US Overtakes EU in Banking Sector M&A

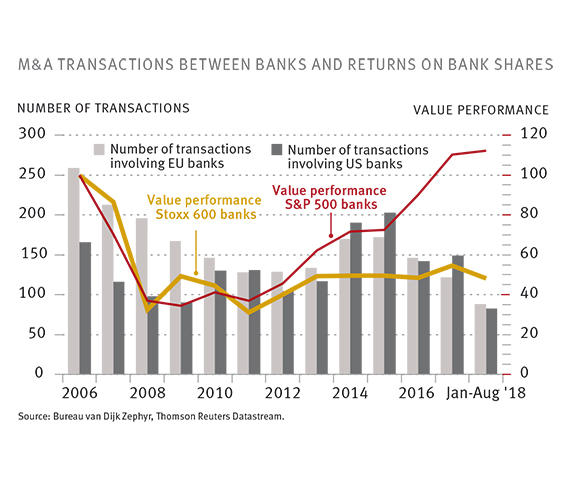

M&A IndexIn the ten years since the collapse of Lehman Brothers, Europe’s banks have fallen strongly behind their counterparts in the US. Although the stock performance of EU credit institutes was somewhat better than that of their US competitors during the financial crisis that began in 2007, US banks have been pulling ahead ever since 2011. The significant divergence between US and EU banks is reflected in their respective activities regarding mergers and acquisitions (M&A) since 2006. These are the findings of studies carried out by the Centre for European Economic Research (ZEW), Mannheim, on the basis of the Zephyr database of Bureau van Dijk.

The number of M&A transactions involving US banks began to increase again in 2010 after falling in the wake of the economic crisis. By contrast, the number of M&A transactions involving EU banks did not begin to increase again until 2014 after years of experiencing a downward trend. A further difference between the two markets concerns the extent of M&A activities immediately after the crisis in comparison with the level before the crisis. Transactions involving US banks exceeded their pre-crisis levels in 2014. By contrast, the number of M&A transactions involving EU banks is still behind their pre-crisis levels, despite an increase in 2014. Nevertheless, during the period from 2006 to 2017, EU banks were, on average, involved in more M&A transactions than US banks.

Between January and August 2018, US banks saw 64 M&A transactions, down from the 75 transactions in the previous year. This is somewhat surprising because tax reform and bank deregulation have increased the ease and desirability of acquiring US banks. In the medium term, these factors are expected to have a positive effect on M&A activities. In the EU, the same period saw 45 transactions (versus 42 in the previous year). In the EU as well, more transactions are expected in the medium term, though the primary concern acting as a driving force here is maintaining competitiveness.

For further information please contact:

Frank Brückbauer, Phone +49(0)621/1235-148, E-mail frank.brueckbauer@zew.de