High Taxation Puts Germany at a Disadvantage Internationally

ResearchHigh Tax Burden Makes Germany Unattractive for Businesses and Skilled Professionals

In the international tax competition for corporate investments, Germany falls into the category of high-tax countries. In terms of the tax burden for a highly qualified labour force, however, Germany is positioned in the mid-range of the ranking. Due to the recently introduced global minimum tax, the taxation of skilled professionals could become more relevant in the future. This has been illustrated by the current BAK Taxation Index, which was established 20 years ago by ZEW Mannheim on behalf of BAK Economics.

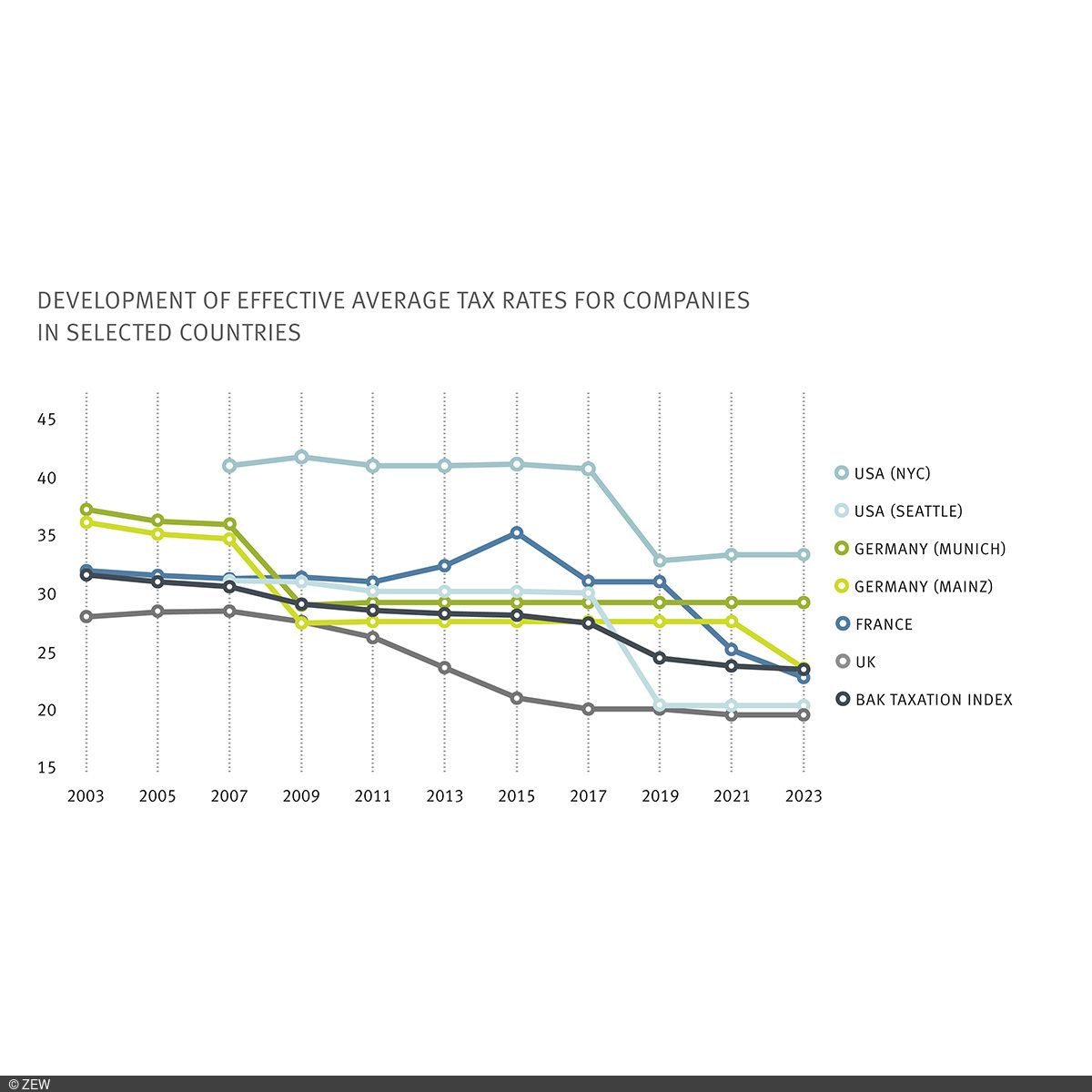

The corporate tax burden has stagnated at a high level since 2009

For a profitable investment project of a company located in Munich, the average effective tax burden was 29.3 per cent in 2023. Since the fundamental tax reform of 2008, the tax burden for German businesses has remained virtually unchanged, while other industrial nations such as France and the United States have lowered their corporate tax rates and therefore become much more attractive from a fiscal standpoint. Sophia Wickel, a researcher in ZEW’s “Corporate Taxation and Public Finance” Unit, points out that “local authorities at least have the option of adjusting their trade tax multipliers to remain fiscally competitive. A prominent example is the city of Mainz, which reduced the effective tax burden from 27.7 per cent to 23.7 per cent in 2022 by lowering the trade tax multiplier. However, many local authorities in Germany have actually raised their trade tax multipliers over the years due to tight local government budgets.”

Internationally, there has been a clear downward trend in the last 20 years in the average effective corporate tax rate. While the international average of the BAK Taxation Index, weighted by gross domestic product, was still at 31.7 per cent in 2003, it was only 23.6 per cent in 2023.

To stop this downward trend driven by tax competition, numerous countries have agreed to introduce a global minimum tax rate of 15 per cent starting in 2024. Since the tax burden in Germany is considerably higher than this level, tax policy measures to reduce the effective tax burden are still possible despite the global minimum tax. In low-tax countries, on the other hand, the effective tax burden is likely to increase in future.

