Enhancing Germany’s Attractiveness to Businesses through Tax Reform

ResearchMannheim Tax Index Measures Effective Tax Burden of Companies

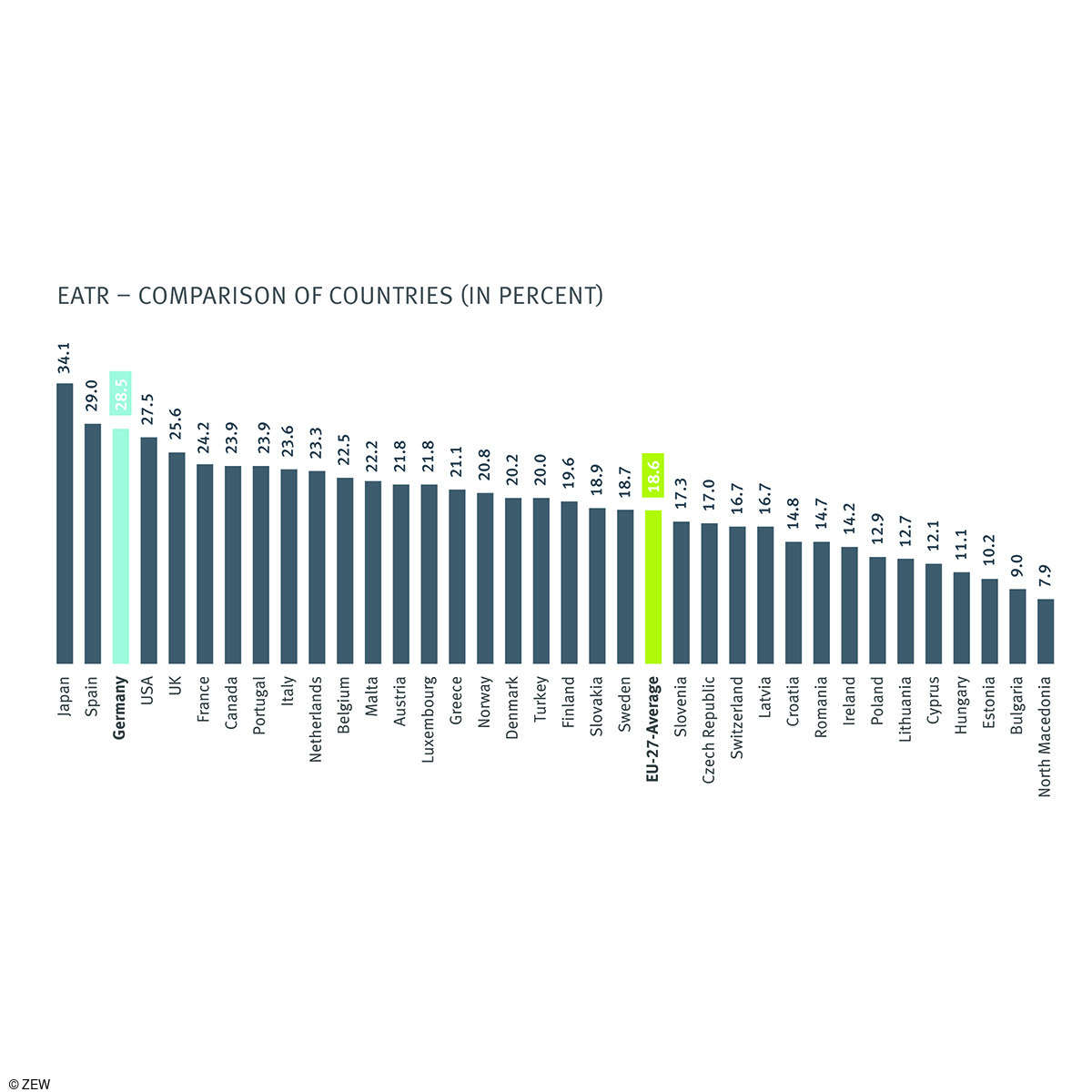

The current Mannheim Tax Index of ZEW Mannheim underscores Germany’s continued status as a high-tax country in global tax competition. The effective average tax burden for profitable investments is 28.5 per cent in 2023 – nearly 10 percentage points above the EU average. However, potential measures to significantly improve Germany’s international standing imply substantial tax revenue losses and heightened risks of free riding.

