Downturn for Cryptocurrencies and Real Estate

ResearchSpecial Question on Asset Classes in the June 2023 ZEW Financial Market Survey

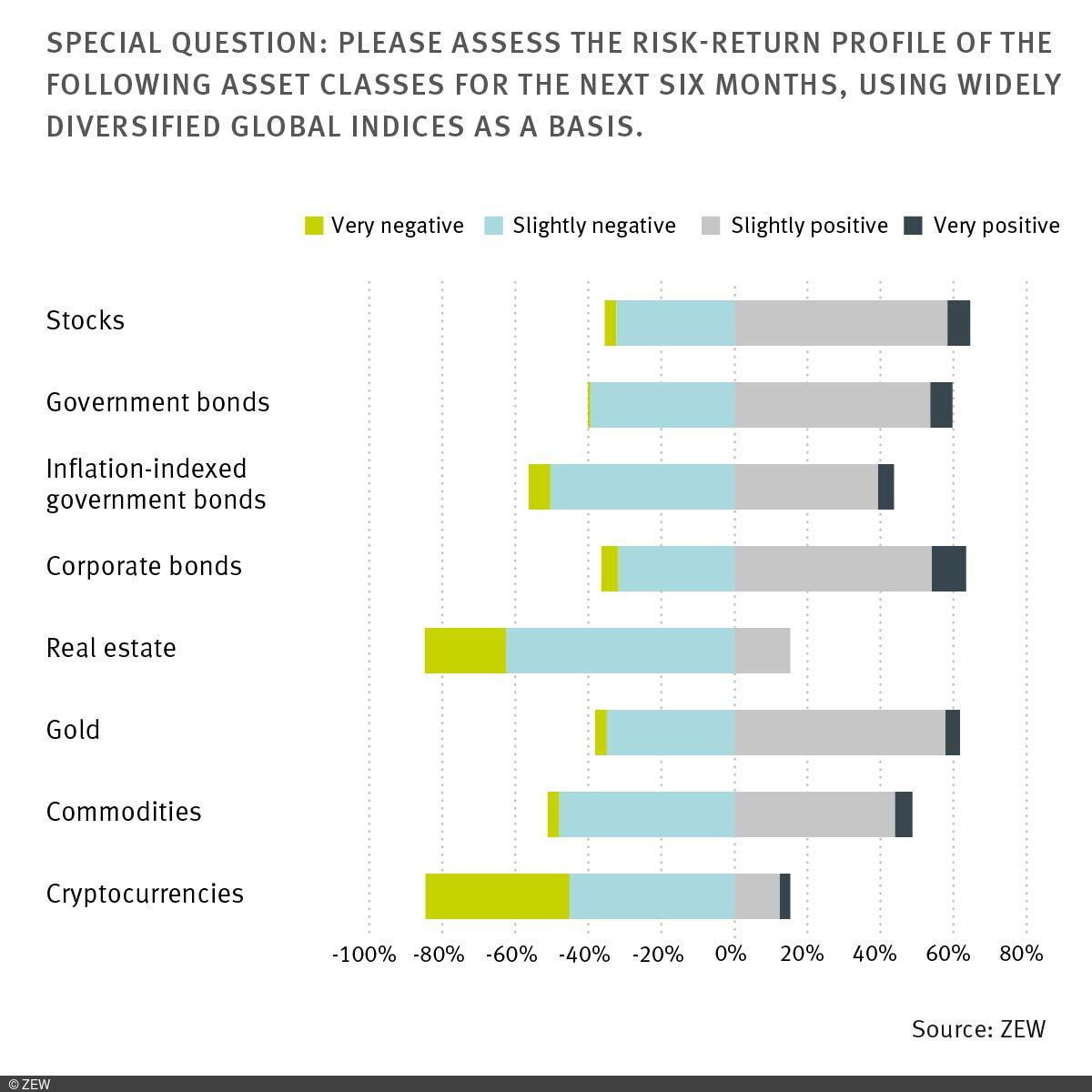

Financial market experts surveyed by ZEW Mannheim hold a markedly negative outlook on cryptocurrencies and real estate as investment options. Regarding the real estate markets in the eurozone, the monetary policy of the European Central Bank (ECB) is seen as a decisive factor for this pessimism. However, economic developments, political conditions, and market valuations also contribute to the respondents’ sceptical stance. These are the result of the special question in the ZEW Financial Market Survey conducted in June 2023, in which financial experts were asked to give their assessments of various asset classes.

“Compared to the survey conducted in March 2023, the experts remain pessimistic regarding cryptocurrencies and real estate. In contrast, gold, stocks, and government and corporate bonds are viewed as significantly more appealing asset classes,” comments Thibault Cézanne, a researcher in ZEW’s “Pensions and Sustainable Financial Markets” Unit, on the results.