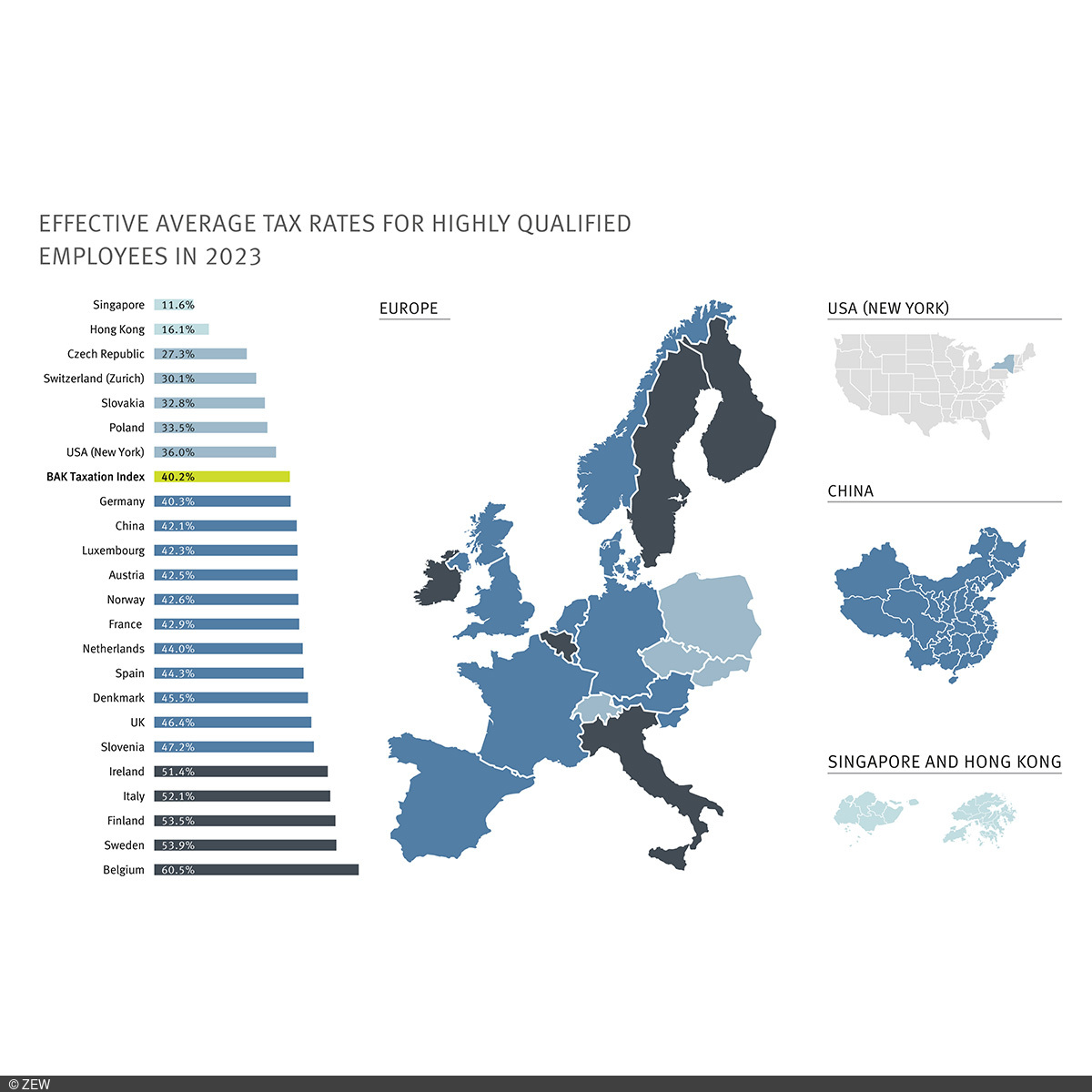

Global minimum tax could shift tax competition increasingly towards highly qualified workers

“By introducing a minimum tax of 15 per cent, tax competition could move increasingly towards the taxation of a highly qualified labour force in the future,” explains Professor Jost Heckemeyer, ZEW Research Associate in the “Corporate Taxation and Public Finance” Unit and professor at Kiel University.

“If countries lose the opportunity to distinguish themselves through attractive corporate tax rates, there is a fundamental opportunity to reduce corporate labour costs through a low tax burden and thus create favourable conditions for businesses,” says ZEW economist Johannes Gaul. “This is especially true for highly skilled workers, who are in such demand that they can negotiate their after-tax income with interested companies.”

Germany ranks in the middle in terms of the tax burden on highly qualified workers

In contrast to Germany’s international position in terms of the corporate tax burden, the country is significantly improving with respect to highly skilled workers. Although Germany has a relatively high effective average tax burden of 40.3 per cent compared to individual neighbouring countries such as the Czech Republic and Poland, the tax burden is low in contrast to countries such as France, Denmark and Belgium. Consequently, the German tax burden is close to the average in the BAK Taxation Index for highly qualified workers, the latter equalling 40.2 per cent.

About the BAK Taxation Index

Since 2003, ZEW economists have been calculating effective tax rates for the BAK Taxation Index on behalf of BAK Economics. The index tracks the average effective tax burden for companies and highly qualified employees at the level of the 26 Swiss cantons and in over 80 locations worldwide. This time series created under constant model assumptions makes it possible to identify trends in the effective tax burden of companies and highly qualified employees.

When calculating the effective corporate tax burden, taxes on profits and the employed capital are taken into account. The calculations consider the statutory tax rates, the interaction of the different types of tax, and the most important regulations for determining the tax base. Examples include regulations on tax depreciation and inventory valuation.

The BAK Taxation Index for highly qualified individuals measures the effective average tax rate for single employees without children with a disposable income of 100,000 euros after taxes and duties. All relevant taxes are factored into the calculation, including the respective regulations for determining the tax base, for example, the deductibility of employee contributions to social security and company pension schemes.