Discussing New Regulations in International Corporate Tax

ConferencesEighth MannheimTaxation Annual Conference Held Online

How can we ensure all players in economy, including multinationals, contribute to society in a fair way? How should taxation be handled in individual countries against the backdrop of international value chains and global markets? At this year’s MannheimTaxation Annual Conference many topics presented by ZEW Mannheim addressed the currently hotly debated new regulations in international corporate taxation.

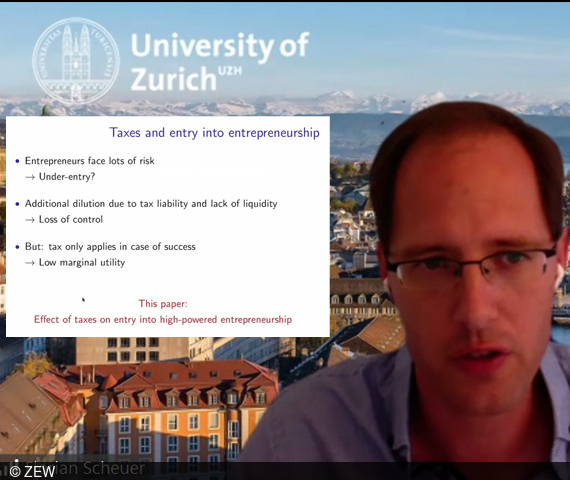

More than 200 experts debated issues surrounding this topic in 48 presentations held in 16 online sessions. Highlights of this year’s conference were the keynotes by Professor Wolfgang Schön from the Max Planck Institute for Tax Law and Public Finance and Professor Florian Scheuer from the University of Zurich, as well as the policy session with renowned experts who debated whether minimum corporate tax rates will end tax competition.

Will there finally be an international tax system?

Professor Schön, director of the Max Planck Institute for Tax Law and Public Finance, gave a thorough overview over past and current efforts to harmonise international tax systems. His presentation addressed currently used and strongly debated tax instruments, including their implementation and feasibility at the international level. The new and stronger role of the G20, which has been instrumental in recent efforts to introduce a global minimum tax rate for multinational corporations, should be highlighted in this context. Although this newfound international consensus may indicate that something like an international tax system exists, Wolfgang Schön warns, however, that even if the minimum tax system for international corporations is fully implemented, there are still many unanswered questions that will shape future international tax disputes.

How to tax start-ups?

Amazon, Facebook, Apple and Co.: examples of large multinational corporations that obviously pay too little or unfairly distributed taxes are at the centre of current debates on corporate taxation. However, the fact that a large part of the innovative strength and economic performance of national economies is based on small, innovative companies is often disregarded. These start-ups and their employees usually take great risks to develop a new product or an entirely new market. Moreover, these companies are often subject to severe financial constraints and additional taxes would be a major burden for them. Higher taxes could even prevent some start-ups from being founded in the first place. As a result, the innovation intensity of the economy will decline. Based on an extensive data set, Professor Scheuer analysed the reactions of start-ups to changes in the tax system. In his presentation, he showed how strongly corporate taxation affects the innovation activity of small start-ups.

About the ScienceCampus MannheimTaxation

The ScienceCampus MannheimTaxation is a joint initiative of ZEW Mannheim and the University of Mannheim. Founded in 2014, MannheimTaxation has contributed significantly to establishing Mannheim as an internationally recognised centre for tax research. Numerous researchers in Mannheim and Heidelberg are working on current issues regarding corporate and private taxation, public finance and tax law. The ScienceCampus model is a Leibniz Association initiative to promote strong and visible cooperation between Leibniz member institutions and universities, as well as to establish complementary local research partnerships. The goal is to promote research in a field while advancing its individual topics of research. The networks associated with MannheimTaxation complete high-quality research, further interdisciplinary cooperation in research, projects and methods, increase the visibility of participating research facilities and improve their research profile.

![[Translate to English:] Prof. Schön, Director of the Max Planck Institute for Tax Law and Public Finance Prof. Schön on past and ongoing efforts to harmonize international tax systems.](/fileadmin/_processed_/2/2/csm_NachberichtMannheimTaxation2021WolfgangSchoen_7e17318b7b.jpg)