the Mannheim Tax Index do?

The Mannheim Tax Index is an indicator for the effective tax burden at company level. More specifically, it benchmarks various countries from a tax perspective. In doing so, it provides a comprehensive overview of the tax landscape by tracking two general strands, i.e. the taxation of domestic companies along with their shareholders, and cross-border corporate investment. Analysing the tax burden for companies is a traditional way of comparing the fiscal attractiveness of regions that compete with one another internationally. The Mannheim Tax Index includes all European Member States, the United Kingdom, Norway, Northern Macedonia, Turkey, Switzerland, Canada, the USA and Japan. However, the index does not focus on a specific industry, but maps the country-specific tax burden for a model company whose fixed assets consist equally of industrial buildings, acquired intangible assets (patents), machinery, financial assets, and inventories.

How is the index calculated?

The Mannheim Tax Index maps the effective tax burden of a company for a hypothetical investment project, based on current tax regulations. Thereby, we take into account the most important national regulations that apply to the taxation of corporate profits in the respective location. In addition to the statutory corporate tax rates and their surcharges as well as special rates for certain types of income and expenses, these also include the most important types of taxes on assets, e.g. property taxes. The most important rules for determining the tax base, such as regulations on tax depreciations, the valuation of inventories as well as the deductibility of interest in the case of debt financing are also taken into account. At ZEW we have experts for the respective tax systems of each country and match our research with the auditing firm PWC. To obtain country-specific details, we send a questionnaire to all local PWC offices in the countries we map. Finally, all data are entered into a database and software developed at ZEW to calculate the results.

What are the key results of the latest index?

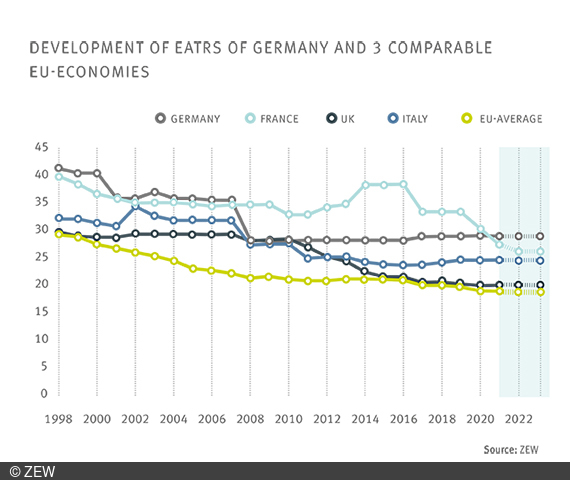

Germany as one of the most important European countries for foreign direct investment continues to lose ground in international tax competition. A comparison with France, Italy, the United Kingdom and the EU average shows that the tax burden for companies in Germany is relatively high. Only France has a slightly higher tax burden. However, if we take into account the tax reforms announced by its direct competitors, Germany will soon take over the top position in terms of taxing corporate profits. If tax reforms fail to materialise, this could exacerbate the persistently high burden on investments in Germany in the coming years and jeopardise its current midfield position in the ranking of tax burdens among comparable large industrialised nations, provided they continue to actively participate in tax competition.