Real Estate Experts Discuss Resilience and Challenges Through Digitalisation

Events13th ReCapNet Conference in Hybrid Format for the First Time

What impact does digitalisation have on the real estate markets and how can we develop a resilient society? These were two of the key questions addressed at this year’s conference of the Leibniz network “Real Estate Markets and Capital Markets” (ReCapNet) on 18 and 19 November 2021, which was jointly organised by ZEW Mannheim and the KTH Royal Institute of Technology and sponsored by the KTH Digitalization Platform. Around 100 researchers participated in the event either online or on site in Stockholm. It featured presentations and discussions of twelve selected research papers as well as a keynote speech by Professor Markus K. Brunnermeier from Princeton University.

This was already the 13th time the conference was held, but this year for the first time it was organised in a hybrid format – both online and on site at the KTH Royal Institute of Technology in Stockholm – by ZEW alumnus Professor Bertram Steininger. This provided the guests on site with the opportunity to exchange scientific ideas also before and after the presentations, and at the same time it allowed as many researchers as possible from all over the world to participate who otherwise would not have attended due to travel restrictions or sustainability considerations.

Resilience as a core capability to survive crises

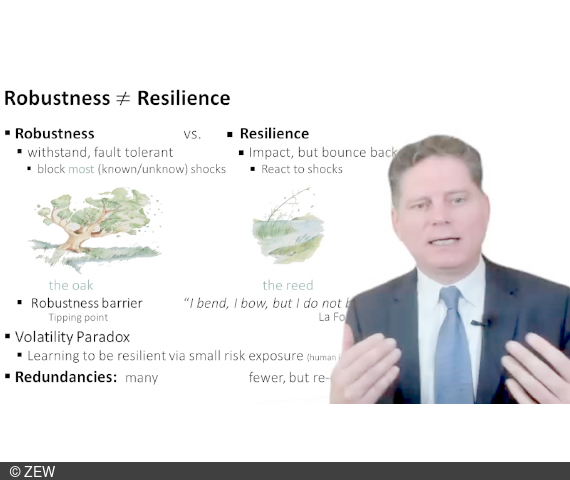

Professor Markus K. Brunnermeier, Edward S. Sanford Professor of Economics and director of the Bendheim Center for Finance at Princeton University, presented and discussed with the audience the results of his latest book, “The Resilient Society”. In it, he analyses how important it is not only for individuals but for society as a whole to adapt social, political, and economic structures in such a way that they can react flexibly both to crises such as pandemics or climate change, and shocks such as those caused by computer attacks or digitalisation. He illustrated his idea using the metaphor of a reed, which he contrasted with a mighty but rigid oak that could break irrevocably.

This year’s ReCapNet conference once again offered researchers from the field of real estate and capital markets the opportunity to present their latest research and have it critically reviewed and discussed by experts during the two-day event.

Selected topics included:

- the automated valuation of real estate

- the behaviour of real estate borrowers in times of digitalisation and regulation

- the impact of wildfires on housing and mortgage markets in California

About ReCapNet

The Leibniz Network “Real Estate Markets and Capital Markets” (ReCapNet) has been investigating the interactions between real estate markets and capital markets since its launch in 2009. So far, the aim of the network has been to assess the consequences of such interactions for housing and commercial real estate markets, for the development perspectives of different real estate markets and for the stability of real estate and financial markets. In the future, questions of old-age provision in connection with real estate investments as well as income and wealth distribution and regional policy are likely to gain in importance.