ICT Sector: Economic Sentiment Falls to Historic Low

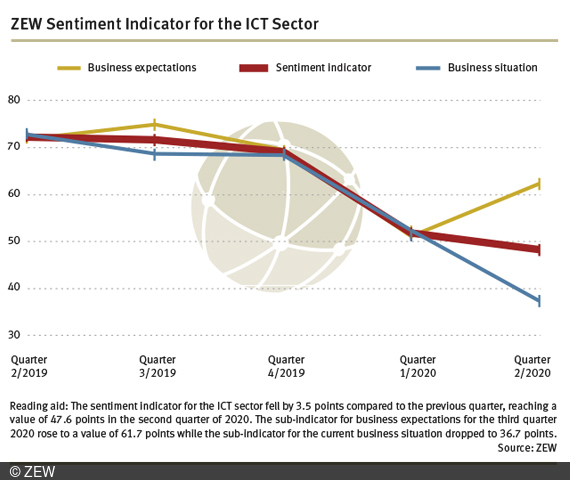

Information EconomyThe economic sentiment in the information and communication technology sector (ICT) in Germany further deteriorated in the second quarter of 2020: The ZEW sentiment indicator for the German ICT sector decreased by 3.5 points compared to the first quarter of 2020, falling to a historic low of 47.6 points. This marks the first time that the ZEW sentiment indicator has dropped below the critical 50-point mark since the survey began in 2011, indicating a negative development of the business situation. In addition to reporting negative expectations regarding turnover and demand for business products, firms in the ICT sector are also pessimistic about imminent personnel changes.

“Currently, much emphasis is placed on progress in the area of digitalisation as a way to overcome the coronavirus crisis. But the companies in the ICT sector that offer these digital solutions are also struggling with the effects of the crisis,” explains Dr. Daniel Erdsiek, a researcher in the ZEW Research Department “Digital Economy”. In the second quarter of 2020, the business situation among ICT firms deteriorated significantly, with almost 42 per cent of companies reporting a decline in turnover compared to the previous quarter. Only 19 per cent of the firms have been able to increase their turnover since the first quarter. In addition, the companies surveyed also assessed the demand for their products and services as largely negative. Due to these negative developments, the sub-indicator for the business situation fell from 51.7 points in the last quarter to a current value of 36.7 points.

Hardware manufacturers much more pessimistic than ICT service providers

While the sub-indicator for the business situation plunged by 15 points, business expectations brightened somewhat. Around 41 per cent of ICT companies assume that the demand for their products will increase, while 37 per cent expect rising turnover in the third quarter of 2020. Only a small share of companies expect a decline in demand (14 per cent) or turnover (18 per cent). As a result, the sub-indicator for business expectations increased by 11.2 points compared to the previous quarter, climbing to a reading of 61.7 points.

In the survey, companies in the ICT hardware sector were much more pessimistic about the business situation and business expectations than ICT service providers. While, for instance, 87.7 per cent of hardware manufacturers recorded a decrease in turnover in the second quarter, this share only amounts to 36 per cent among ICT service providers. Hardware manufac-turers are also more pessimistic than ICT service providers when it comes to the expectations for the third quarter of 2020, as these firms were much more likely to expect a decline (40 per cent) rather than an increase in turnover (20 per cent). In contrast, merely 15 per cent of ICT service providers anticipate a decrease in turnover, whereas 40 per cent expect turnover growth.

Coronavirus crisis affects employment figures

“In the second quarter of 2020, companies in the ICT sector have now also clearly felt the effects of the coronavirus crisis on employment,” says Daniel Erdsiek. “One in four companies saw a decrease in the number of employees compared to the previous quarter. Only ten per cent of firms were able to hire additional staff. In the remaining 65 per cent of companies, the number of workers has remained unchanged.” With regard to employment expectations for the third quarter of 2020, the proportion of ICT companies with a pessimistic outlook was also greater than the share of those with optimistic expectations. While 22 per cent of companies expect that they will have to make staff cuts, approximately 15 per cent are planning new hires. Accordingly, just under 63 per cent of the companies expect their number of employees to remain unchanged in the next quarter.

The sentiment indicator for the ICT sector is the result of the Businesses Survey in the Information Economy conducted in June 2020 by ZEW’s Research Department “Digital Economy”. The information economy consists of the sub-sectors information and communication technologies (ICT), media service providers and knowledge-intensive service providers.

[Translate to English:]

[Translate to English:]