ECB Inflation Target Remains a Long Way Off

ResearchSpecial Question of the May 2023 ZEW Financial Market Survey

According to financial market experts who were surveyed by ZEW Mannheim, the rate of inflation in the Eurozone is expected to stabilize at a high level in May 2023. Inflation is expected to decline in the coming years, meaning the inflation target of the European Central Bank (ECB) will probably not be reached until after 2025. While a large majority of respondents were concerned about wage developments in the Eurozone, developments in energy prices and in ECB monetary policy have led some survey participants to expect inflation to decline. The experts anticipate the ECB to implement at least one more interest rate hike in 2023. In 2024 and 2025, ECB interest rates are expected to continue to fall gradually. These are the results of the key question included in the ZEW Financial Market Survey in February 2023, in which the respondents provided their predictions of how inflation and key interest rates will develop in the Eurozone from 2023 to 2025.

“For the first time since the beginning of 2021, financial market experts are not predicting an increase in inflation rates. However, their expectations are stabilizing at a high level, meaning that inflation rates are likely to remain well above the ECB's 2 percent target until 2025. Just as in February 2023, wage developments in the Eurozone were cited as an important inflation driver. However, falling energy prices and the ECB's active interest rate policy are contributing to the fact that some respondents expect inflation rates to be somewhat lower in May 2023 than in February 2023,” commented Professor Frank Brückbauer, Advanced Researcher in the ZEW Research Unit “Pensions and Sustainable Financial Markets.”

Slight Decline in Inflation Expectations

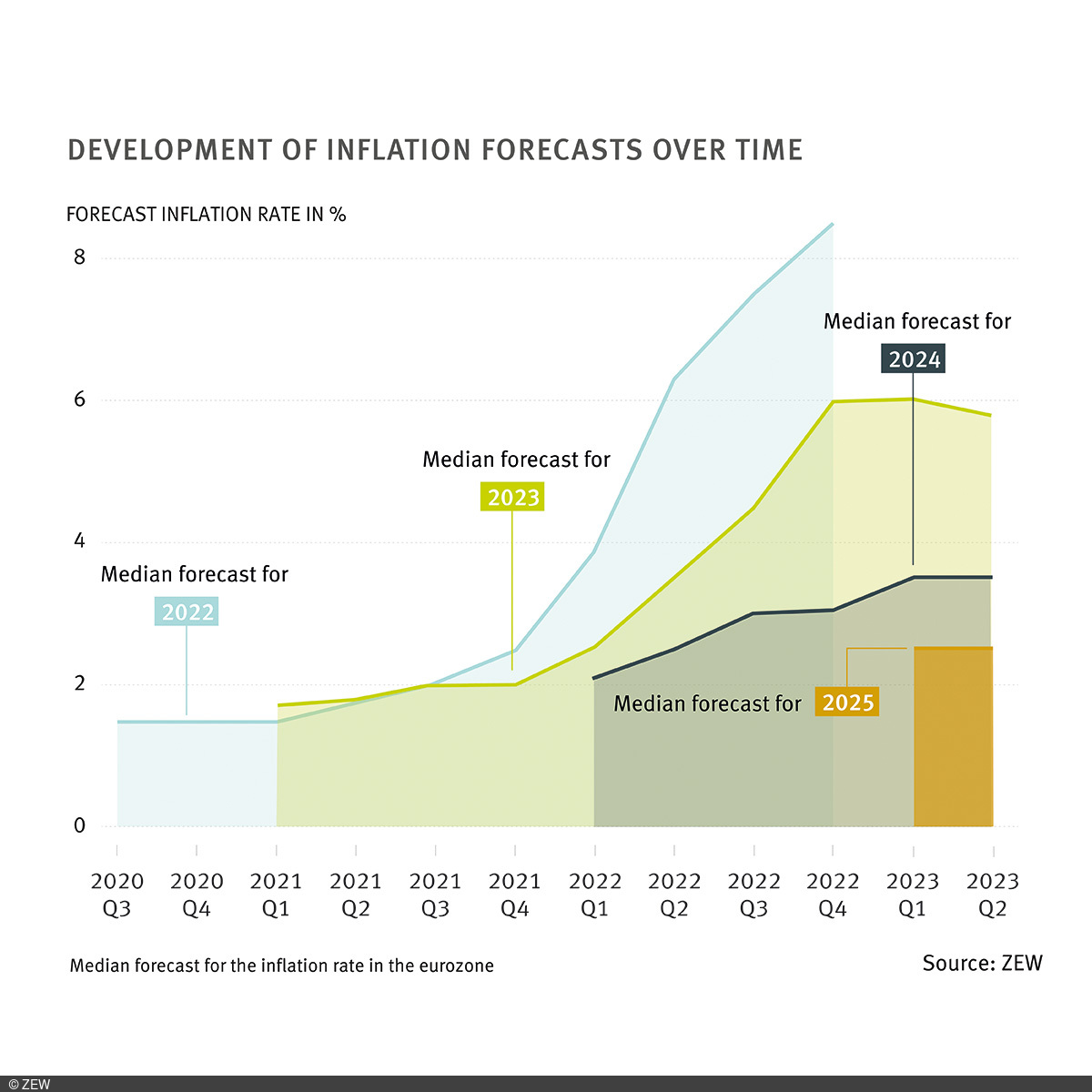

In the May 2023 survey, financial market experts predicted median inflation rates of 5.8, 3.5 and 2.5 percent for 2023, 2024 and 2025, respectively. Thus, the majority do not expect the ECB to be able to achieve its inflation target of two percent between 2023 and 2025. Since the time that the survey began, in which expectations for inflation in 2023 had risen exclusively, they fell slightly for the first time in May 2023. In February 2023, for example, the median forecast for 2023 was still 6.0 percent. By contrast, the median forecasts for 2024 and 2025 remain unchanged from February 2023.