Real estate markets particularly affected

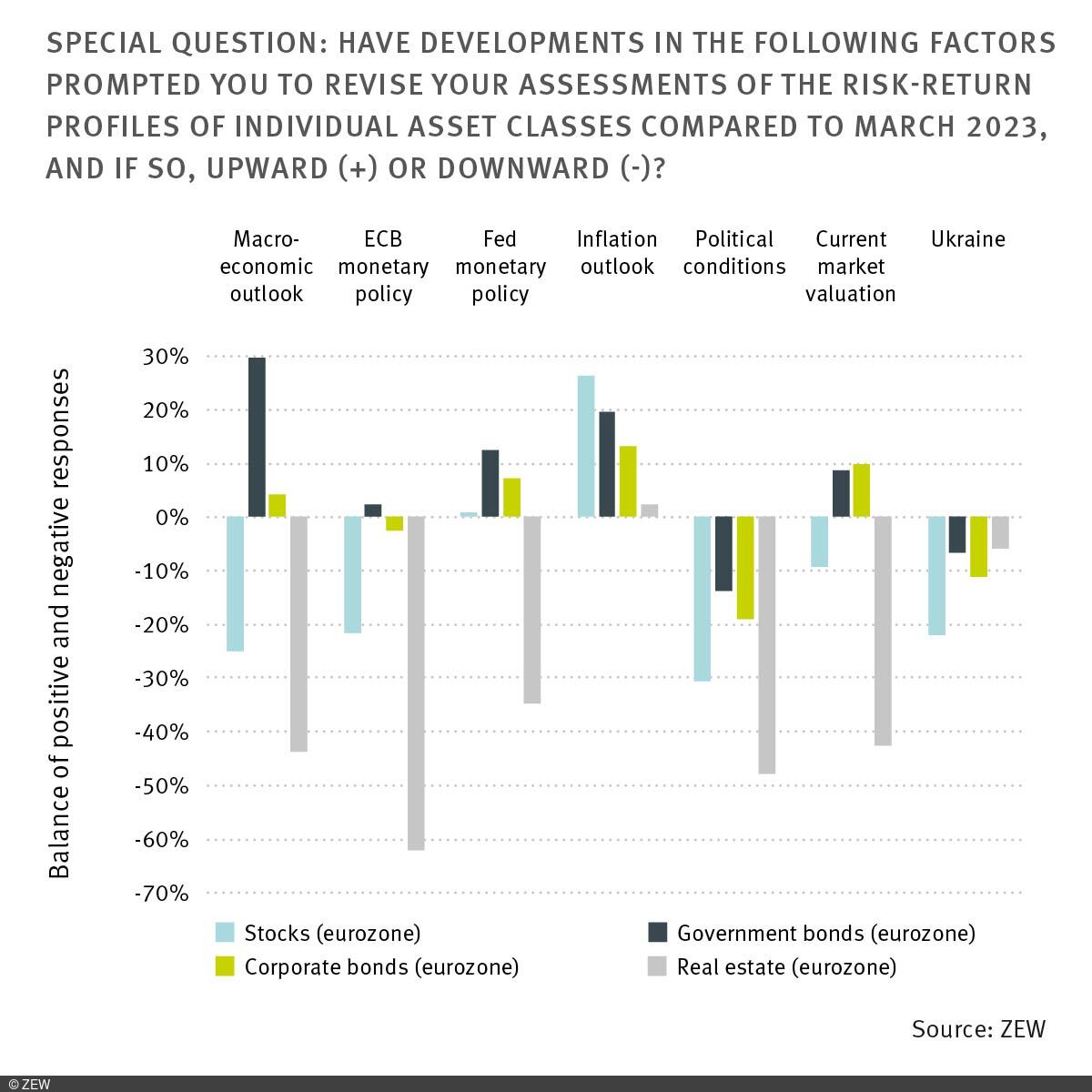

In the survey, the experts also evaluate how their assessments of asset classes such as stocks, real estate, and government and corporate bonds in the eurozone have changed since March 2023, along with the factors influencing these changes. The primary reason for the grim outlook in the real estate sector is attributed to the ECB’s monetary policy, with 67 per cent of respondents stating it has a negative impact on their assessment (27 per cent saying it has no effects, and only 6 per cent perceiving positive effects). Economic developments, market valuations, and the political conditions are identified as additional negative factors, particularly when it comes to real estate markets.

Regarding government and corporate bonds, respondents view economic development and inflation as having a slightly positive influence. When it comes to stocks, two factors play contrasting roles. “Interestingly, inflation, previously considered as detrimental for all eurozone asset classes, is now seen as a positive factor. Economic development is now regarded as negative for stocks but positive for government bonds. Hence, the recent entry of the German economy into recession may have shifted the concerns of financial market experts from inflation to economic growth, explaining their shift in favour of government bonds and their more negative view of stocks,” concludes Thibault Cézanne.

About the Survey

The ZEW Financial Market Survey has been conducted since December 1991. Participants are asked monthly about their expectations concerning the development of major international economies, including Germany, the eurozone, the United States and China. In total, the panel consists of about 350 financial analysts from banks, insurance companies and selected corporations, specifically from the finance, research and economics departments as well as the investment and securities departments. Most of the participants are from Germany.

The financial experts are asked about their expectations on a six-month horizon regarding the development of the economy, the inflation rate, short- and long-term interest rates, equity prices and exchange rates. In addition, they are asked to assess the earnings situation in 13 German sectors. Besides a fixed survey section, special questions on current topics are included on a regular basis. The ZEW Indicator of Economic Sentiment, which has established itself as an early indicator of economic development (“ZEW Index”), is calculated from the expectations of financial market experts on the development of the economic situation in Germany. The results are published and analysed in detail in the monthly ZEW Financial Market Report.