First Increase in 2018

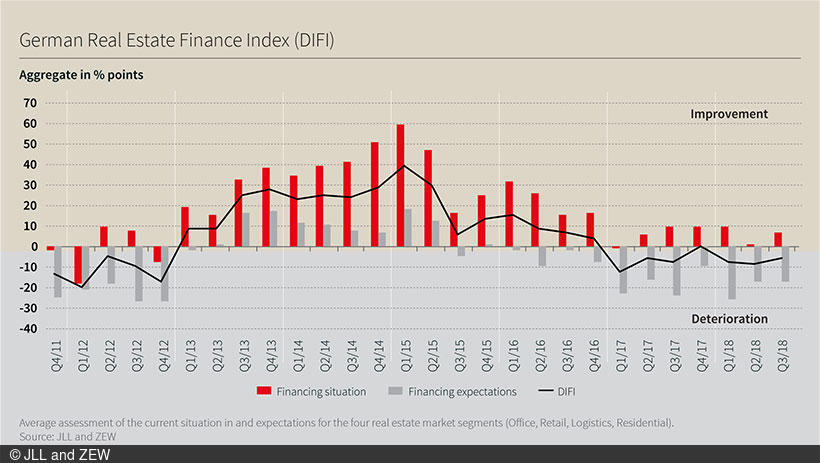

DIFI Report by ZEW and JLLIn the third quarter of 2018, the German Real Estate Finance Index (DIFI) by ZEW and JLL climbed 3.7 points compared to the previous quarter, recording the first increase of the year. This marks the highest reading of sentiment indicator for commercial real estate financing in 2018. With a current value of minus 4.5 points, the indicator, however, still remains in negative territory.

This slight upward movement was largely driven by a considerably better financing situation, which caused the corresponding indicator to rise by 7.2 points (increase of 6.6 points compared to the previous quarter). This upward trend in the financing expectations is set to continue over the course of the next six months, which is reflected in a slight increase of 0.8 points. The sentiment amongst the experts remains, however, subdued, leaving the sub-indicator for financing expectations at a level of minus 16.1 points. This negative assessment can largely be attributed to the survey results for the retail sector, which has received strongly negative assessments from the experts for both the current situation and future expectations due to the challenges that stationary retail businesses are likely to face in the coming months. The results of this quarter’s special question indicates that financial backers are fairly sceptical over the user category “flexible office space”.These are the key findings of the DIFI Report, a quarterly survey on the commercial real estate financing market in Germany carried out by ZEW in cooperation with JLL.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. DIFI is a survey conducted and published by JLL and the ZEW – Leibniz Centre for European Economic Research. 29 experts participated in the January/February 2019 survey.