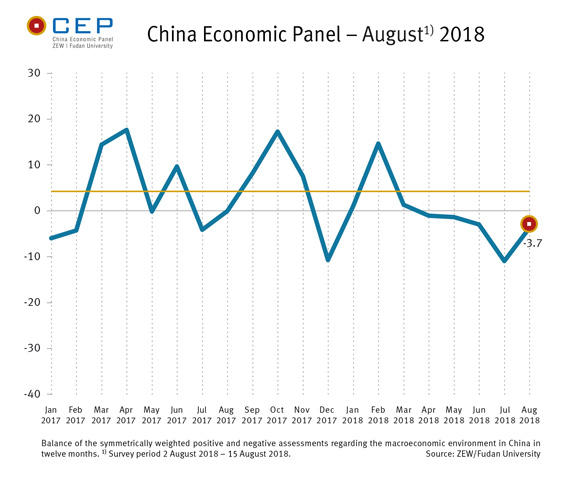

Expectations for Chinese Economy Are Recovering Again

China Economic PanelAccording to the most recent survey in August (02/08/2018–15/08/2018), the economic outlook for China has recovered again after having declined considerably in the previous five months. The CEP Indicator, which reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, is currently at minus 3.7 points (July 2018: minus 10.9 points). However, the CEP indicator is still well below the long-term average of 4.3 points. Climbing 1.7 points to a level of 9.3 points, the assessment of the current economic situation in China was also more positive than the previous month.

“The economic outlook is thus still worse than it was before the outbreak of the trade dispute between the United States and China. It remains to be seen whether this slight recovery will last. At the diplomatic level, there has so far been only a slight easing of the tension between China and the United States,” says Dr. Michael Schröder, senior researcher in the ZEW Research Department “International Finance and Financial Management” and project leader for the CEP survey. At the end of August, a Chinese delegation is to resume talks in Washington on possible solutions to the trade dispute.

The Chinese economy, however, still appears to be quite robust, as it has shown hardly any negative effects on growth to date. Accordingly, the forecasts for real gross domestic product (GDP) have remained at the same level as in July, with expectations being 6.5 per cent for 2018 and 6.3 per cent for 2019.

Optimistic picture with regard to the trade conflict

The relative stability of the Chinese economy is certainly based in part on a supportive economic policy, both on the expenditure side (e.g. through government infrastructure expenditure) and on the revenue side (e.g. through tax relief for companies and private households). Decision-makers are also attempting to stabilise the economy in terms of monetary policy by reducing the minimum reserve ratio and by providing banks with additional liquidity in order to stimulate lending to companies. However, the fact that the indicators for domestic and foreign debt have been rising in the current survey signals that such measures cannot be continued for an indefinite period of time.

By contrast, China’s exports worldwide and to the USA rose surprisingly strongly in July. The current survey therefore paints a rather optimistic picture with regard to the trade conflict. The indicators for exports and China’s share of world trade have each risen very strongly, after having experienced a significant drop in the previous months.

“It remains to be seen whether the developments at the diplomatic level will actually confirm this current optimism,” says Michael Schröder.

For more information please contact

Dr. Michael Schröder, Phone: +49 (0)621-1235-368, E-mail: michael.schroeder@zew.de