High Spirits Among Knowledge-Intensive Service Providers

Information EconomyIn the first quarter of 2017 the majority of firms in the information economy are in an optimistic economic mood. This is according to the ZEW sentiment indicator, which currently stands at 66.8 points. This assessment of the economic situation is just as positive as in the fourth quarter of 2016. Economic sentiment is currently at the highest it has been among knowledge-intensive service providers for many years. This is the result of a survey among firms in the German information economy, conducted by the Mannheim Centre for European Economic Research (ZEW) in March 2017.

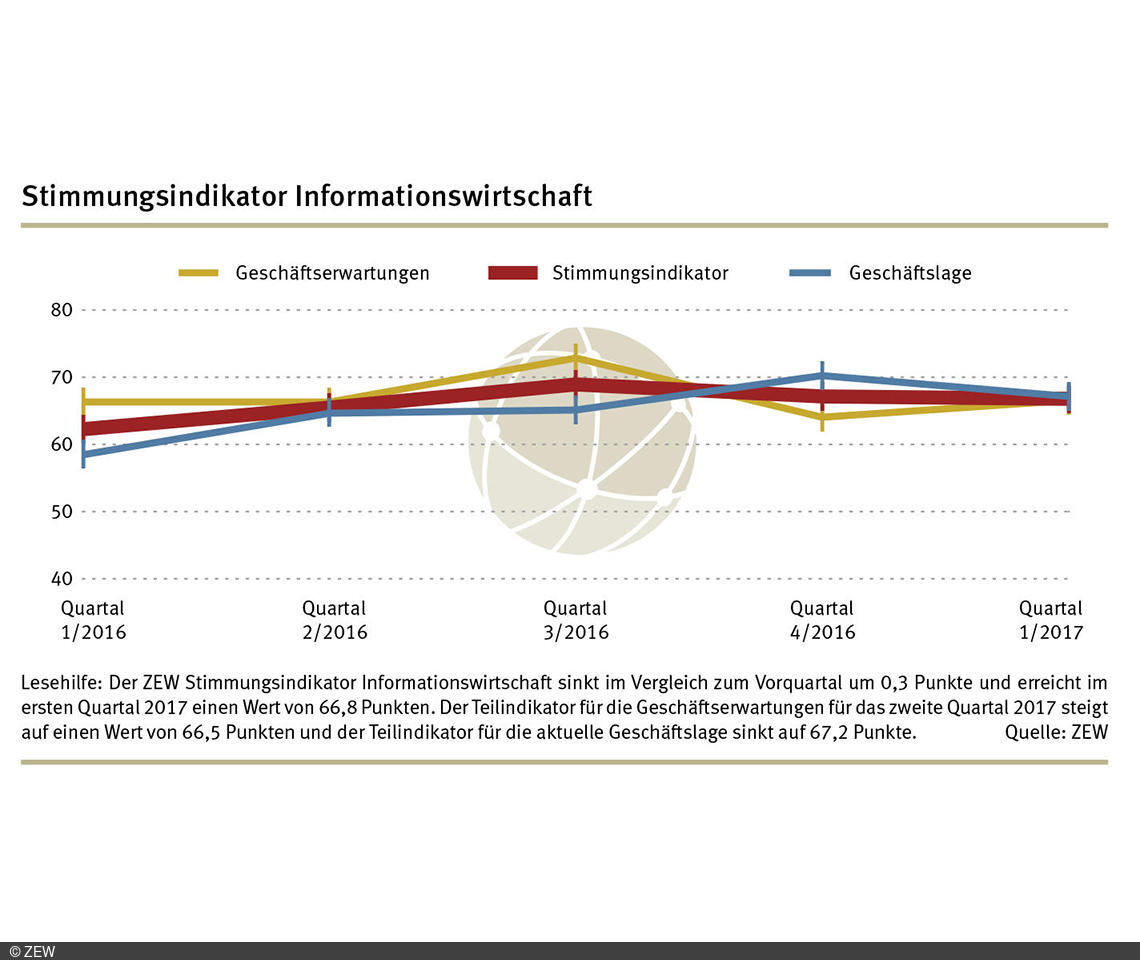

Dropping only 0.3 points from the previous quarter, the sentiment indicator reported only a minimal loss. The reason for this slight decrease was the more gloomy assessment of the business situation. After rising sharply in the previous quarter, the sub-indicator for the business situation fell by 3.1 points in the first quarter of 2017 and currently stands at 67.2 points. The fact that this figure is well above the critical 50 point mark indicates that the majority of firms saw an increase in turnover and demand for their products or services. Furthermore, firms in the information economy are looking to the future with optimism and expect turnover and demand to continue to improve in the second quarter of 2017. The corresponding sub-indicator for business expectations currently stands at 66.5 points.

The information economy is composed of information and communications technology (ICT) firms, media service providers and knowledge-intensive service providers. Based on the already very high level of the sentiment indicator, the mood among firms in the ICT sector has become somewhat clouded, with the sentiment indicator dropping six points down to 71.5 points compared to the previous quarter. There was also a negative development in both the sub-indicator for the business situation and that for business expectations. The sub-indicator for the business situation fell by 3.7 points but remains high at 76.9 points, signalling a positive economic climate. The ICT sector is less optimistic when it comes to the future, with the sub-indicator for business expectations dropping 8.1 points down to 66.5 points.

Media service providers remain optimistic

Media service providers remain in a positive mood. The corresponding sentiment indicator has exceeded the critical 50 point mark for the third time in a row, if only just. Following a slight increase of 1.4 points the sentiment indicator now stands at 54.1 points. This increase is the result of conflicting trends in both sub-indicators. The sub-indicator for the business situation fell by 11.1 points compared to the previous quarter and now stands at 52.4 points. In contrast, the sub-indicator for business expectations climbed an impressive 12 points to 55.8 points. Almost a quarter of media service providers anticipate higher turnover in the second quarter of 2017.

Based on an already positive economic climate, the economic sentiment among knowledge-intensive service providers is better than it has been in many years. The sentiment indicator rose by 3.9 point compared to the previous quarter to 65.7 points. Though the sub-indicator for the business situation fell by one point to 62.8 points, this slight decrease is more than compensated for by the positive trend in business expectations. The corresponding sub-indicator for business expectations climbed 8.9 points to its current level of 68.7 points.

For further information please contact:

Dr. Daniel Erdsiek, Phone + 49 (0)621/1235-356, E-mail erdsiek@zew.de

The Economic Sentiment Indicator in the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. The sales situation and the demand situation form a sub-indicator reflecting the business situation. Sales expectations and demand expectations form a sub-indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations is the value of the Economic Sentiment Indicator in the Information Economy. The sentiment indicator can take on values from 0 to 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The economic survey conducted by ZEW

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. Sectors three to nine make up the knowledge-intensive service providers. Overview of the ZEW Business Survey in the Information Economy (in German):http://www.zew.de/konjunktur.