One in Five Households Did Not Claim Social Benefits Despite Needing Them

ResearchFinancial Consequences of the COVID-19 Pandemic

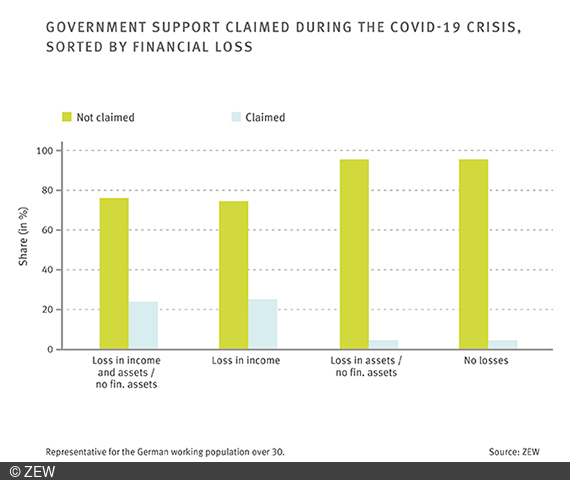

One fourth of all private households in Germany suffered income losses at the height of the second pandemic wave. Taking into account the loss of assets, roughly 34 per cent of households faced financial setbacks. Less than a quarter of them claimed state support.

On average, only about nine per cent of the working population made use of social benefits during the COVID-19 crisis. These are the results of a survey conducted as part of a joint project of the University of Mannheim, ZEW Mannheim and the Leibniz Institute for Resilience Research (LIR) at the height of the second wave of the pandemic between December 2020 and January 2021. The survey is representative of citizens aged 30 and over who are at least irregularly employed, unemployed, on a traineeship, or on maternity or parental leave.

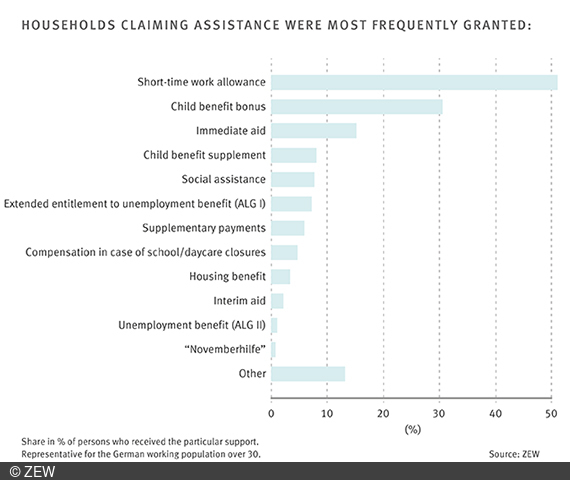

Easily accessible measures are paid out most frequently

Of all the federal and state support measures, the short-time work allowance and the child benefit bonus were most frequently claimed. Just under half of all households receiving state support claimed short-time work allowance, and almost a third claimed the 300-euro child benefit bonus. The federal government automatically transferred the bonus to all benefit recipients in 2020. “Low-threshold assistance such as the short-time work allowance or the child benefit bonus, which is paid automatically and without the need to apply, is of course the most frequently received. Nevertheless, it is important to learn more about how state aid most effectively reaches benefit recipients and particularly vulnerable groups,” says Professor Carmela Aprea, researcher at the University of Mannheim and co-author of the study.

Other benefits claimed included child benefit supplement, social assistance, extended entitlement to unemployment benefit (Arbeitslosengeld 1) and compensation in case of school/daycare closures. Immediate aid is also common among self-employed people and was claimed by 32 per cent of those receiving assistance in this group of the working population.

Medical and social care professionals are most likely to apply for benefits

Among the households that claimed social assistance, an above-average number of people works in the hospitality industry or in the arts, entertainment and recreation sector. Respectively one in three and one in five households reported having applied for transfers.

“By analysing demographic data, we were able to identify even more categories of households that claimed benefits more frequently than the average person affected by losses,” explains ZEW researcher Marius Cziriak, who analysed data for the study. People from East Germany, for example, utilised social policy measures twice as often as people from West Germany. The same applies to single parents compared to childless couples. Self-employed people were five times more likely to apply for assistance than employees. Younger people applied for assistance more frequently than older age groups.

Benefits do not reach all vulnerable groups

The second wave of the pandemic hit the self-employed particularly hard. Around 44 per cent of this group reported income losses, compared to 22 per cent of employees. Mini-jobbers also suffered above-average income cuts at around 34 per cent, as did single parents at around 30 per cent and people aged between 30 and 39 at around 26 per cent. “It is right to put the self-employed at the centre of the discussion about the economic impact of the pandemic. However, it is little known that single parents, marginally employed and younger workers also suffered above-average financial losses,” says Professor Tabea Bucher-Koenen from ZEW Mannheim, who supervised the study together with the project leaders of the participating institutes.

Single parents are three times less likely to apply for assistance than childless couples

Belonging to a demographic group not only increases the likelihood of experiencing a loss of income or assets. It also influences the likelihood of the respective household applying for assistance. For example, people in marginal employment were about five times less likely than those in full-time employment to apply for assistance despite being in need. People without or in irregular employment were three times less likely than those in full-time employment. Compared to childless couples, single parents were significantly more likely to forego social benefits despite being in need.

“The government has readjusted existing social benefits and introduced additional support. Nevertheless, the welfare state measures to cushion the economic impact of the pandemic still don’t reach certain groups of vulnerable households,” says ZEW researcher Bucher-Koenen. “Single parents in particular are not only more frequently affected by financial losses. They are also three times less likely to apply for assistance than childless couples. Our study suggests that the welfare state should make its assistance even more accessible to this group.”

Besides the self-employed, other groups also recorded income losses

The second wave of the pandemic hit the self-employed particularly hard. Around 44 per cent of this group reported income losses, compared to 22 per cent of employees. Mini-jobbers also suffered above-average income cuts at around 34 per cent, as did single parents at around 30 per cent and people aged between 30 and 39 at around 26 per cent. “It is right to put the self-employed at the centre of the discussion about the economic impact of the pandemic. However, it is little known that single parents, marginally employed and younger workers also suffered above-average financial losses,” says Professor Tabea Bucher-Koenen from ZEW Mannheim, who supervised the study together with the project leaders of the participating institutes.