Has the Worst Been Overcome?

DIFI Report by ZEW and JLLDIFI Benefits from Improved Expectations

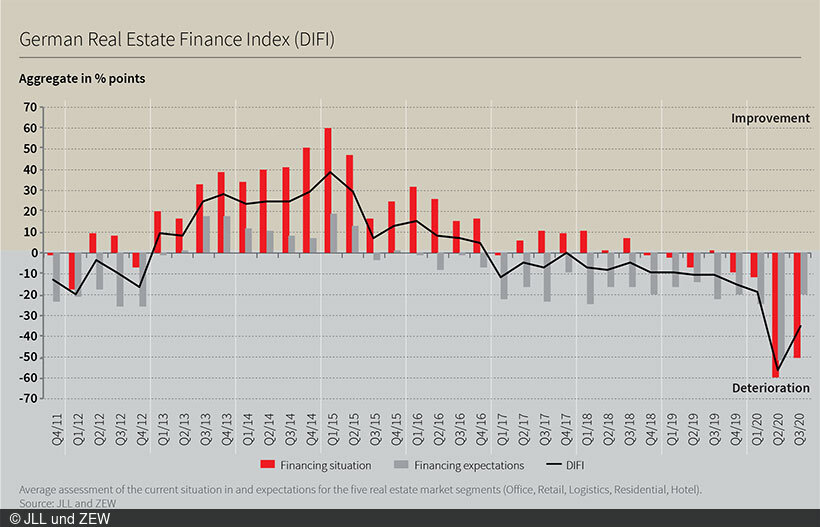

The German Real Estate Financing Index (DIFI) of ZEW Mannheim and JLL rises again, but remains in negative territory at minus 36 points. After a slight decline in the sentiment indicator at the beginning of the year (by minus 3.7 points) to minus 18.9 points, and a plunge of 37.8 points in the second quarter to an index level of minus 56.7 points, the DIFI has now improved by more than 20 points in the third quarter compared to the previous quarter. At present, however, the indicator continues to remain below the values registered since the the survey began in 2011.

Responses from the interviewed experts (investors, credit institutions and consulting firms) resulted in an assumed improvement of almost all partial balances for the individual types of use, both for the financing situation (situation assessment of the past six months) and for the financing expectations for the coming six months. In the previous quarter, there was a significant deterioration for all of them. These are the key findings of the DIFI Report, a quarterly survey on the commercial real estate financing market in Germany carried out by ZEW in cooperation with JLL.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by Jones Lang LaSalle (JLL) and the ZEW – Leibniz Centre for European Economic Research. 42 experts participated in the July/August 2020 survey.