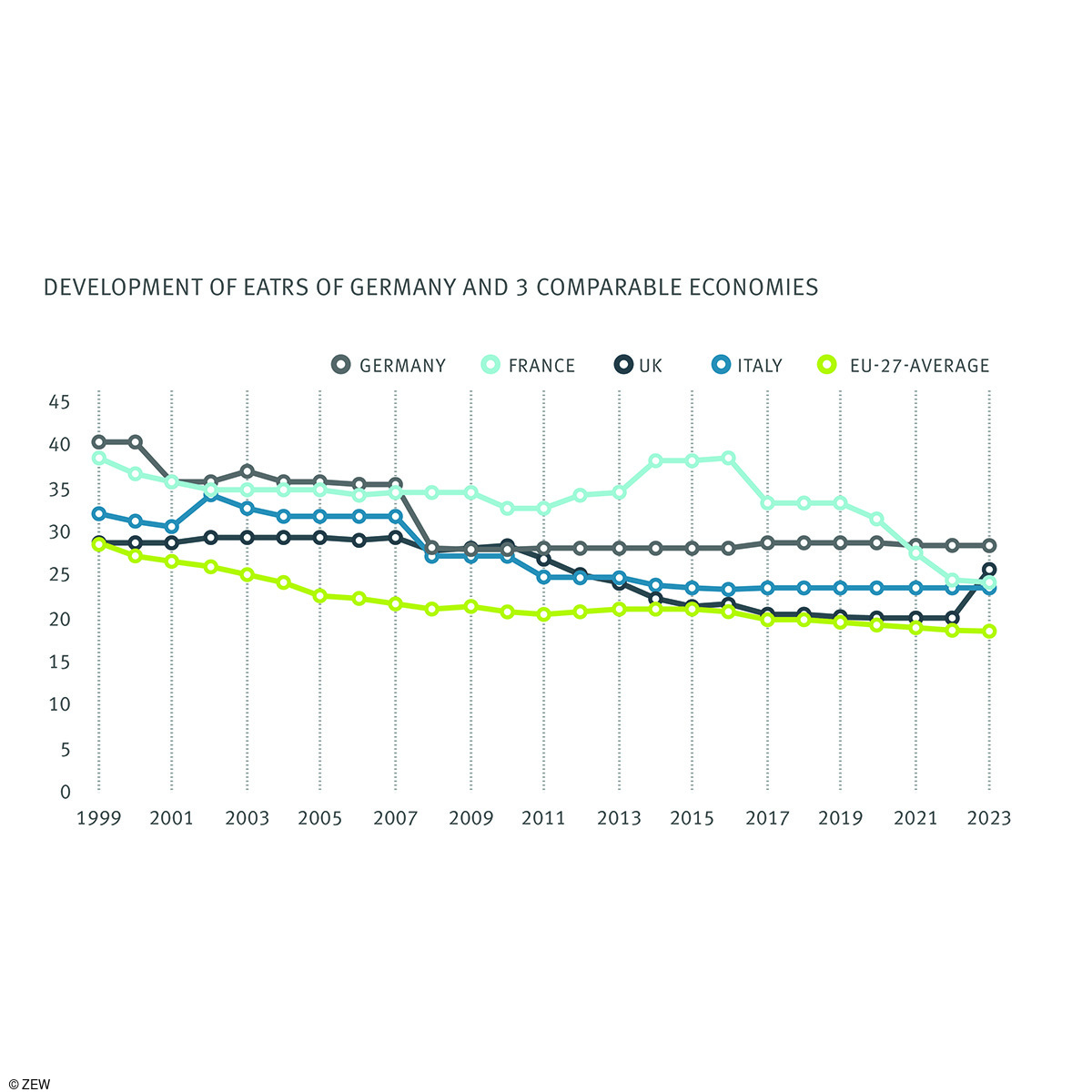

“Due to a lack of substantial tax reforms in the past 15 years, Germany has seen a decline in its tax attractiveness for corporate investments compared to key economic partners. This concern is particularly pronounced in the context of an overall negative development of the German economy,” highlights Julia Spix, a researcher in ZEW’s “Corporate Taxation and Public Finance” Unit. Germany’s high-tax profile has become all the more apparent with France reducing its corporate tax rate in recent years, and even the UK’s increase in corporation tax to 25 per cent hasn’t changed Germany’s leading position.

Strategies to enhance Germany’s attractiveness for businesses

Measures currently under discussion to improve the country’s tax attractiveness include more generous depreciation rules for movable assets, the abolition of the solidarity surcharge and a reduction of the corporate income tax rate to 25 per cent. “An immediate write-off for movable assets, with its prompt investment-promoting effect, would at least align Germany with its important economic partner, the USA, in the international ranking of the Mannheim Tax Index,” emphasises Dr. Daniela Steinbrenner, a researcher in ZEW’s “Corporate Taxation and Public Finance” Unit.

However, introducing degressive depreciation and eliminating the solidarity surcharge would only marginally decrease the effective tax burden on companies by 0.2 and 0.7 percentage points, respectively. “A reduction in the corporate income tax rate to 25 per cent has the strongest signalling effect, positioning Germany in the mid-range of Western European investment locations, with an effective tax burden of 23.5 per cent. Nevertheless, this scenario poses a high risk of free riding,” adds Dr. Katharina Nicolay, deputy head of ZEW’s “Corporate Taxation and Public Finance” Unit. “In essence, achieving a noteworthy improvement in tax attractiveness is not possible without a significant reduction in tax revenue in the short term.”

About the Mannheim Tax Index

The effective average tax burden at the company level is an important factor for multinational companies when deciding on an investment location. Against this backdrop, the Mannheim Tax Index takes into account taxes on companies’ profits and capital costs. The calculations consider both the tariff burdens of these taxes as well as the interaction of the different types of taxes and the most important regulations for determining the tax base. Examples are the regulations on tax depreciation or the valuation of inventory assets. The index covers a comprehensive set of countries (EU-27, United Kingdom, Switzerland, Norway, USA, Canada, Japan, North Macedonia and Turkey) for the period from 1998 to 2023.