Pessimism Continues to Prevail Among Real Estate Financing

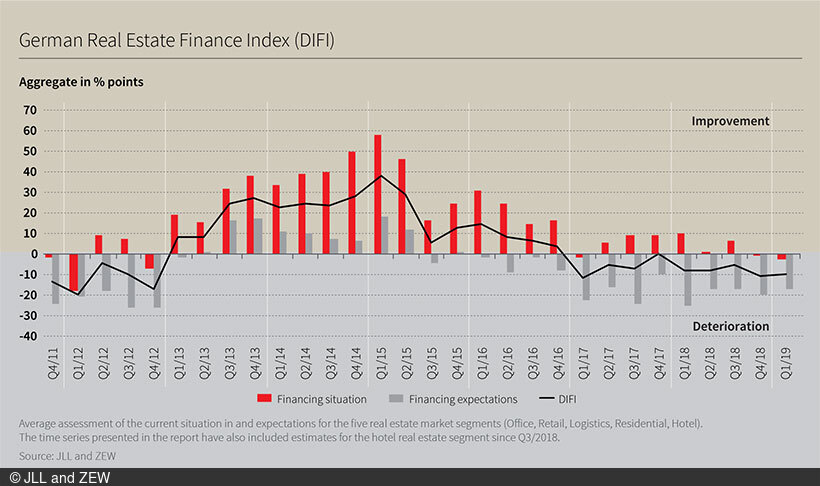

DIFI Report by ZEW and JLLThe German Real Estate Finance Index (DIFI) by ZEW and JLL stagnates at a current reading of minus 9.7 in the first quarter of 2019. The index has remained in negative territory for almost two years now. The experts’ persistently pessimistic financing expectations reflect the subdued global economic situation as well as the economic and geopolitical tensions between the major powers. The uncertainties that come with a no-deal Brexit and its possible negative effects on German companies also contribute to this pessimism.

Although the surveys showed a slight trend reversal when it comes to both the situation and expectations for real estate financing in the retail sector, it is questionable whether this reversal will continue to last. The survey included a special question which asked about the development of investor demand over the next twelve months. The experts assume that the behaviour of the various investor groups will remain unchanged and that demand will continue to rise. Investments in German real estate are expected to come particularly from Asia and the Middle East. These are the key findings of the DIFI Report, a quarterly survey on the commercial real estate financing market in Germany carried out by ZEW in cooperation with JLL.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. DIFI is a survey conducted and published by JLL and the ZEW – Leibniz Centre for European Economic Research. 29 experts participated in the January/February 2019 survey.