Experts More Critical of Bureaucracy than of the Debt Brake

ResearchSpecial Question in the ZEW Financial Market Survey from February 2024

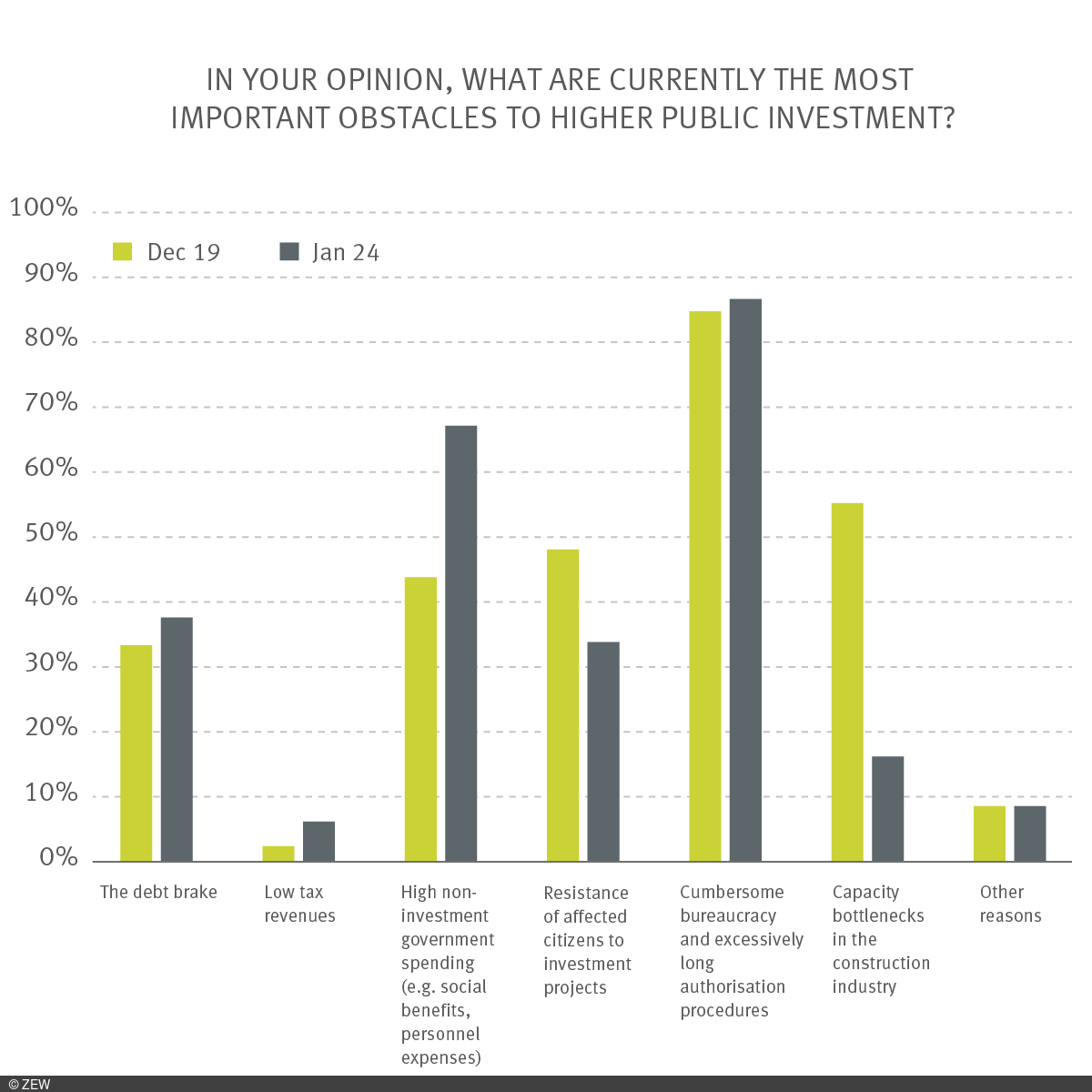

Despite the current strained budget situation, financial market experts surveyed by ZEW Mannheim do not consider the constitutional debt brake to be the biggest obstacle to investment in Germany. Instead, they attribute the lack of public investment to cumbersome bureaucratic processes and high social and personnel costs. This is the result of the special question included in the ZEW Financial Markets Survey of February 2024, in which 173 financial market experts participated.

