How Do Demographics and Climate Change Influence the Decisions of Financial Market Actors?

ConferencesZEW Conference on Ageing and Sustainable Finance

How do demographic and climate change influence the decision-making of financial market actors? What are the specific challenges and effects for individual market participants such as retirees, homeowners, heirs, individual investors in general, banks, and corporations? To explore these questions, ZEW Mannheim organised a conference on “Ageing and Sustainable Finance” on 27–28 April 2023.

In addition to three keynote speeches by leading experts in the fields of life-cycle finance, household finance and banking, the event featured presentations and discussions of fourteen selected research papers by speakers from ten different countries.

Keynotes on wealth decumulation, sustainable asset management and green lending

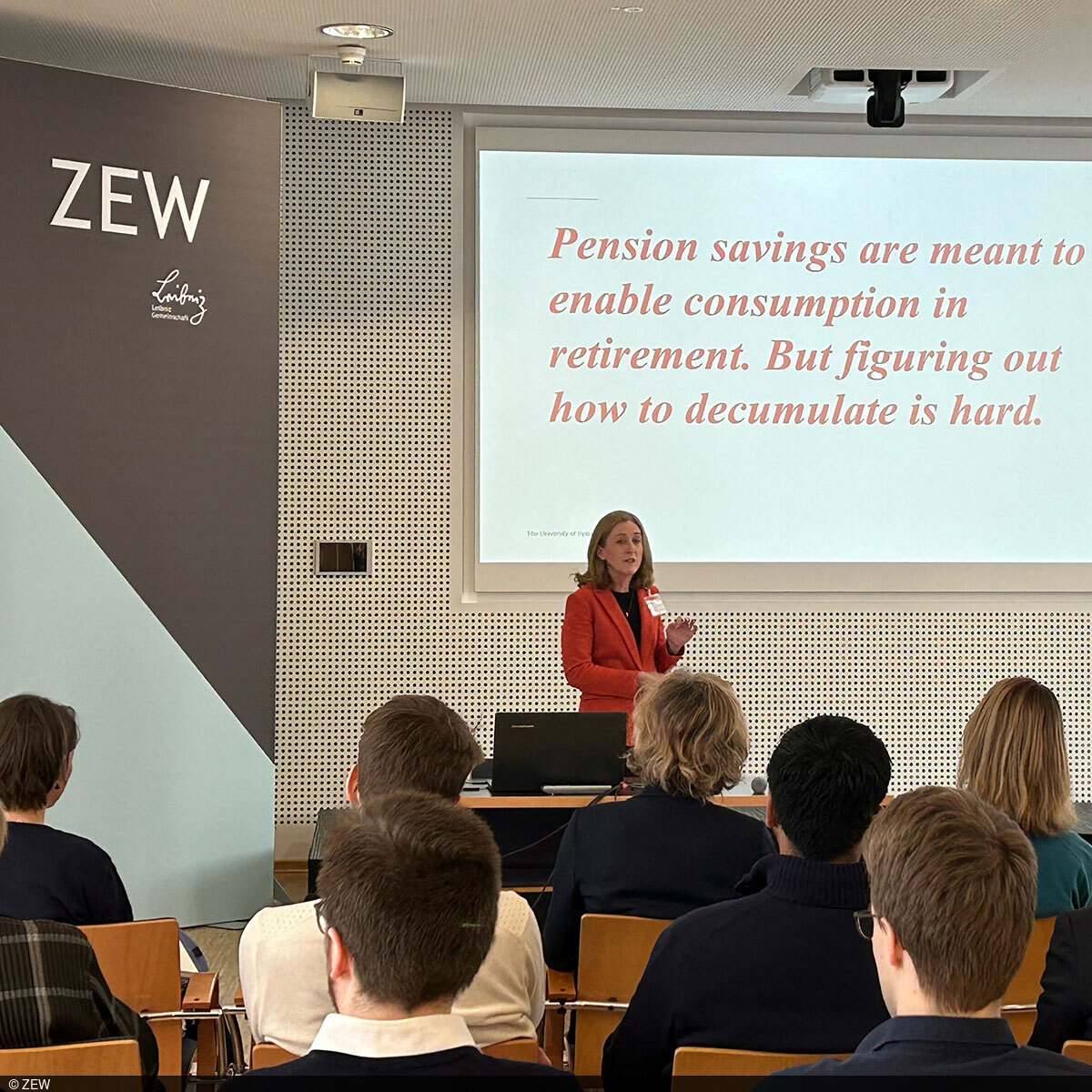

Professor Susan Thorp from the University of Sydney gave the first keynote speech titled “Ageing and Complex Financial Decision Making”. Using data from Australia, she showed that retirees are reluctant to decumulate their wealth and almost never choose to annuitize voluntarily. Thorp identified the desire to maintain a comfortable lifestyle, bequest motives, and the fear of significant medical expenses as possible reasons for this behaviour. She summarised three main explanations for why decumulation is so difficult for the elderly: timing (the decline in cognitive abilities and financial knowledge with age), input (biased expectations and lack of pension knowledge), and complexity (due to the challenging nature of decumulation decisions). Thorp’s research shows that more guidance on decumulation is needed.

Professor David Robinson from the Fuqua School of Business, Duke University, delivered his keynote speech on how climate forecast revisions affect household portfolio choice. Based on Swedish survey panel data, he showed that greater geographical proximity to extreme weather shocks is associated with revisions in individuals’ beliefs about climate change, which in turn affect their portfolio holdings. He also found that gender and financial literacy play a role in this relationship. However, he also showed that the resulting shift in portfolio allocation is insufficient to significantly reduce the cost of capital for sustainable versus less sustainable firms, mainly because of political polarisation.

On the second day of the conference, Professor Steven Ongena from the University of Zurich talked about “Banking, Demographics, and Climate” in his keynote speech. Through an analysis of data on firm loan application and bankers’ preferences from a mid-sized bank in China, he showed that customer managers with pro-environmental values tend to give more favourable recommendations for the loan applications of so-called green firms, while in a second step, loan officers – who are the managers’ superiors – with non-sustainable preferences tend to reject managers’ recommendations for sustainable applications. Ongena’s work highlights the importance of bankers’ biospheric values in banks’ lending decisions when green firms apply for loans.

In the course of the conference, fourteen researchers presented selected papers on stock market participation, spending behaviours, sustainable household investments, climate finance, green financial intermediation, and retirement savings and income. Among other things, the following questions were discussed:

- What factors contribute to low stock market participation among households? Does climate change influence this participation? Can the inclusion of sustainable financial products and improved sustainability practices by firms increase participation?

- How do climate change, the green transition and financial intermediation impact each other?

- Do investors and homeowners care about sustainability?

- How can mandatory pension saving distort housing decisions?

- Do people anticipate inheritance by spending in advance?

- Are retirees willing to accept fluctuations in pension income?

- How do asset managers allocate risk in mandatory retirement savings funds?

The conference provided an outstanding opportunity for attendees to discuss the interconnection between two major long-term macroeconomic trends – demographic change and climate change – and to exchange ideas with researchers from around the world who share an interest in these topics.

The conference was kindly sponsored by the Foundation Geld und Währung.