R&D Tax Credit Is an Asset for Germany’s Innovation Landscape

ResearchStudy on tax incentives for R&D in the chemical and pharmaceutical industry

The German tax credit for research and development (“research allowance”) has been well-received in the chemical and pharmaceutical industry. This is the result of a study jointly conducted by ZEW Mannheim and the Center for Economic Policy Studies (CWS) at the Leibniz University Hannover, on behalf of the German Chemicals Industry Association (VCI). Ulrike Zimmer, director of Science, Technology and Environment at VCI, says: “The R&D tax credit is an asset for Germany’s innovation landscape. We anticipate additional positive impacts from the Growth Opportunities Act, providing a tailwind for our industry.”

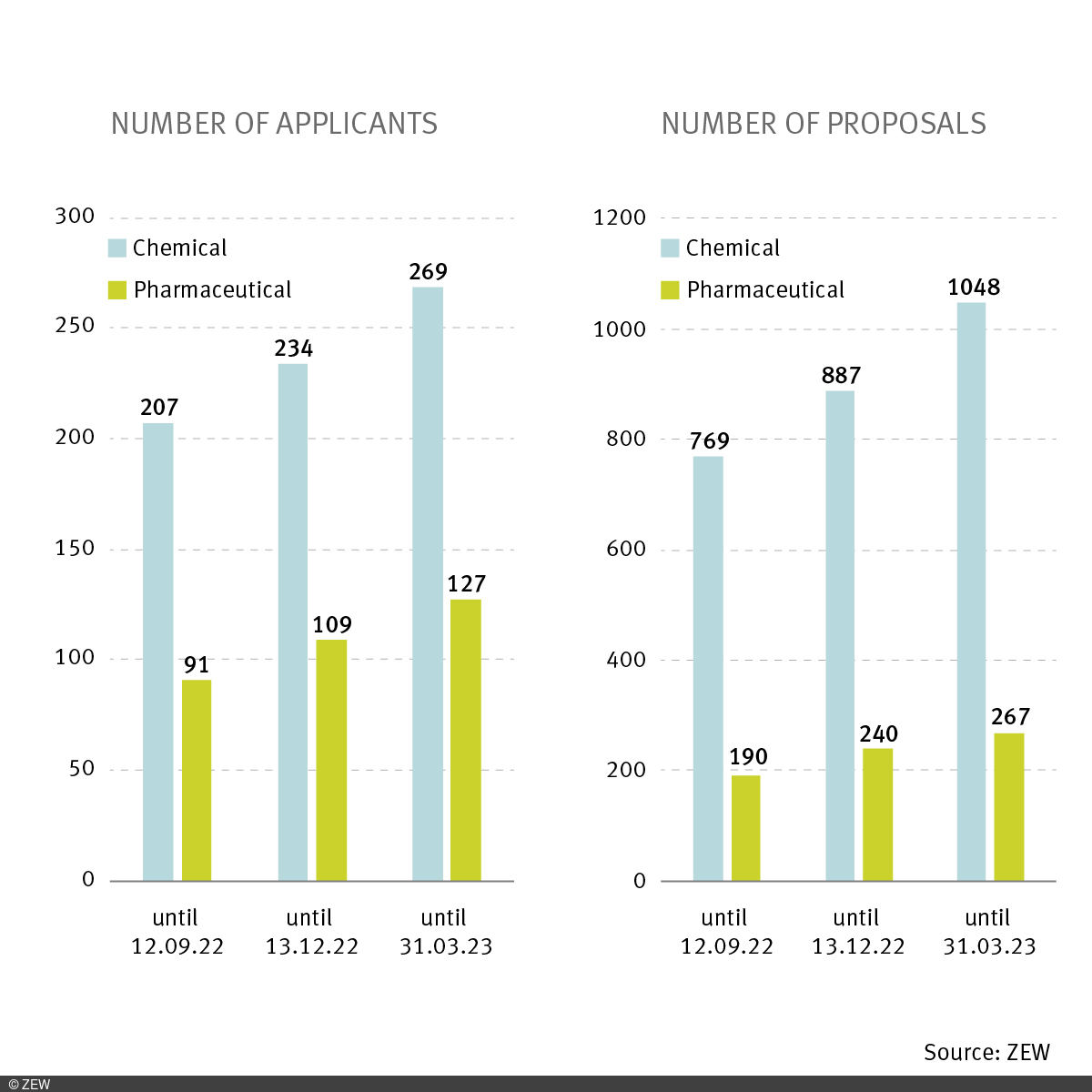

As of March 2023, nearly 400 applicants from the chemical-pharmaceutical industry submitted over 1,300 proposals for the R&D tax credit. In total, 6.3 per cent of all applications were from the chemical and pharmaceutical industry. “This means that these two industries together are among those with the highest number of applicants. This ranks them fourth in terms of the highest number of applicants across all industries,” explains co-author Dr. Christian Rammer, deputy head of ZEW’s “Economics of Innovation and Industrial Dynamics” Unit. “Only information services, mechanical engineering, and the electrical industry have submitted more applications for the tax credit.”

Of the applications from the chemical-pharmaceutical industry, 90 per cent were fully or partially approved, with a total funding volume of 110 million euros. “This high percentage sets the R&D tax credit apart from project funding, where approval rates can be a quarter or even less,” says Rammer. Zimmer adds: “Compared to project funding, the tax credit is characterised by its good planning security and openness to technology. This benefits especially small and medium-sized enterprises.”

Growth Opportunities Act: additional positive effects expected

The ZEW study also reveals that the plan included in the new Growth Opportunities Act to expand the tax credit will be particularly attractive for SMEs. The law aims to expand the “research allowance” to twelve million euros, make material costs eligible for funding, and raise the funding rate for SMEs to 35 per cent. The study predicts that this will benefit primarily medium-sized companies with 250 to 999 employees. Among these companies, the share of eligible R&D expenditure that will be funded is expected to increase from 39 to 64 per cent. Zimmer emphasizes: “The Growth Opportunities Act is a promising start. However, it is still unclear how the expansion of the tax credit to material costs will look like in practice. To create a real benefit for our companies it would be crucial to opt for a pragmatic implementation.”

Surging interest in tax credit

Interest in this new R&D funding opportunity has been steadily increasing. Between September 2022 and the end of March 2023, the number of users of the tax credit in the chemical industry rose by 30 per cent (from 207 to 269), and in the pharmaceutical industry, it increased by 40 per cent (from 91 to 127). Notably, the lion’s share of applicants comes from SMEs. In the chemical industry, they account for 64 per cent of applicants, while in the pharmaceutical industry, a striking 81 per cent of applicants are SMEs.

About the R&D tax credit

In 2020, the Federal Ministry of Finance introduced the new tax incentive for R&D. This tax credit complements existing direct funding opportunities such as targeted programmes by the German government or the Framework Programmes for Research and Technological Development of the European Union. With the Growth Opportunities Act approved by the federal government, which comes into effect on 1 January 2024, eligible R&D expenditures will, in addition to personnel costs, now also include material costs. External R&D contracts awarded to contractors in the EU will be supported at a rate of 70 per cent instead of the previous 60 per cent. The funding rate remains at 25 per cent; however, SMEs can apply for an increase of 10 per cent. The maximum amount of eligible R&D expenditures will be raised to 12 million euros per fiscal year and funding application, up from the previous four million euros.