Altered Savings Behaviour Due to Pension Reform

ResearchZEW Study Reveals: When Women Plan to Retire Later, They Save Less – Yet Have More Money Available in Old Age

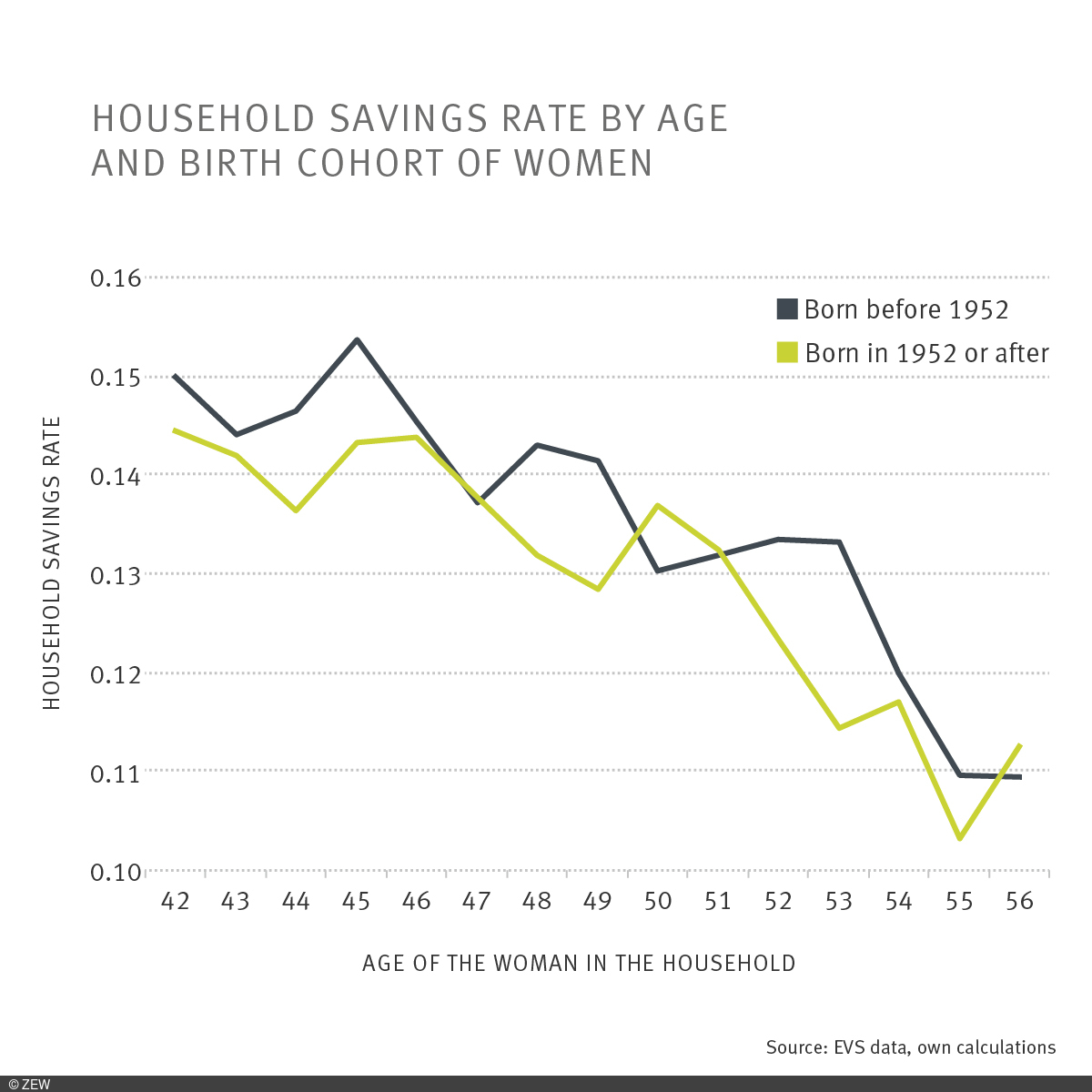

In 1999, a pension reform raised the retirement age for women from 60 to 63, affecting those born in 1952 or later. This reform has had a significant – albeit individually variable – impact on the working lives of those affected. A recent study by ZEW Mannheim and the University of Mannheim reveals that women have been taking this reform into consideration early on and, as a result, save less and spend more money during their working years compared to before the pension reform. However, women born in 1952 or after still enjoy higher incomes during retirement.

“While most affected women save less for their old age, as they factor in their extended working lives, they do not necessarily face a disadvantage. In fact, they have a higher overall income available, particularly in retirement,” says Dr. Björn Fischer, a researcher in ZEW’s “Labour Markets and Social Insurance” Unit and one of the authors of the study. The ZEW study, which analysed data from the Sample Survey of Income and Expenditure (EVS) and data from German respondents in the Survey of Health, Ageing and Retirement in Europe (SHARE), demonstrated that women born after 1952 adjust their savings behaviour in response to the pension reform implemented in 1999. In total, the EVS data included almost 25,000 households, while over 1,500 women were interviewed as part of the SHARE survey.

Higher income during retirement despite lower savings rate

“Throughout their working years, the available incomes of women from different birth cohorts show little difference. However, households with women born after 1952 tend to spend more on leisure activities during their working lives,” explains Fischer. Consequently, their savings rate decreased by an average of 1.5 percentage points compared to women born earlier. As a result of the pension reform, women’s income over the entire retirement period would increase by an average of 12.7 per cent. This can be attributed to their longer duration of employment and higher pension contributions. With the lower savings rate, these affected women are now shifting a portion of their income growth to the pre-retirement phase. Despite this, they still enjoy approximately ten per cent higher income during retirement compared to women born earlier who retired at 60.

For several decades, policymakers have been raising the retirement age in an attempt to stabilise pension system finances within an ageing society. At the same time, the government incentivises private retirement planning through savings and insurance, with the aim of enhancing income during retirement. Little has been known until now about how households respond to an increase in the retirement age in terms of their savings habits. “It is now evident that people adapt their savings behaviour in response to reforms that extend their working lives. This should be taken into consideration by policymakers, who should promote retirement savings in conjunction with such reforms,” comments Fischer.