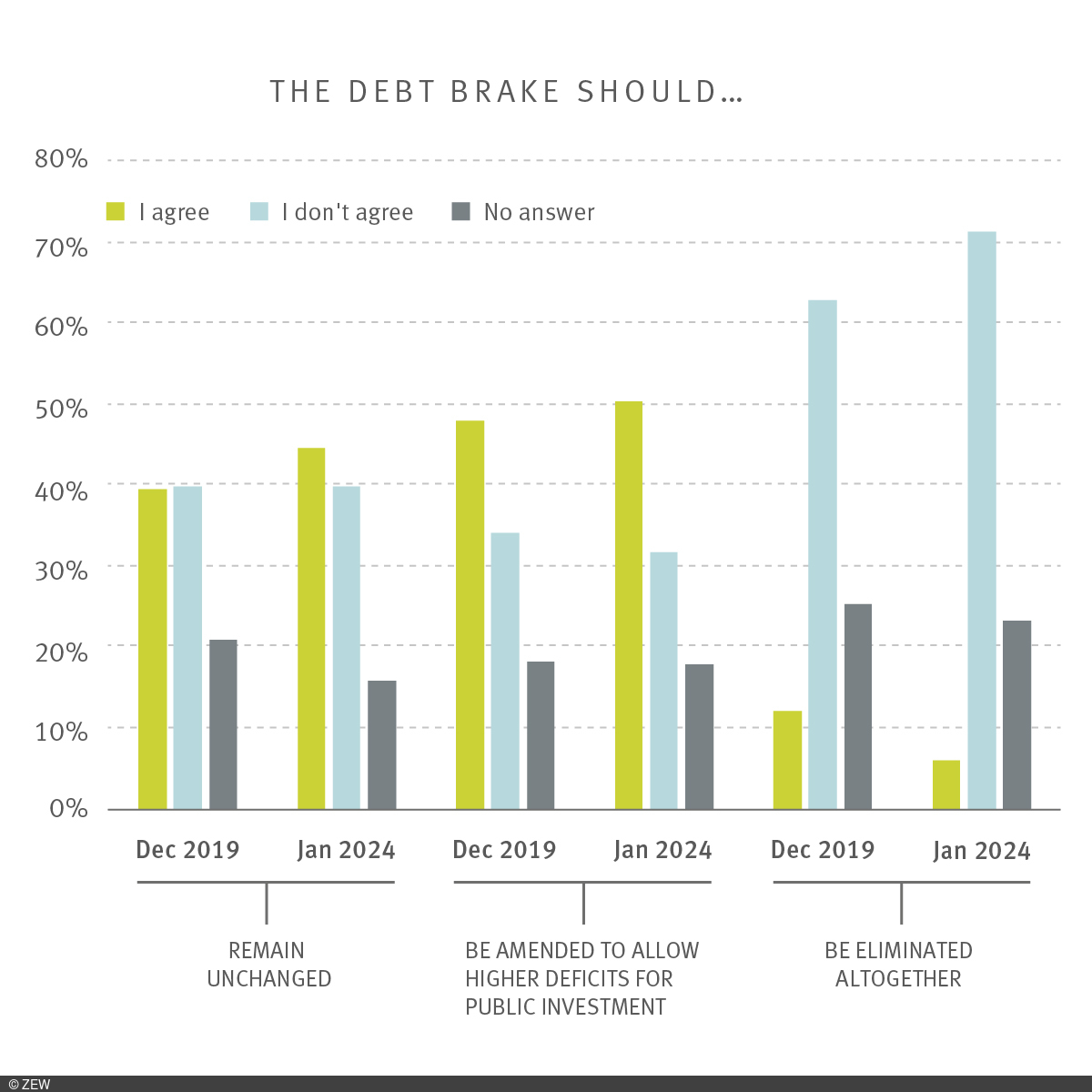

“While some question the legitimacy of the debt brake in public discourse, experts widely agree that it serves as a crucial financial policy anchor. Nearly 95 per cent of respondents are in favour of maintaining the debt brake either in its current or in a revised form complementing it with an ‘investment rule’. Conversely, only a small and shrinking minority supports the abolition of the debt brake,” comments Professor Friedrich Heinemann, head of ZEW’s “Corporate Taxation and Public Finance” Research Unit. “The experts strongly criticise bureaucratic inefficiency, lengthy approval processes and the volume of non-investment expenditure. There is clearly much more need for reform in these areas than with the debt brake.”

Debt brake retains support even in times of crisis

Compared to the last survey in December 2019, support for the debt brake has barely changed despite costly crises. In the view of the experts, the debt brake has thus established itself as a stable and reliable instrument. Accordingly, the percentage of respondents favouring the abolition of the debt brake has more than halved, from 12.1 per cent in 2019 to 5.8 per cent in 2024. When assessing the main obstacles to higher public investment, the debt brake is not at the top of the list.

Bureaucracy is the main obstacle to investments

Already in 2019, experts identified bureaucratic processes and structures as the main obstacle to public investment, and this has not changed in the current survey. In second place comes non-investment government expenditure, which respondents believe has reached a level that crowds out investment spending in the government budget, even with sufficiently high tax revenues. In 2019, 43.9 per cent of respondents saw this as an obstacle, while in 2024, even 67 per cent consider it a significant hindrance. Only after that is the debt brake cited as an impediment to investment by 33.3 per cent of respondents in 2019 and 38 per cent in 2024 – an increase at a relatively low level.

Shortages in the construction industry are considered a much less significant obstacle. While 55.1 per cent of respondents identified this as a constraint in 2019, only 15.9 per cent do so today. This clearly reflects the recession in the construction industry with falling capacity utilisation, making it easier for the public sector to implement projects.

About the survey

The ZEW Financial Market Survey has been conducted since December 1991. Participants are asked monthly about their expectations concerning the development of major international economies, including Germany, the eurozone, the United States and China. In total, the panel consists of about 350 financial analysts from banks, insurance companies and selected corporations, specifically from the finance, research and economics departments as well as the investment and securities departments. Most of the participants are from Germany.

The financial experts are asked about their expectations on a six-month horizon regarding the development of the economy, the inflation rate, short- and long-term interest rates, equity prices and exchange rates. In addition, they are asked to assess the earnings situation in 13 German sectors. Besides a fixed survey section, special questions on current topics are included on a regular basis. The ZEW Indicator of Economic Sentiment, which has established itself as an early indicator of economic development (“ZEW Index”), is calculated from the expectations of financial market experts on the development of the economic situation in Germany. The results are published and analysed in detail in the monthly ZEW Financial Market Report (available in German only).