Trade Dispute Hampers Economic Outlook for China

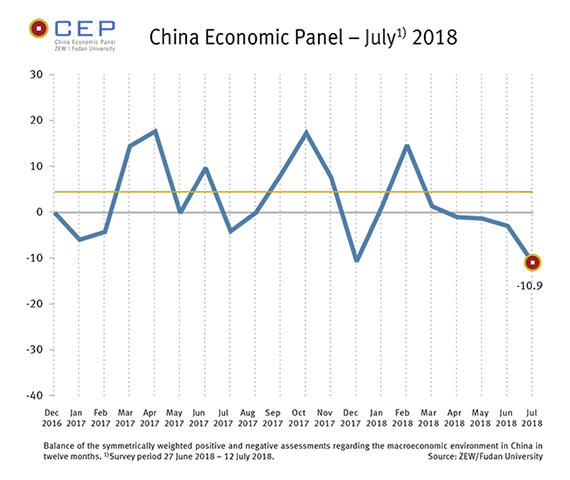

China Economic PanelIn the recent survey for July (27/06/2018–12/07/2018), economic expectations for China once again dropped considerably to a new level of minus 10.9 points (June 2018: 2.9 points). This represents the fifth consecutive decrease in the CEP Indicator, which is currently well below the long-term average of 4.5 points. The CEP Indicator reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months.

At 7.6 points, the assessment of the current economic situation in China was also more negative than the previous month. This constitutes a decrease of as much as 14.4 points compared to the assessment in June. “The outlook for the Chinese economy has been in a continual and significant decline for the past five months,” says Dr. Michael Schröder, senior researcher in the ZEW Research Department “International Finance and Financial Management” and project leader of the CEP survey.

The financial market experts polled in the current survey expect China’s real GDP to grow by 6.5 per cent in 2018 and 6.3 per cent in 2019. Both figures are 0.2 percentage points lower than those from the previous month.

Expectations regarding exports lower

A central cause behind the worsening economic outlook is the international trade dispute with the US. Expectations regarding exports currently stand at minus 12 points, 19.9 points lower than the reading in June. The surveyed experts also expect this to lead to a reduction in China’s share of global trade, with the corresponding indicator dropping 29.6 points to a current reading of minus 5.3 points.

This month’s drop in expectations affects every sector of the Chinese economy assessed by the financial market experts and all components of GDP. Both private consumption and private investment exhibited a large two-figure drop in terms of expectations. In the case of private consumption, the indicator experienced a drop of 53.5 points down to minus 20.7 points compared to the previous month. Meanwhile, the latest expectation indicator for private investment stands at minus 1.7 points following a decrease of 22.1 points over the course of the month.

“By weakening the Chinese economy, the trade dispute triggered by the US could end up slowing down economic growth worldwide,” says Michael Schröder.

For more information please contact

Dr. Michael Schröder, Phone: +49 (0)621-1235-368, E-mail: michael.schroeder@zew.de