Changing Wages and Green Transformation Seen as Drivers of Inflation

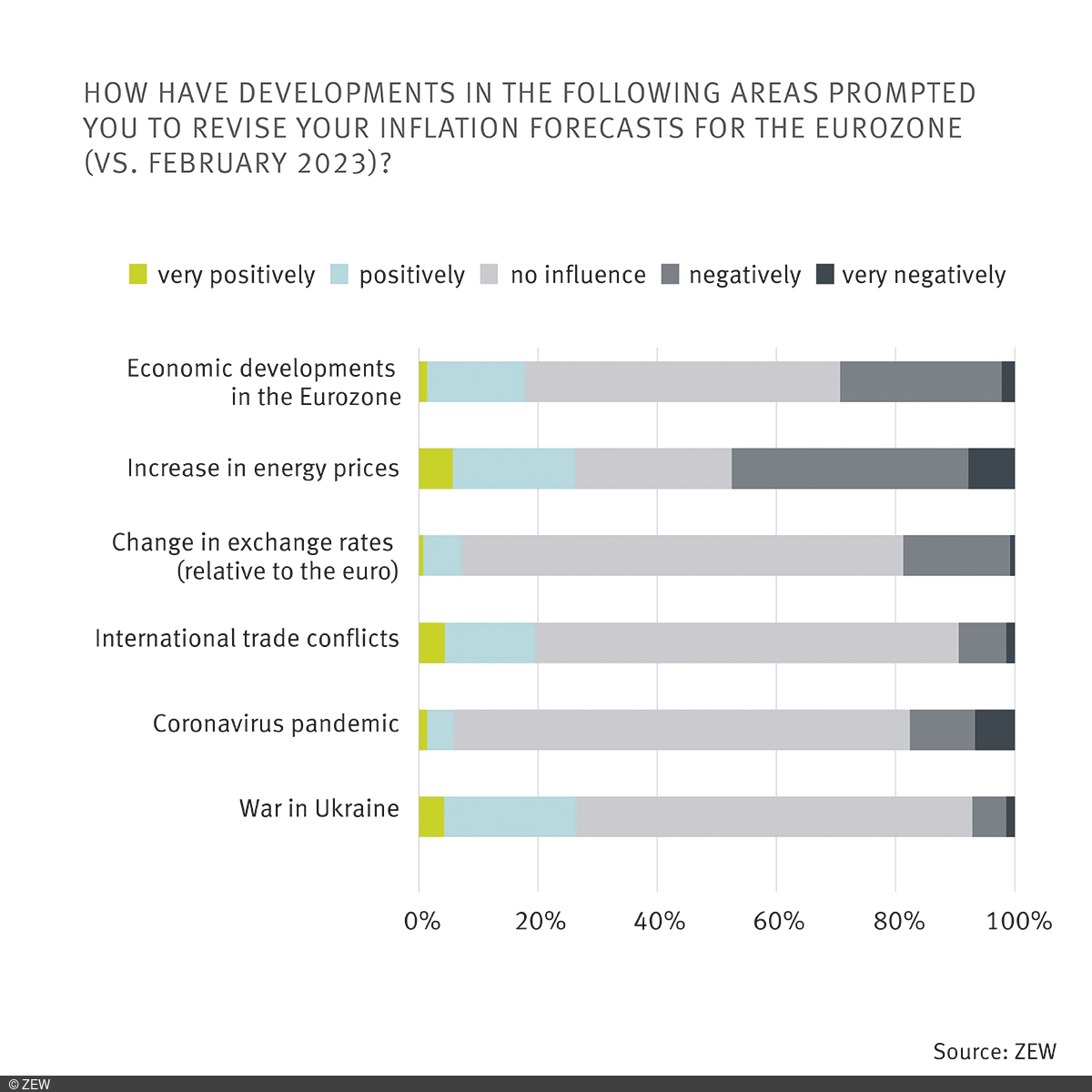

A look at the factors driving this forecast shows that the development of wages in the Eurozone continues to lead to unpleasant surprises. A clear majority of 70 percent of financial market experts say they have raised their inflation forecasts based on the development of wages since February 2023. Some 14 percent of respondents even say they have increased their forecasts significantly. The green transformation of the economy is also predominantly seen as a driver of inflation, with just under half of the experts increasing their predictions as a result. By contrast, the development of energy prices and the ECB's monetary policy were predominantly seen as having a deflationary effect. Around 48 and 39 percent of respondents respectively stated that the development of these factors had a negative impact on their inflation forecasts beginning in February 2023.

About the Survey

The ZEW Financial Market Survey has been conducted since December 1991. Participants are asked monthly about their expectations concerning the development of major international economies, including Germany, the eurozone, the United States and China. In total, the panel consists of about 350 financial analysts from banks, insurance companies and selected corporations, specifically from the finance, research and economics departments as well as the investment and securities departments. Most of the participants are from Germany.

The financial experts are asked about their expectations on a six-month horizon regarding the development of the economy, the inflation rate, short- and long-term interest rates, equity prices and exchange rates. In addition, they are asked to assess the earnings situation in 13 German sectors. Besides a fixed survey section, special questions on current topics are included on a regular basis. The ZEW Indicator of Economic Sentiment, which has established itself as an early indicator of economic development (“ZEW Index”), is calculated from the expectations of financial market experts on the development of the economic situation in Germany. The results are published and analysed in detail in the monthly ZEW Financial Market Report.