Businesses See Boost in Digitalisation During COVID-19 Pandemic

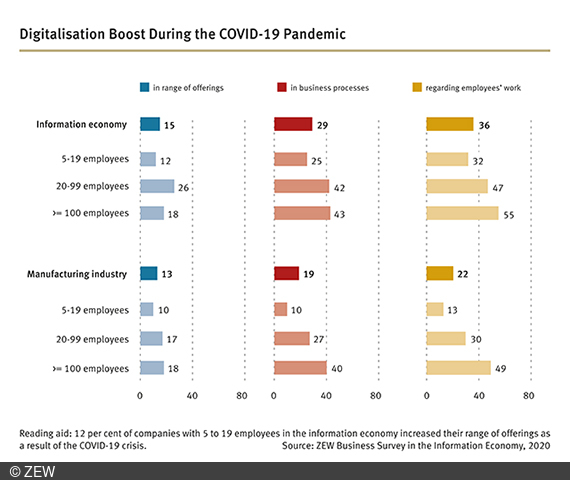

Information EconomyMany firms have made progress with regard to the digitalisation of their products and services, their business processes and the way of working over the course of the coronavirus pandemic. Around 40 per cent of companies in the business-related services sector and approximately 25 per cent of businesses in the manufacturing industry stated to have seen a surge in digitalisation. Meanwhile, the turnover of these businesses often remains – sometimes significantly – below pre-crisis levels. These are the results of a representative survey conducted by ZEW Mannheim in September 2020 among approximately 1,400 companies in the information economy and manufacturing industry.

“Compared to before the crisis, there has been a noticeable shift towards a more digital way of working in many businesses. Around one in three companies in the information economy and one in four companies in the manufacturing industry were able to increase their level of digitalisation,” says Dr. Daniel Erdsiek, researcher in the ZEW Research Department “Digital Economy”. “This push towards digitalisation is most likely primarily the result of the adjustments that became necessary in order to ensure an efficient shift from office to remote working.” These adjustments could pay off in the long term, since many companies plan to continue to offer work-from-home arrangements after the crisis, as a survey conducted by ZEW in June 2020 shows.

“The crisis has not only introduced a more digital way of working; the range of products and services and business processes have also become more digital,” says Daniel Erdsiek. In around 30 per cent of companies in the information economy and 20 per cent in the manufacturing industry, business processes have become more digital. Around 15 per cent of businesses were able to achieve improvements in the area of the digitalisation of company products and services. However, it should be noted that the businesses in each sector entered the crisis from very different starting points. For instance, companies in the ICT sector, media service providers and knowledge-intensive service providers were far better equipped in terms of digital infrastructure before the crisis than firms in the manufacturing industry.

Large enterprises more likely to achieve digital advances

“The likelihood of companies achieving a higher level of digitalisation also depends on the size of the company: Larger companies are far more likely to see digital advances,” explains Daniel Erdsiek. In around one in two companies with more than 100 employees both in the information economy and in manufacturing, the way of working has become more digital. This share is lower for companies with 20 to 100 employees (47 and 30 per cent, respectively) as well as for firms with 5 to 19 workers (32 and 13 per cent, respectively). Larger companies are also more likely to make digital improvements in the area of their range of products and services and their business processes.

Turnover development: Many losers, few winners

Almost half of the companies in the information economy and around 70 per cent of companies in the manufacturing industry have seen a – sometimes massive – decrease in their turnover compared to before the crisis. In around one third of companies in the manufacturing sector, turnover has fallen by up to 25 per cent. Another third of firms recorded decreases in turnover ranging between 25 and 75 per cent of their pre-crisis level, while four per cent of companies have seen an almost complete collapse in turnover. “Losses in turnover are far more likely in the manufacturing industry than in the information economy. On the other hand, both sectors recorded a similar share of companies that were able to increase their turnover since the onset of the crisis: Around one in seven companies have seen a rise in turnover compared to before the crisis,” concludes Daniel Erdsiek.